Just a few days ago, Alibaba Group, the Chinese on-line retailer, came within 1% of being the world’s most valuable retailer – with a market capitalisation of U$473b, its value was just US$4b lower than that of Amazon. Alibaba has been on a tear this year – it is up 95% since January, while Amazon is up 33%. But, importantly, Amazon has been flatlining ever since hitting US$1000/share in July.

It’s not just about Alibaba. The other two big Chinese internet stocks, Baidu and Tencent, have also been performing very strongly. Together, they make up BAT, in the same way the Facebook, Amazon, Netflix and Google make up FANG.

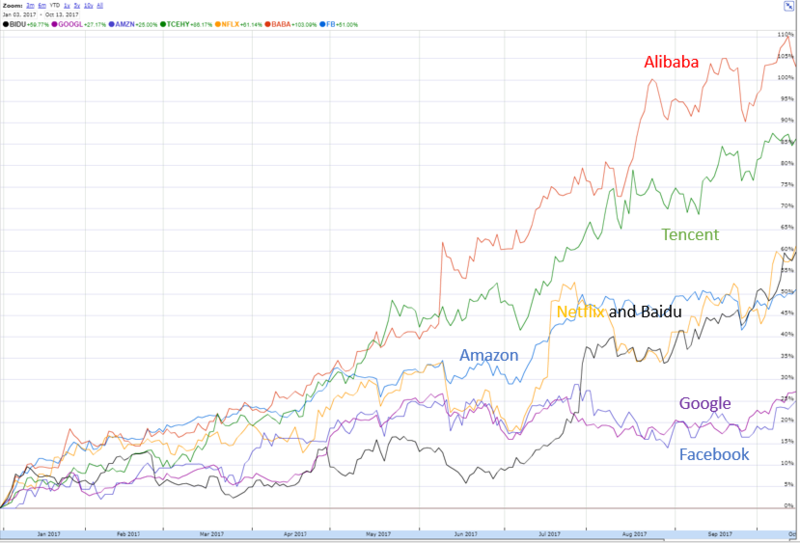

Netflix aside, the shareprice growth of the FANG companies has slowed a little, though they still certainly are very valuable companies. But Alibaba and Tencent are the outperformers in the year to date, as the chart below shows.

Tencent, the games, social media and ecommerce platform is up 85% this year, with Netflix only just beating Baidu in the past week after the former announced a price rise.

What is going on? Is the centre of on-line world moving east, toward China? Or is it just that China is a less developed market, and so has more growth?

Ride the subway in Beijing and watch everyone on their devices – playing games, interacting with friends, buying stuff. Sit in the office foyer and watch the flow of delivery companies bringing armfuls of parcels. In 2016, Alibaba stated it delivered 657m parcels for Single’s day, a 41% increase on the previous year. And this is just for the half of the population that are connected, so there is a lot to come (Internet penetration in China is below that of the US – just over 53%, while in the US it is over 95%. China GDP is now running at around two thirds of the US, at US$11.22 trillion, but growing at double the rate).

But there are other important factors as well. In the west, there are big visible companies spread throughout a number of industries including transport, tourism, financial services and retail – companies like Airbnb, Uber and Paypal. These companies compete relentlessly against other disruptors, and also with traditional offline-moving-online businesses like Hilton Hotels and the banks.

In China, the BAT companies are harvesting very significant value outside their core businesses – for example Tencent is very heavily invested in the banking sector through its huge payments business (which has over 600m active users), while Baidu has a large investment in on-line travel. Alibaba, like Amazon, has a massive presence in the cloud and logistics, but also a one third interest in Ant Financial, the payments business which is like paypal but very much bigger. Amazon doesn’t field a major competitor in the payments space.

Chinese in China are underbanked – only 80% of adults had a bank account in 2014, up from 65% in 2011, which is the reason it was so easy for Tencent to expand so quickly. Even for those who do have a bank account, the banking system is not the way most people transact in China – they prefer the convenience of the Tencent and Alibaba payments system. (The Australian banks, for the record, are on to this, and it is definitely helping them.) To get a picture of the size of Chinese banks relative to Australia, China has 5 banks in the global top 30 by market capitalisation, only one more than Australia.

Tencent and Alibaba also have a significant holding in Didi Chuxing, which effectively won the battle for the Chinese taxi service against Uber. The reach of the big three in China is larger, industry-wise, than that of FANG, with exposure to more industries.

Of course, the FANG companies are diversifying where they can – Google (Alphabet) has its life sciences division, Calico, while Amazon is moving into entertainment. But in the west a larger number of the adjacencies are completely separate businesses, with value not really captured by the big four.

It’s a furphy that the Chinese companies are not profitable – they all generate massive amounts of cash, like their western cousins, and are actively encouraged to deploy this cash into new industries – food delivery, entertainment and the like.

We have included these names as a core holding in our disruption portfolio since inception, on the basis that China, by virtue of size and growth, is a disruptor in its own right. We expect this will continue to mean strong performance.

This article was originally posted on Livewire Markets

Share this Post