Source: American Institute for Economic Research

Source: American Institute for Economic Research

From almost every economic perspective, 2022 was a bad year.

COVID had already pushed governments to loosen monetary policy, stretching vulnerable supply lines to breaking point. When combined with shortages arising from the supply/demand mismatch as different industries exited lockdowns at different times, as well as the poorly executed Chinese snap lockdowns, the stage was set for a breakout in inflation.

Even as 2022 started, this had shocked the US Federal Reserve to commence a rash of interest rate rises. The turmoil was unexpectedly fuelled by Russia’s illegal invasion of Ukraine, which further boosted inflation and meant that the Fed was tightening too late. Inflation was galloping away and hit a 40-year annual high in June of +9.1%, by which time markets had fallen by -20%, repeatedly testing their low points and finishing the year only a few per cent above.

Higher interest rates mean money costs more – just as economic growth slows. This one-two punch is particularly damaging for unprofitable companies. They are squeezed by falling consumer and business spending, and are also paying higher interest rates on debt or being shut out of debt markets altogether.

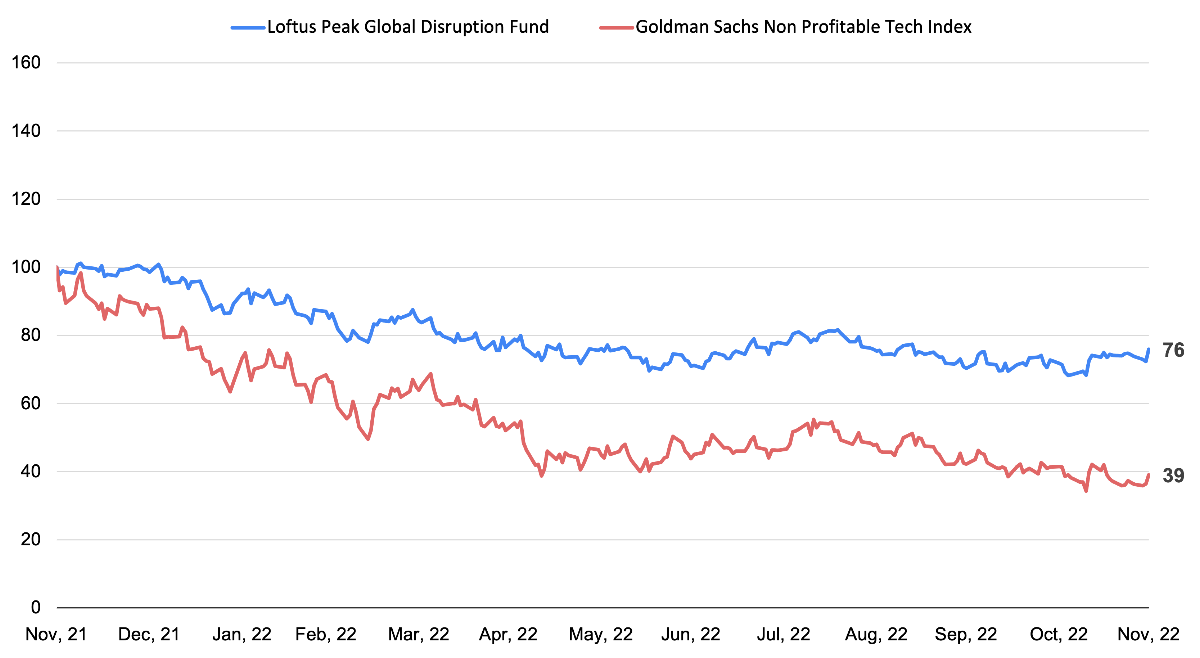

Our March investor letter ”Inflation is here. Set Quality to Max” explained why cash-flow positive enterprises produce better results on a risk-adjusted basis. In practical terms, this meant the Fund exited higher-risk companies early in the calendar year, such as those in life sciences, which freed up capital for allocation to lower risk positions. This turned out to be a prudent decision, as the chart below illustrates.

