The recession we don’t seem to be having

Source: FrankHH, Shutterstock

Markets had braced for impact following the US Federal Reserve rate hikes (+2.25% so far this year) with expectations of a recession to hit relatively quickly, so forcing stock prices down in anticipation in the first half of the year. There are many negative indicators which pointed to this, except one very important one – the US unemployment rate which now stands at around a 50-year low. That could deteriorate if US policy makers are forced to raise rates again in the event inflation readings do not fall from currently elevated levels. Many companies held by the Fund did not get the memo that the economy was in a technical recession – earnings were instead driven by many of the strong underlying disruptive trends we have pointed to in recent months, including cloud, auto and the internet of things. The better-than-expected June profit numbers saw many holdings rally in response.

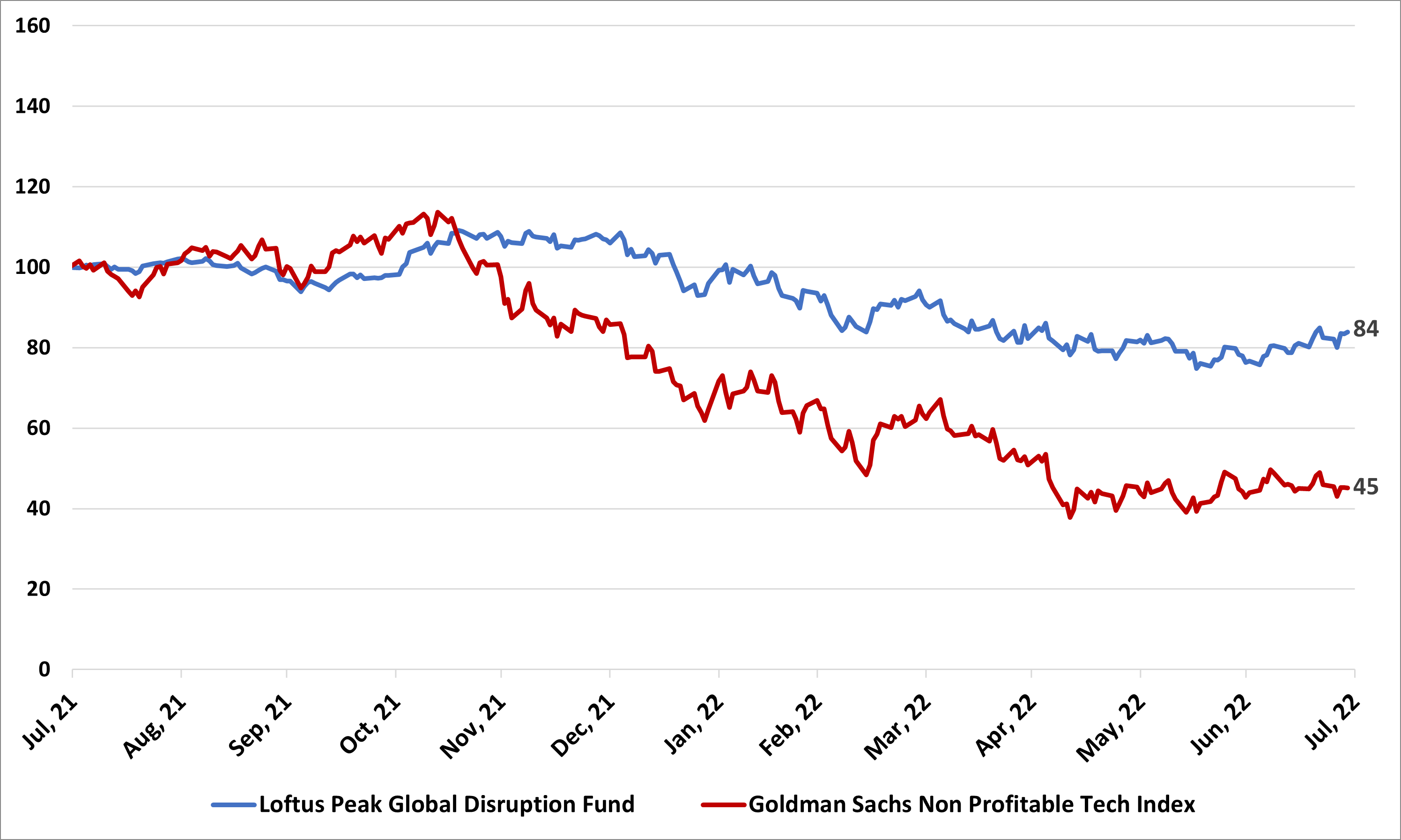

The turn in the market over the past month has prompted some investors to ask whether it is better to move up the risk curve in anticipation of a re-run of the post COVID 2020 rally that sent companies such as Zoom, Docusign and Tesla to stratospheric levels only to fall heavily as interest rates rose in 2022. There is good performance to be had from investors who get it right timing-wise, but the undperformance when markets move away from risk can be brutal. The chart below is illuminating.

