Markets rallied on the back of the Trump victory, and probably correctly in the near term as the US will almost certainly commit to a series of expensive infrastructure projects to re-energise the mining industries and even possibly build a wall on the Mexican border. However ill-advised the spending targets, it is right to say it will create some economic activity, and this is also what markets are reacting to.

But there is genuine fear in Silicon Valley. Google’s Eric Schmidt, Facebook’s Sheryl Sandberg and Tesla’s Elon Musk have all spoken out against Trump in the run-up to the election. The Wall Street Journal quoted one advisory firm’s note to clients, which stated Trump’s election could re-ignite the debate on technology’s role in displacing workers – for example autonomous vehicles taking jobs from truck and taxi drivers.

Obama was one of the biggest boosters of tech. One of the big venture capital funds (Sherpa Capital) has said “If Trump wins, I am announcing and funding a legitimate campaign for California to become its own nation”.

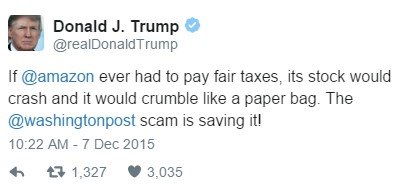

Trump has been reasonably vocal about the valley in his campaign, and not in a good way. He called for a consumer boycott of Apple (down 0.2% last night) over its refusal to help the FBI access a terrorist’s iPhone. He also said that Jeff Bezos was using his personal ownership of the Washington Post to advocate against him: “Amazon is getting away with murder tax-wise. [Bezos is] using the Washington Post for power so that the politicians in Washington don’t tax Amazon like they should be taxed…he’s using [the Washington Post] as a tool for political power against me and against people and I’ll tell you what, we can’t let him get away with it.” Bezos hotly denied it. Amazon was down 2% last night.

At the same time, he has been saying that he will force these companies to pay their fair share of tax going forward. Since companies are generally priced on the basis of a full tax rate, this should not change prices. Still, with the Donald, it’s the thought that counts.

The Chinese big-cap disruptors did poorly – Alibaba was down 3%, Baidu was down 1.3%. Trump has taken a generally isolationist view on the US, with the possibility that he will impose stricter trading regulations and maybe even tariffs on Chinese imports. He has also trash-talked the perceived Redback (Chinese renmimbi) manipulation by the Politburo – for the record, the Chinese unit hit a six year low against the US dollar in October this year, so don’t rule out currency wars.

But currency markets didn’t quite know what to make of it; the US$ did appreciate slightly overnight against the Euro (and the Aussie). The Mexican peso sold off, but I guess we figured that.

With a Trump presidency and the Republicans in Congress, there’s a hit to solar and renewables. One solar ETF was down 5.5%, while Tesla was down 2.5% – remember it is about to merge with Solar City, the home solar play, so it’s a double negative for Elon Musk.

On the plus side, Trump has repeatedly raised the possibility that the big companies, with their offshore cash mountains, will be able to repatriate that cash without adverse tax consequences – and that would be a positive, and could herald a wave of takeovers.

But thinking big picture, what can Trump really do to slow the march of disruption and progress. If we have learned anything in the past 20 years, it is that Big Business (Big in the sense or Tobacco, or Pharma) cannot withstand the impact of an idea whose time has come, whether it is newspapers and social media, or TV and Netflix.

So Trump may withdraw subsidies for renewable energy companies, but the preppers who work in the coal industry are actually installing solar panels on their rooves for when the day arrives. The problem with technology is that it is massively more efficient – read cheaper – and this is the reason it catches on.

It may be that petrol engines result in more jobs in the US, but they won’t be able to compete on price, and in the end it may be the voters who decide by going electric and driverless. Tesla’s quarterly income statement last month showed an automotive gross margin of 19.7% in June quarter – and this is before the company gets scale in the supply chain. For comparative purposes, GM’s gross margin is just over 15%.

The other significant is that the disruption infrastructure is already there. It’s one thing to try and stop Tesla before it builds a giga-factory in Nevada, but that now factory is already built, it’s hard to turn the clock back. Same could be said for Amazon and distribution centres.

Will Trump be business friendly, generally? He has already said, for example, that the AT&T/Time Warner merger should not go ahead because it is bad for consumers, so AT&T went up (since investors already thought is was a bad idea) while Time went down (because now AT&T won’t be able to overpay for Game of Thrones). Mega-mergers could be off the table, which Wall Street would not like.

In the final analysis, it appears that a significant amount of what Trump has said has just been campaign clickbait, designed to grab the attention of potential voters and then get them to vote. And he was right on that. But cooler heads have already noted that it is possible that Trump will be more pragmatic on the actual policies – for example, there was no mention of the wall when he met the Mexican president.

Australia’s $7bn data centre | Harry Morrow features in SBS On the Money

18 Dec 2025Anshu Sharma features on EquityMates Best of the Best Podcast

18 Dec 2025December 2025 Update+

18 Dec 2025‘US Tech Volatility, AI Winners & Top Stock Picks’: Alex Pollak features on EquityMates Talk Money to Me

04 Dec 2025

Share this Post