Unprofitable companies sold off much more heavily than the Fund

Source: Goldman Sachs, Loftus Peak. Data in AUD, indexed to 100 at 30/11/21

Source: Goldman Sachs, Loftus Peak. Data in AUD, indexed to 100 at 30/11/21

It is the quality of the portfolio that gives us the confidence to look through the global economic weakness that is ahead and focus on the prospects of the underlying business models of the companies in which we invest.

Understanding how the world, and business models, are changing is a key part of Loftus Peak’s investment process. In the past, we have found success through the early identification of companies that are diversifying their revenue streams, before the value of those new revenues is broadly understood.

We see this unfolding in parts of the semiconductor industry, specifically Qualcomm, a company that is synonymous with the development of mobile communications, especially smartphones.

Historically, the end-market for semiconductors consisted mostly of personal electronic devices such as computers, tablets and phones. Today, this end-market is mature, but the overall semiconductor market continues to grow. In recent years, growth has been driven by new end-markets such as datacentres, cars and connected devices (what is known as the internet-of-things, like GPS trackers and fire sensors).

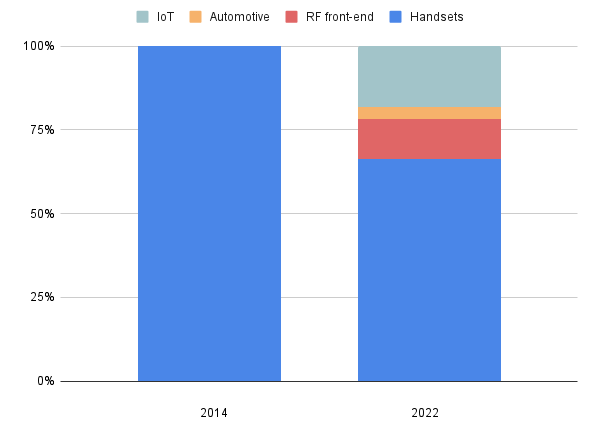

And Qualcomm is capitalising on this growth. The company now generates over a third of its revenue from sources other than smartphone processors, which compares to 100% of revenues in 2014, as the chart below shows. This mix shift has occurred at the same time Qualcomm grew revenues from US$26 billion to US$45 billion.

Qualcomm’s increasingly diverse business

Source: Company Filings

Source: Company Filings

The automotive semiconductor end-market is relatively small today (US$50bn), but is projected to triple and surpass the PC segment by 2030. This is not just Qualcomm’s view. It is backed up by companies including Dutch group ASML Ltd – the company that makes the machines that make the semiconductors. This growth is being driven by the shift to electric vehicles as well as demand for safety features such as lane-keeping and ever more sophisticated infotainment systems.

