Anshu Sharma, PM at Loftus Peak

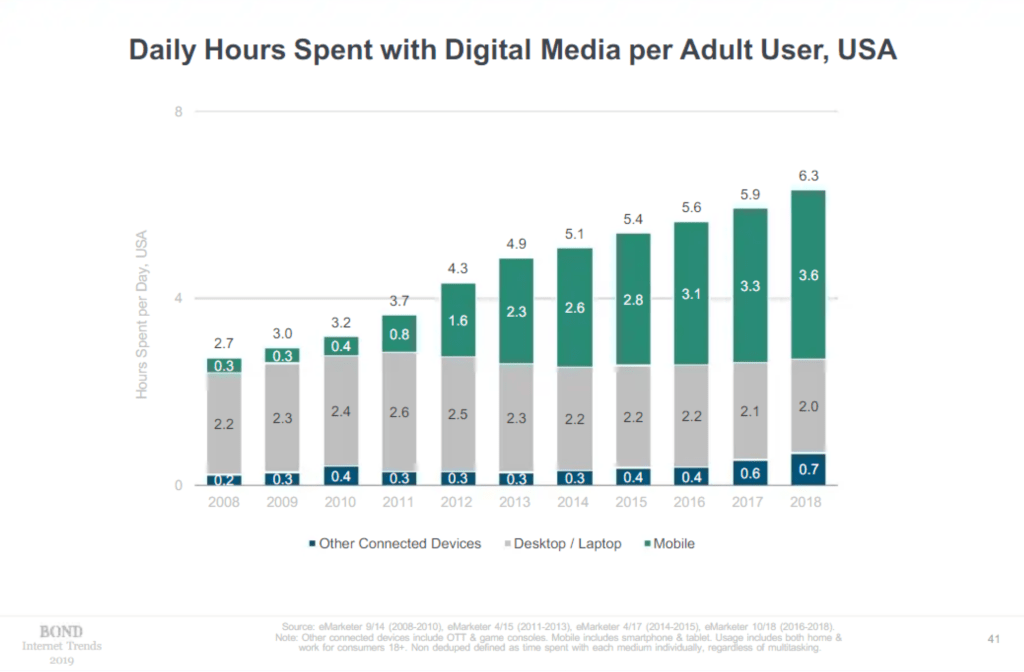

It won’t come as a surprise that over the last decade the average daily time spent on screens, which used to be restricted to television and computers, has increased significantly. In the US, the daily average screen time (excluding TV) is up more than 100% to 6.3 hours over 11 years.

Source: Bond Internet Trends 2019

The time spent on mobile media used to be 20 minutes back in 2008, but this has now jumped to 3 hours and 40 minutes. This means we are allocating an additional 3.5 hours every day to mobile media, and this is not at the expense of Television and Desktop/Laptop, with time spent on these virtually constant over the period. For confirmation, take a look around at the people travelling to work, eating lunch or just walking down the street – all looking at their phones.

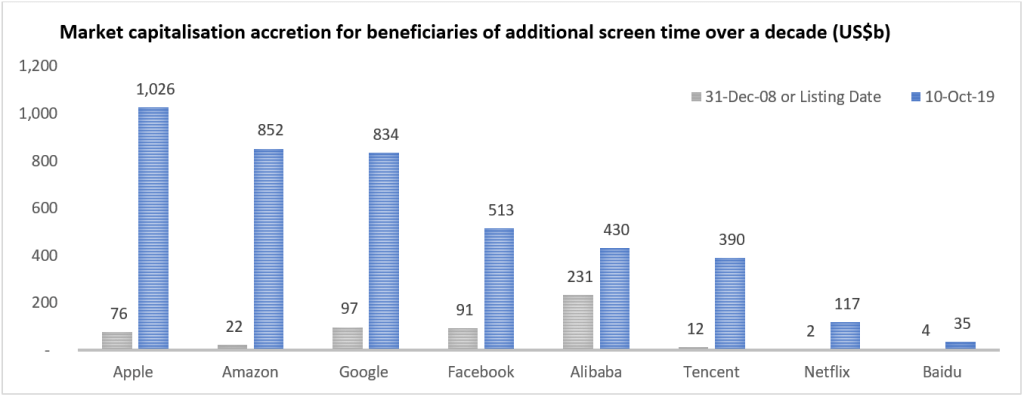

So, which businesses are harvesting returns from these additional hours of your valuable time, and just how much is it worth?

