Source: Onsemi

The answer is simple. The company re-imagined the future of transport, and understood that the technology was at hand to radically simplify the car around electrification. The Tesla electric car was fast, quiet, had 90% fewer moving parts than vehicles powered by fossil fuel and could be given new features or recalled for faults with over-the-air software patches.Which then begs the question: if cars can run better with electrification, what about the rest of the gadgets with which we are surrounded. We are talking about, in the US alone, 280 million cars and trucks, 70 million fossil-fueled furnaces, 60 million fossil-fueled water heaters, 20 million gas dryers, and 50 million gas stoves, ovens, and cooktops, according to figures from 2021 Yale publication: From Homes to Cars, Its Now Time to Electrify Everything.

The push is on for all these gadgets to be powered by electricity. Transforming the economy so that more things run on clean electricity is a cornerstone of President Biden’s plan to slash emissions to nearly zero by 2050.

The technology already exists for electricity to be created cleanly with wind and solar, among others. There would be absolutely no point in any of this if the electricity for this mammoth task were to be produced by setting a whole new bunch of larger fires by burning exajoules of coal and gas. That would simply be shifting the problem around, not solving it.

Biden’s proposal isn’t just about cutting fossil fuel emissions. When combined with better technology – for example the use of heat pumps instead of air conditioners – the drawdown of energy actually decreases.

The key point is both simple and elegant. Unlike value in the sharemarket, energy cannot be created or destroyed, but can be converted and harnessed with the right technology.

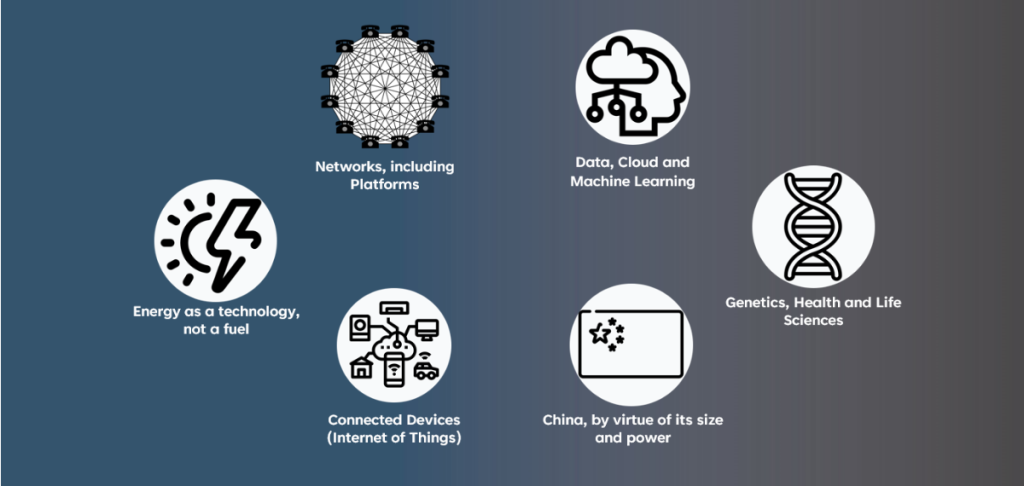

We framed this proposition as a key investment theme of the Fund at inception under the heading “Energy as a technology, not a fuel.”

It remains one of six disruption drivers – networks, data, life sciences, connected devices or IoT and China, as the chart shows below.

Electrification is a fertile area for investment, subject to share price

At first glance, there are many ways to play the disruptive effect of electrification on energy, like batteries and the materials such as lithium that go into making them.

But Loftus Peak does not invest in battery companies, critical as they are, because as investment vehicles they suffer from a number of problems. Firstly, the speed of development is hindered by significant complexity relating to specialist materials, even including lithium. Furthermore, battery companies are likely to be exposed to sovereign risk, since a number are China domiciled, and accounting risk, because of the variable quality of published accounts, to name just a few.

Where the Fund sees rapidly emerging electrification value is in wide band-gap semiconductors, which are critical in turning energy from batteries, or any DC energy source, into motive power. These are not new – they have been the bedrock of trains for decades.

There has been significant progress in this area in the past few years. For example silicon carbide (SiC) is a wide band-gap semiconductor that can improve the efficiency of the car inverter by about 5%. That 5% gain can be spent in many different ways – a larger vehicle, greater range or a faster charging cycle.

In Power Electronics News, Stephen Lambert, Head of Electrification at McLaren Applied (yes, that McLaren), pointed to the game changing benefits of bringing more efficiency to the inverter in the EV powertrain.