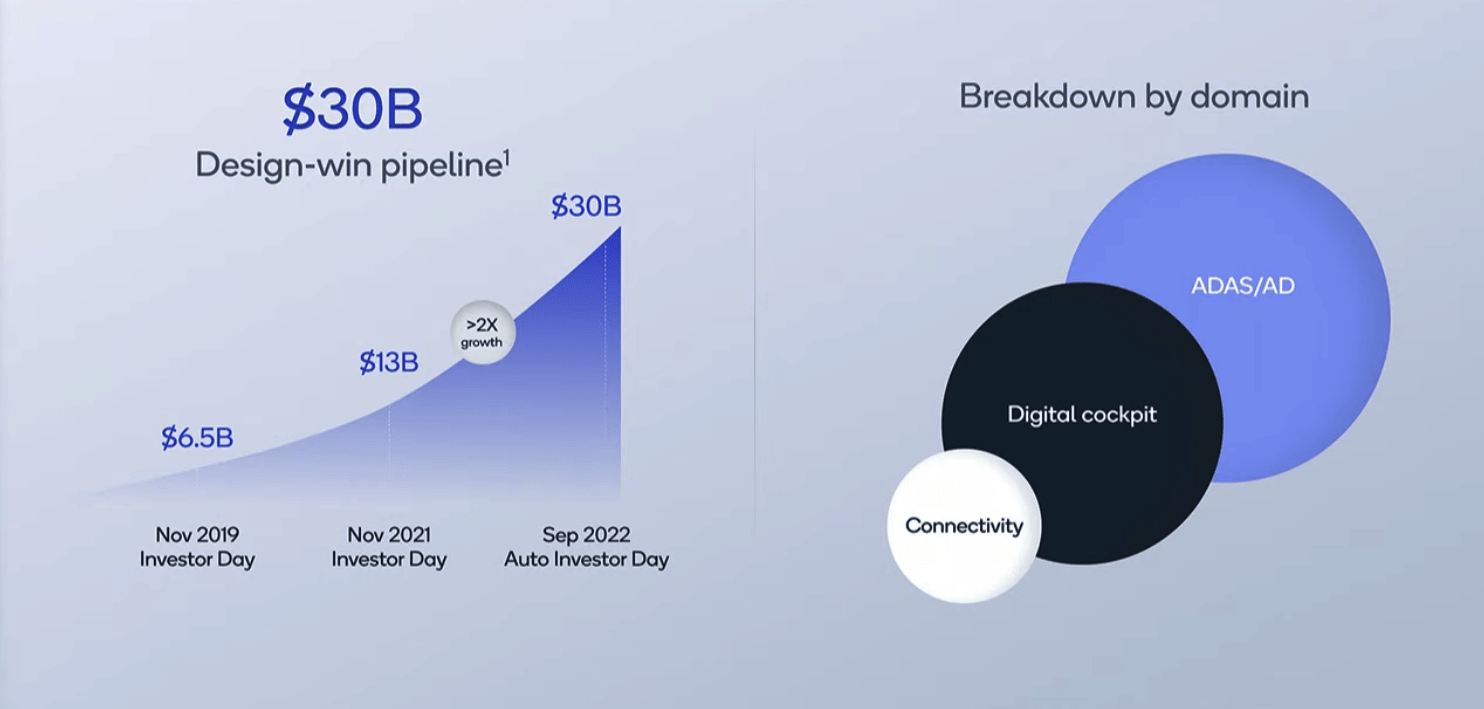

Qualcomm is at the heart of these changes, providing semiconductors that enable connectivity (including cellular, Wi-Fi and Bluetooth) as well as power infotainment and safety solutions. The company is showing early signs of success in this fast growing segment, with its design pipeline for connectivity, digital cockpit and advanced driver-assistance systems solutions rapidly expanding (from US$6.5 billion in 2019 to more than US$30 billion today).

Qualcomm’s automotive business grows strongly

Source: Qualcomm

Source: Qualcomm

Despite a solid mainstay business, and increasing business line diversification, Qualcomm trades at a forward P/E of 10.0x – a lower figure than even during the Global Financial Crisis.

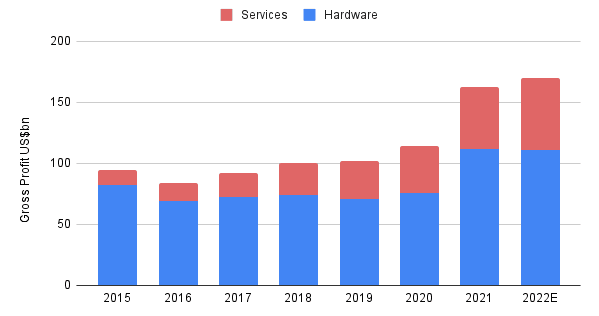

Looking for this type of diversification has helped generate return over the years for Loftus Peak investors. For example, in 2015, the market viewed and therefore priced Apple as a mature smartphone company with little capacity for growth or margin expansion. At that time, the company generated 12% of its gross profit (revenue less cost of goods sold) from services, powered by the App Store, Apple Music, a nascent Apple Pay, and 88% from hardware such as the iPhone, Mac and iPad (see chart below).

Six years later, Apple services generated more than 30% of the company’s gross profit. Because services revenues are annually recurring, they are valued more highly than hardware revenues. Apple’s share price growth reflects this changing business line mix.