The chart below shows the market value accretion since 2008 of the companies that are driving a majority of the increased mobile media usage. The aggregate revenue for these 8 companies has jumped from approximately US$82 billion to US$850 billion and the aggregate market value has increased from US$558 billion to US$4.3 trillion – an increase of 937% and 670%, respectively.

Source: Bloomberg

Improved internet connectivity has been a major driver of increased screen time. The platform companies listed above keep us engaged, or provide superior services to those we currently use, allowing them to capture this additional screen time, monetise it and subsequently grow significantly. Let’s take a closer look at how.

The platform companies monetising our additional screen time

Search Platforms: Google (GOOGL) and Baidu (BIDU) keep us engaged by providing the mechanism to search for publicly available online information. The primary source of revenue for these companies is the sale of advertising slots on the page on which our search results appear. For instance, if searching for a holiday, companies like Flight Centre, Expedia and Webjet might pay to place themselves higher on the search results page, as an ad, hoping to get our business. The combined revenue of these companies for the trailing 12-month period was US$164 billion.

E-Commerce Platforms: Amazon (AMZN) and Alibaba (BABA) provide a method to buy goods online. We remain engaged due to the sheer number of goods offered, and they make money when we buy goods through their platforms by commissions charged to the seller. They also make money by selling advertising slots to businesses which make their products more visible. The combined revenue of these companies for the trailing 12 months was US$312 billion.

Social Platforms: Facebook (FB) and Twitter (TWTR) help us stay connected with our friends and family or follow our interests. While we are doing this, these platforms sell advertising slots to businesses which they think may be of interest to us, in the hope that we end up buying the good or service. The combined revenue for these two was US$66 billion for the trailing 12-month period. Tencent, another social platform, makes money by upselling games, settling monetary transactions and other services to subscribers and generated US$50 billion over the same period.

iOS Platform: Apple (AAPL), which generated US$259 billion revenue in the trailing 12-month period, sells quality phones and other hardware which keeps us engaged through its rich ecosystem. Luckily for Apple, this ecosystem is optimised to run on the hardware it sells. It makes money from selling its hardware as well as services like apps, music, payments and more. And now, Apple will launch its TV service to an installed base of 1.4b devices. This is the very definition of a business with adjacencies.

Streaming services: Netflix (NFLX) might be the easiest platform business model to understand, as many of our readers may already be paying a monthly subscription to Foxtel. Rather than buying Foxtel and its box, Netflix streams video content “over-the-top” via the internet to your phone, laptop, smart TV or other device for a monthly subscription. It generated revenue of US$18 billion in the trailing 12-month period.

Increased screen time is a sub-set of some of the bigger themes which we are seeing play out in our daily lives at present – namely networks, mega-data, the internet of things, energy as a technology, and China which, by virtue of its size and political power, is changing the nature of global capitalism.

Just as we see every second person in our daily commute engrossed in their screens, we also experience:

- An uber turning up to our doorstep on demand – via an intelligent interactive network that connects drivers to passengers and optimises their trips based on proximity;

- Netflix suggesting programs which may be of interest to us or Gmail suggesting a response to our emails. Both use mega data analytics to make an informed recommendation;

- The ability of our transport network to charge as well as inform us in real time of the location of the train or bus is based on knowledge of the journey start and end point as connected devices log the journey;

- Batteries keeping the lights on in South Australia or powering our cars; and

- Demand for various Australian consumer goods (not commodities) and services by China – the rise of Chinese consumer discretionary spend with increasing income.

Are investors missing out on the value created from their increasing digital screen time?

We are all experiencing and embracing this change at home, at work, during our leisure time and in just about everything we do. The companies which are at the forefront of facilitating these changes are adding significant financial value to their businesses by monetising our additional screen time. The magnitude of the potential value addition is increasing as these themes expand both horizontally and vertically – beyond the boundaries of sector and industry classifications.

The question that should be asked, therefore, is whether today’s investment portfolios are participating in this value creation, or instead reflecting index funds that are constructed based on the success of companies in the past, many of which now operate with outdated business models.

Share this Post