How much further will the companies underpinning the application of artificial intelligence rise? Nvidia‘s rocketing share price has a sound basis – the company more than doubled sales to US$61b in the year that ended in January 2024. That number is poised to nearly double again to over US$110b by January 2025. On the 2020 actual number, that is an 11-fold increase in sales (along with gross margin expansion). In this context a 10 times lift in the share price is not that surprising.

But investors should think twice before assuming similar share price gains are ahead for Nvidia (at least in the short-term). As it stands, Nvidia’s stock price necessitates sustained double-digit revenue growth off of this new US$110bn base – this is certainly possible, but outsized share price returns would imply revenue growth even greater than double digits. Is that realistic?

Despite its forays into software, Nvidia is primarily dependent on hardware sales and therefore remains exposed to product cycles. We acknowledge that the current iteration of AI infrastructure spend shows no signs of slowing, but it would be a mistake to assume this expansion continues indefinitely. Nvidia’s own history is littered with instances of overinvestment and digestion. One only needs to look back 18 months to see its last datacentre digestion cycle, which coincided with the collapse of crypto-related revenues to bring its share price down -66% from peak to trough.

And there are other risks too: a less than perfect product launch (Nvidia has just doubled its cadence to a blisteringly fast one annually) or hotter than expected competition from Advanced Micro Devices (AMD) or other AI accelerators. With expectations so high, any glimmer of weakness would have a significant negative impact on the company’s share price.

It is a recognition of this reality, backed by an increasingly ‘full’ valuation, that has led to the weight allocated to Nvidia being cut by about half over the past three months in the portfolios we manage. It is not scepticism over the AI roll-out, but because the share price as it stands today – materially higher – adequately reflects the shape of the dollar roll-out to come.

But that doesn’t mean there isn’t still value to be had from investing in AI – there are many companies for which expectations do not yet reflect their opportunities in AI. For example, the hardware build we have seen is likely to be a prelude to a usage and device boom which has yet to be realised, in a return sense, from other major players including Qualcomm, AMD, Apple and Alphabet, among others.