Loftus Peak vs Unprofitable tech: What happens when markets shun risk

Source: Goldman Sachs, Loftus Peak. Data in AUD, indexed to 100 at 30/07/21

Apple says sales of iPhone are increasing, despite recessionary fears

Perhaps the most telling comment came from Apple’s Tim Cook, who said following the Apple result: “There is no obvious evidence in our data that there is macroeconomic effect on iPhone sales” (which rose, contrary to expectations). He went further, stating “we expect revenue (growth) to accelerate in the September quarter as compared to June” (growth relative to the year earlier quarter). Apple shares rose +3% on this news, adding +1% to the value of the portfolio.

These positive comments by Cook should be of assistance to Qualcomm, the largest contributor for the month (at +1.8%). The company, which supplies 5G chips to the iPhone, delivered sales up +35% to US$10.9b in the quarter, though it did trim its forward guidance. Our investment in Qualcomm ticks many boxes: it is foundational disruptive technology with applications in transport, communications, farming, entertainment, banking and manufacturing to name a few. We will be patient with the company – it is up +14% in the past month, but still well below its 52-week high of US$194.

Qualcomm chips in cars: a market bigger than smartphones?

The commentary behind the video below shows Qualcomm’s significant expansion into cars, with customers including the largest car company in the world by sales, Volkswagen, as well as Honda and Renault. Sales in this division this year will top US$1b and are growing at 30%+ compound. The key point from the video isn’t related to self-driving cars, which are frankly years away, but advanced driver assistance (ADAS) meaning the car has awareness of traffic (including pedestrians) using Qualcomm chips which have been at the heart of smartphones since they first rolled out (including the iPhone).

Microsoft CEO: Technology spend will increase as a percentage of GDP

In comments following the company’s result, Microsoft chief executive Satya Nadella said that “as a percentage of GDP (technology) spend is going to increase because every business is trying to fortify itself with digital tech to navigate this macro environment.” This far-sighted observation on the modern global economy provides context for Loftus Peak’s future-focused portfolio. The company’s shares were up +9.3% for the month, and added +0.7% to the value of the Fund value.

Of course, Nadella’s remarks are relevant to our investments in semiconductor companies including AMD, Taiwan Semiconductor Manufacturing and Nvidia (the latter of which we recently re-entered at low levels after a period based on valuation). We hold these companies because they make the tools that enable the disruption economy to function at scale, but do not command the same multiples and valuations as software-driven companies such as Amazon and Google. These latter companies have outperformed as applications for the networked, on-demand economy were turbo-charged by the smartphone.

AMD’s competitive ascendancy was underlined this week following competitor Intel reporting its quarterly earnings and downgrading revenue guidance by +15%, confirming again that it missed critical milestones demanded by its customers. AMD’s outstanding execution has brought it to a position unthinkable a few years ago: the company is now worth more than Intel. Combined, our semiconductor investments added +6.3% to the value of the Fund.

Amazon too reported growth, though not in its traditional retail business revenue, which went backwards, a victim of inflation which curtailed its own sales even as costs grew. But the company’s cloud services business AWS lifted revenue +33% to US$19.7b with operating income up +36% to US$5.7b. This element of Amazon’s business now earns more than the core retail business, which, along with Amazon services such as advertising, entertainment and its Prime business are now the value drivers for the share price. The company’s stock jumped +10% on the news, to bring its monthly increase to +27%, adding +1.4% to the value of the portfolio.

We had mixed results in the streaming companies. Netflix rallied strongly (it is up +28.6% for the month) as the company delivered better than expected subscriber losses, while advertising video-on-demand streamer Roku rescinded its +35% annual revenue guidance, virtually cancelling out all the contribution from Netflix.

Silicon’s cousin – the power semiconductor

Beyond all this, the roll-out of electric vehicles along with increasing use of wind and solar are driving the development of new specialised power transfer componentry known as power semiconductors, typically silicon carbide. ON Semiconductor is a critical player in the supply of componentry that facilitates this power transfer.

By the end of July, companies that account for half the portfolio had reported, which powered the +9.9% rally in the value of the portfolio (net of fees).

The takeout: Higher quality companies are the safer place to be

The story of the year so far is that growth multiples came under pressure as monetary policy tightened, causing investors to bail out of cashflow-negative, longer-dated growth stocks. These companies, exposed as they are to an intentionally-slowed economy, declined in value materially. Without profitability today, the market is anticipating that such companies will be forced to find new funding with fresh debt or equity – but of course at significantly higher cost to existing shareholders, which is keeping valuations down.

While we have seen some bounce in companies such as these, the question marks raised over their viability will not go away, especially where additional capital is required. For this reason, we prefer the safety of our quality companies with solid financials, which in any case are performing well.

Share this Post