“The inverter is an often-overlooked part of the EV powertrain, but as a device that converts the DC power stored in the battery to the AC power used in the electric motors, it is vital to the vehicle’s operation and optimization. When looking at all the drivetrain parts, the inverter greatly impacts efficiency (directly impacting range, charge time, etc.). It will also define the feel and character of the vehicle, as it is the inverter that controls the motor which propels the vehicle. We believe that inverter technology will rapidly adopt silicon carbide.”

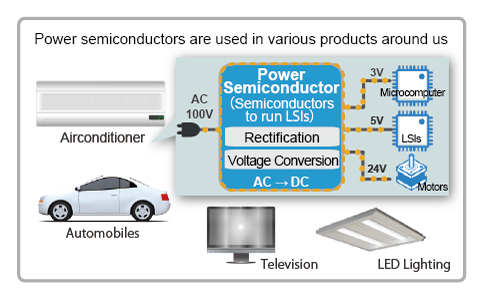

Wide band-gap materials in power semiconductors helps optimise the grid as a whole

Source: Sanken Electric

SiC and related wide band-gap technologies are not limited to EV batteries but can be integrated into car superchargers, trains, longer-lasting solar and wind energy power converters, grid substation transformers and countless home appliances.

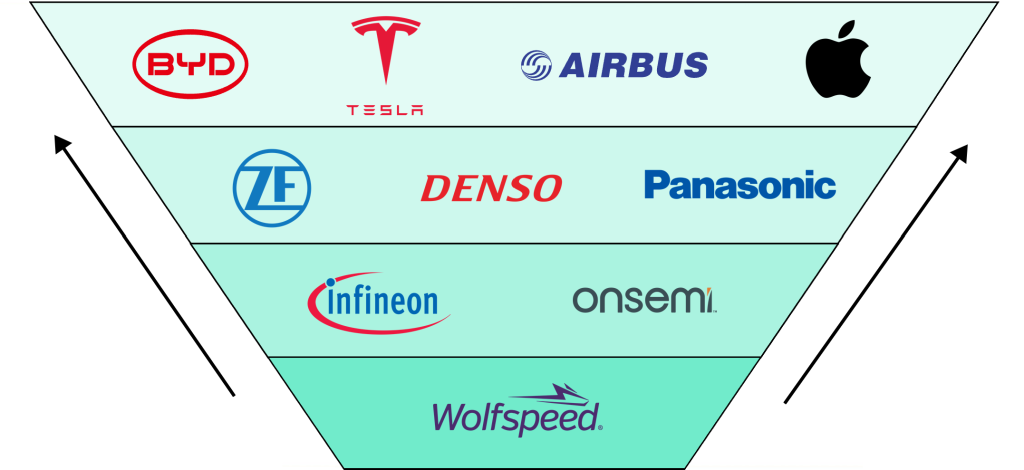

Loftus Peak has holdings in companies that participate in this technological value chain such as Onsemi, Infineon and Wolfspeed and which have contributed to investment returns.

Power semiconductors are foundational to electrification

Source: Bloomberg

Wolfspeed manufactures and sells SIC-based power semiconductor components, but is also the key supplier of the underlying input, SiC ingots (known as boules).

These boules are then sold to other power semiconductor manufacturers such as Onsemi and Infineon for manufacture.SiC devices represent a relatively small, but fast growing, segment within these two companies, which along with Si devices are sold to intermediary companies like ZF Friedrichshafen, Denso and Panasonic.

The intermediary companies sell the power semiconductors onto any number of end-device manufacturers requiring electronic components. This includes many car companies, such as BYD and Tesla, but also companies as diverse as Airbus and Apple.

What about alternatives to SiC?

The specifics of the disruption driven by electrification is not yet settled, so an investor may well ask why SiC instead of other wide-bandgap materials like Gallium Nitride (GaN) or battery commodities like the rare metals and rare earth metals.

GaN has growing use where high frequency low power devices are needed; power semiconductor component holdings in ON and Infineon already carry some exposure to this market.

Rare metals – including Lithium (Li), Cobalt (Co), Indium (In), Gallium (Ga) and others – are generally used in more specific applications and compete amongst themselves for these applications. Rare-earth elements share this issue and run the additional risk of their separation and refinement process being deeply capital intensive and pollutive.

SiC on the other hand, competes with Si in general applications. It can be produced more broadly than rare metals or rare earth elements and the difficulty of manufacturing is diminishing.

We at the Fund believe mass electrification coupled to SiC technologies is a powerful future facing solution, and have been monitoring this disruptive trend for a number of years. The reason is obvious: AI is hot now (more on this coming soon), but generating return requires a constant flow of new ideas.

Share this Post