Growth in Apple’s services business drives profitability

Source: Company Filings, Morgan Stanley

Source: Company Filings, Morgan Stanley

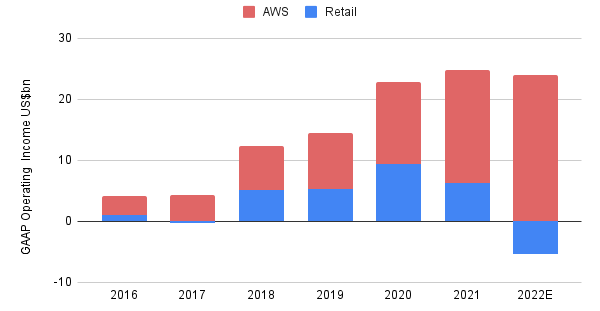

There was a similar story behind Amazon. The company layered a profitable and high-growth cloud datacentre venture, Amazon Web Services (AWS) on top of its lower margin, but still growing e-commerce business. In 2015, because e-commerce was the company’s mainstay, the market was unable and unwilling to factor AWS and the cloud opportunity into its valuation. Today, AWS is a bigger profit contributor than retail, as the chart shows.

AWS a much bigger profit contributor than Retail

Source: Company Filings, Morgan Stanley

Source: Company Filings, Morgan Stanley

Hydrogen, Electrification, Streaming also key portfolio exposures

The hydrogen economy, electrification, TV entertainment streaming and precision agriculture are other areas in which Loftus Peak selectively invests.

Hydrogen challenges the fossil fuel cartel as an alternative fuel source. ‘Green’ hydrogen is capable of being produced anywhere with water and renewable energy. Companies such as Linde are involved in the production, storage and distribution of green hydrogen as outlined in our September insight Vladimir Putin and the Butterfly Effect.

Zero-emission energy relies on electrification componentry to convert electrical energy into motion. Our preference is for businesses which can power the entire transport industry rather than investing in individual EV companies, which necessarily involves picking winners from a slew of poorly-capitalised start-ups.

For example, Tesla, which did very well early on, has been falling in value for over a year as new players, such as Rivian and NIO, have launched cars.

Semiconductor technology is also enabling precision agriculture. We invest in this disruptive development through farm equipment maker John Deere. The company’s compute capability is overlaid with its capacity for cloud-based analysis of crop conditions. This allows for optimisation based on observable and individual data points for soil composition including moisture and mineral content for each seed – a means to significantly enhance yield.

Streaming – replacing traditional TV

Subscription video on demand is proving much more difficult than first appeared, with players including Time Warner’s HBO and Disney trying to cut losses by dramatically curtailing expansion plans. Netflix is the only profitable player at present, and is well-positioned to benefit from the continuing move toward content delivery over broadband. The company released its ad-supported tier in November.

Regardless of transitory macroeconomic factors, advertising spend between connected and linear TV is out of proportion with audience size. As we wrote in June, streaming has surpassed legacy TV in terms of average weekly reach.

Despite a gloomy year in terms of share price, Roku owns the operating system in more than a third of new smart TVs sold in the US. The strength of its offering – both in TV operating system and advertising technology – should see the company take outsized share of the fast-growing connected television segment. Indeed, the arrival of ad-supported tiers for streaming services is itself a milestone for the disruption of traditional advertisers and a further development in the streaming wars.

What about 2023?

While 2022 has delivered lower share prices across the portfolio, we remain confident that the disruptive thematics in which we are invested today will ride out the cyclical downturn.

Inflation appears to have peaked in June and the Fed is decreasing the scale of rate hikes. A swift and destabilising Russian victory in Ukraine has not transpired. Ostensibly, China is softening its Covid-19 policy. Supply chains, at least to some extent, have stabilised.

While there is a very real prospect of global recession, and weaker corporate earnings, should it eventuate its impact on future share prices will depend on how much of this bad news is already priced in. We seek to assess this on a holding by holding basis.

Broadly, we have positioned the Fund’s portfolio to benefit from the disruptive change we see now and, in the future, with a view to taking advantage of where the world will be in the next 2 to 5 years.

Share this Post