Reading time: 4 minutes

It was all about “chips” – semiconductors – in 2021and likely also in 2022. We (internally) break down our portfolio into three categories – those that produce the tools that enable disruption (“tools”), those enabled by these tools (“enablers”) and a group of more downstream beneficiaries (“beneficiaries”). It’s not the only way the portfolio is split, but it is a useful way to understand how value in disruption can be tracked.

This understanding resulted in a significant weighting toward the “tools” companies during the year, including semiconductor designers, makers and suppliers such as Qualcomm, Nvidia, AMD, Marvell, Taiwan Semiconductor Manufacturing Company (TSMC), Samsung and ASML.These companies are the equivalent of pick and shovel makers in a goldrush. They may not perform as strongly as the best miners, but they do produce a steadily-growing and valuable cashflow stream. And they are not as subject to failure if a particular “mine” (social media platform maybe, or app) doesn’t work.

It’s an area in which most investors do not participate. However, it is correct to say that the new disruptive business models which have created so much value for shareholders would simply not have emerged but for the increasing sophistication and sheer grunt of the chips on which they run.

Earlier this week, for example, the agricultural machinery company John Deere debuted a new autonomous tractor with attached tillage equipment at the CES trade show in Las Vegas. Deere’s director of emerging technologies stated the tractor can run fully driverless at all times while tilling, saving significant time and labour. The company has stated it intends to expand the technology to include planting and weed control.

The scope of this is enormous. The feed from cameras, radar and possibly lidar (light detection and ranging) must be fused into a single moving picture – although it is not a picture, since every element of it must be ‘interpreted’ (and so involves graphics processing units, or GPU’s, tied in to the central processing units, or CPU’s). All of this intelligence is then used to drive the actuators which steer, till and spray across the mapped field. This is automation writ large.

The essential tools for these use cases are GPU’s by the likes of companies Nvidia and AMD (which together generated +4.1 percentage points of return for Loftus Peak investors in 2021).

Companies such as these have created interlocking value loops with each other. A Google-map search for directions may take place on a Samsung phone, using a Qualcomm processor, to then be stored in a Microsoft Cloud.

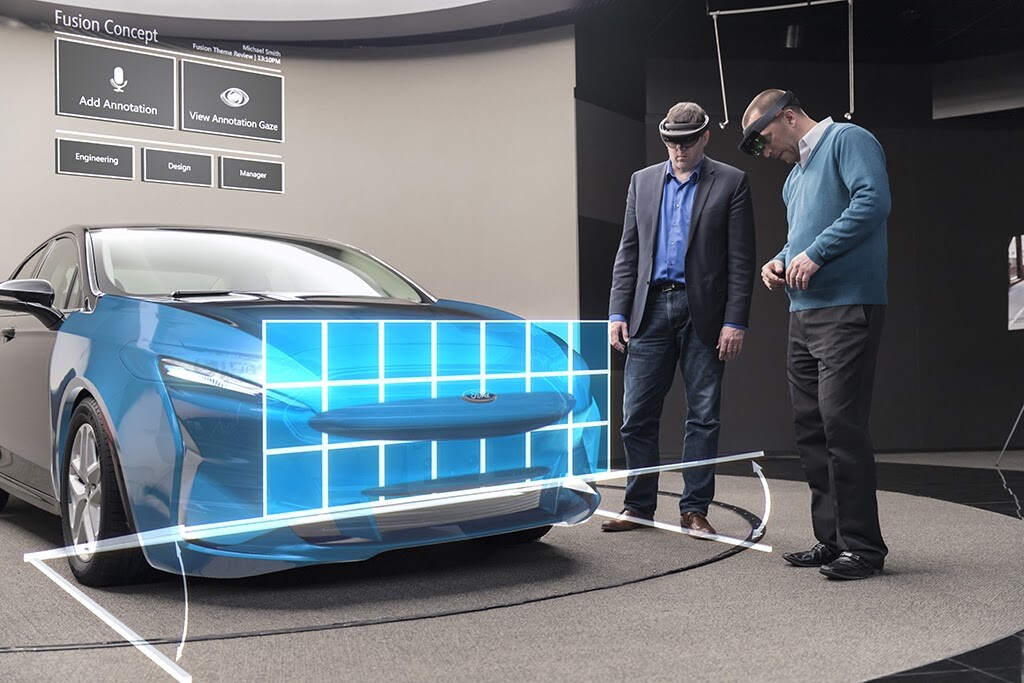

Semiconductor companies are powering disruption across all industries

Need to create recommendation engines for everything from movies to restaurants to clothing, or crank up machine learning systems to remove spam from millions of inboxes? Find the quickest way home? Play a game in smooth 4K? Conjure the metaverse itself?

Electric cars? These cannot run without power semiconductors from ON Semiconductor and Infineon. Ditto the home solar roof panels which require inverters and rectifiers to turn the DC current to AC, on which almost all appliances run. Even excluding battery electric vehicles, the silicon content of cars is set to triple in the next three years as drivers demand better safety features such as lane departure and school zone warnings, not to mention ever more sophisticated in-car displays and entertainment/navigation systems.

Indeed, the reason that used car prices have skyrocketed is because new cars are not available pending the required chips to finish them. Semiconductors are now critical in areas as diverse as shipping logistics, vaccine development and power grid management.

The Loftus Peak portfolio does not include semiconductor companies because it is a technology investor, trying to pick winners from a commoditised group of companies making low value-add components for computers. They are there because of their critical role in powering the cutting edge of disruptive businesses in all parts of the economy.

Where next for semiconductors?

The revenue limitations for semiconductor companies are not related to demand, but supply. Because of supply chain mayhem caused by COVID-19 coupled with an endless thirst for compute cycles required by advanced applications, there is simply not enough capacity in the world’s major chipmakers to satisfy the demand. It’s the reason that TSMC has allocated US$100b over the next three years to additional manufacturing capacity, more than double the normal sum. Virtually the entire company’s production in 2022 is already sold, and the situation seems likely to continue into 2023.

The Economist magazine recently referred to data as the new oil – true enough – and it is the semiconductors that are producing, storing and generating value from it. There is no sensible reason for any fully engaged market participant to miss this trend. Investors should look to their own portfolios to ensure adequate, well-priced exposure.

Close of Year performance

The Fund performed well for the year (again) absolutely, but registered its first full calendar year of underperformance, against a strong “re-opening” trade. For the year, the top contributor to the investment portfolio was Qualcomm, which added +5.3 percentage points to return, with Google second at +3.5 percentage points and Microsoft not far behind with +3.1 percentage points. The worst performing companies were Alibaba, which has been cut down by fiat regulation in China and so detracted -2.1 percentage points for the year, and Roku (-1.3 percentage points) which had a very tough year following a period in which it rose tenfold. Read the full December performance review here.

Looking to the year ahead, we remain particularly confident in the Fund’s exposures to 5G and the Internet of Things, cloud computing, digital advertising as well as the semiconductors underpinning these disruptive changes; we will continue to position our clients to benefit from these long-term secular trends.

Share this Post