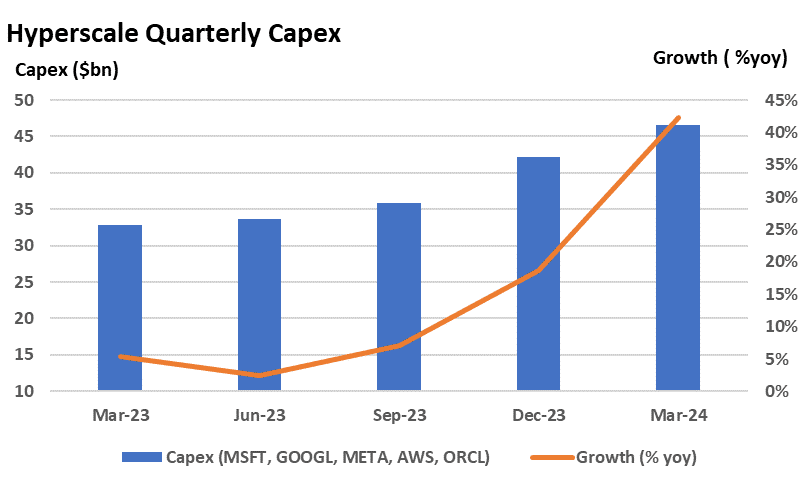

Source: Company Filings

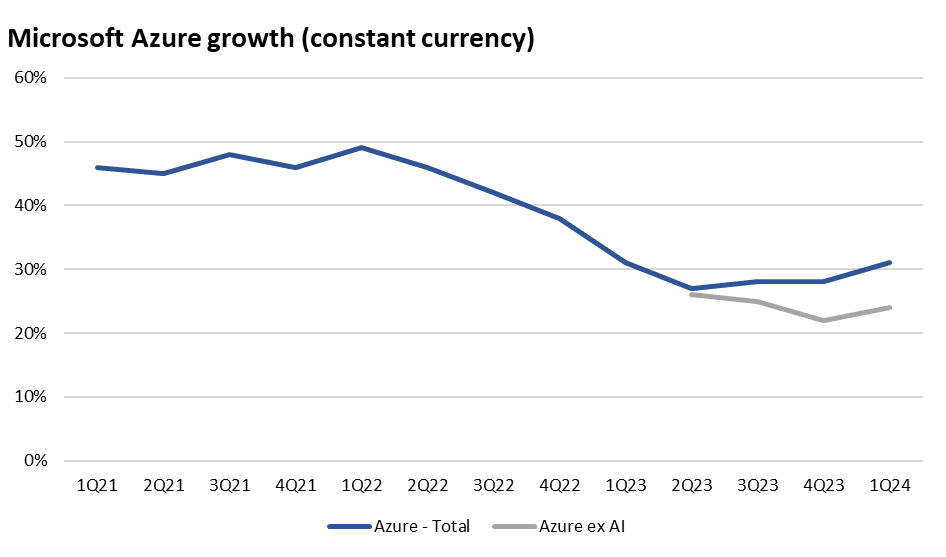

Source: Company Filings

Reducing the exposure to companies such as Nvidia provides more room to invest in other companies that we believe are more prospective and not so richly valued.

For example, Taiwan Semiconductor Manufacturing Company (TSMC) has been a major beneficiary of this reallocation. It fabricates semiconductors for Apple, Nvidia, Qualcomm, AMD, Broadcom, Sony, Amazon and many more across many end markets. These include the most cutting edge chips as well as a long tail of less advanced products which are to be found in sectors as diverse as whitegoods and autos.

TSMC is the fabricator

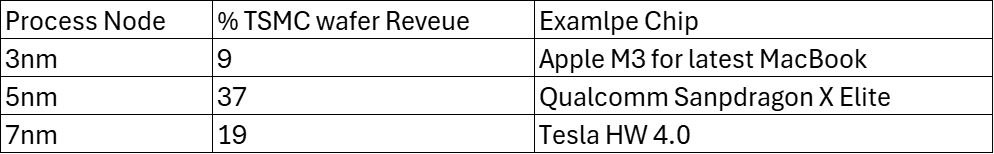

Most of the semiconductor names that catch headlines are in fact semiconductor designers. TSMC is not a designer, it is a fabricator. The designers send their designs to TSMC and negotiatefor volume and process node size. The smaller the node, the more intricate the design can be.

Source: Company Filings

Source: Company Filings

*note that the HW 4.0 is not fabricated by TSMC but by Samsung although on the equivalent 7nm node

What drives the TSMC valuation

The process of ramping a new node dilutes margins for TSMC. The company must buy a number of new lithography machines for as much as US$380 million each (with these machines almost certainly coming from ASML). The company must then calibrate the machines before they become operational. This results in TSMC’s bottom line being more dependent on the nodes that have already ramped (i.e. are in full production) than those that are ramping.

Importantly, the 5nm process node is now ramped. This is the node for chips across a whole range of end markets. Current generation Qualcomm handsets for mobile phones and AMD GPUs for PCs are in the mix. These end markets are trending towards cyclical uplift. The 5nm process also include datacentre chips (crucial to the use of AI). For the time being, Nvidia’s chips are concentrated in 5nm instead of 3nm. This includes the current datacentre chip, the H100, which is made on a 4 nm variant of the 5nm process. The upcoming Blackwell is set to follow suit.

This means that the fabrication of these high demand chips will likely come with the more desirable margins of a ramped process node. TSMC believes that in the next 5 years, AI revenues – driven by several AI processors – will grow at a 50% compound annual growth rate and increase to over 20% of its revenue by 2028.

Despite the cyclical recovery of end markets and additional AI tailwinds, the company is trading at a discount (not at a premium like Nvidia) to the S&P500. We believe this gives added protection to downside risk, allowing us to hold a larger position in the portfolios we manage.

Share this Post