We first saw pictures like these almost ten years ago, produced by Nvidia, the second largest company in the world today. They are not a special effect, but rather a real time recording of what the Nvidia chip “saw” and then processed, represented by the boxes around cars, pedestrians, traffic signs and other objects. It led us to consider much more deeply the progress of artificial intelligence (AI) and semiconductors. And it also led us to invest in Nvidia in 2016 for the first time. Ten years later, the AI foundations on which the video was based have been recognised on the grandest of scales – the Nobel Prize in Physics was awarded to Professor Geoffrey Hinton and his collaborator for work in foundational AI. Professor Hinton was an Alphabet employee.

We believed then, and still do, that processing power and vastly sophisticated work in AI will radically impact business models. And that means we will continue to see disruption powering enterprise, and so will continue to invest in it.

The limitations of “move fast and break things”

A broadly accepted principle of this disruption is “move fast and break things”. We see this in the business strategies of Meta, X/Twitter, Alphabet and Tesla among many others.

In Meta’s case, it is accepted that a range of dangerous behaviours have been unleashed on those who only really wanted to connect with friends and family. Similarly with X/Twitter, the algorithm was weaponised quickly and used effectively to influence election outcomes, enable dangerous movements such as the alt-right and to recruit members for ISIS and more. So much more.

Twitter’s free speech licence was easily upgraded, if that is the word, to a hate speech licence, enabled by the fact that users could post anonymously with a ‘handle’, which sounds cool but isn’t, since that handle has been used as a cudgel to secretly bully or propagate content that is blatantly racist, misogynistic and violent – including livestreaming mass murder. All under the protection of free speech.

It seems highly likely that were these companies and their products ‘slowed up’ in testing with controls added to prevent these behaviours they would be much smaller today. Imagine if the tobacco industry research on the harms of that product was surfaced by tobacco companies before smoking became socially desirable. Big.

The Food and Drug Administration: disruption, controlled

Here the story diverges.

One area that companies cannot move fast and break things is life sciences, because regulations in the U.S. and globally demand rigorous scientific testing before drugs and treatments are unleashed on the public, for obvious reasons.

Unsurprisingly, the growth of processing power exists in life sciences, just as everywhere else. It is unremarkable that the number of drug trials has significantly increased over the past thirty years. Processing power has been a big part of this.

What has come of this progress? A leukemia diagnosis 20 years ago was a one-year death sentence. Now there are around 60 blood cancers for which there are survival rates of 5 years and getting longer.

Non-Hodgkin lymphoma survival rates have tripled in the last 50 years in some countries. In the 1970s in the UK, 22% of people diagnosed with non-Hodgkin lymphoma survived their disease beyond ten years. After 2010 it was almost two-thirds (63.2%).

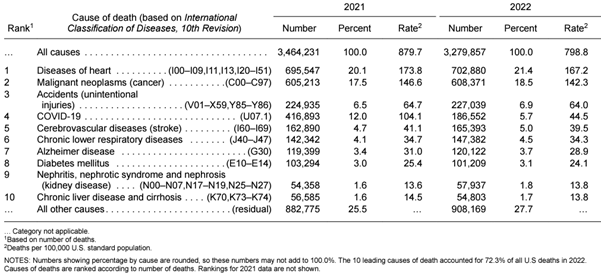

However, diseases of the heart, strokes, cancers as mentioned, and kidney and liver issues remain on the list of the top ten killers, as the table below from 2022.

Source: National Center for Health Statistics (NCHA), National Vital Statistics System

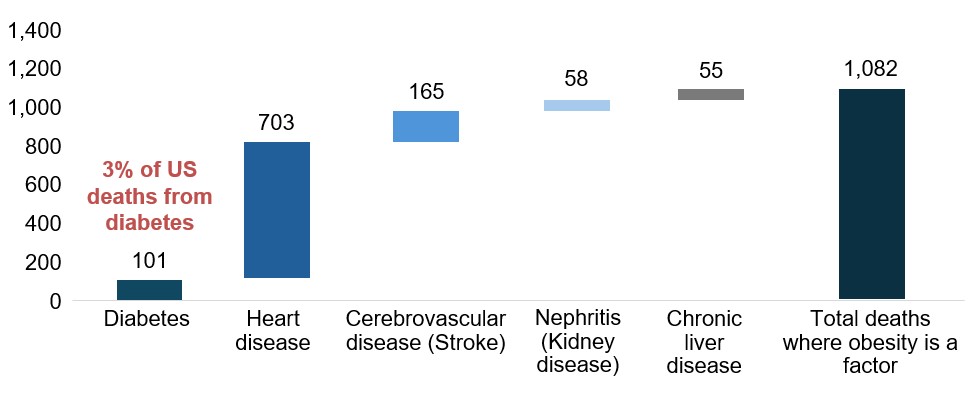

Note: the table above lists diabetes (mellitus) as the cause of 3.1% of deaths in the U.S. in 2022. But obesity is implicated in heart disease, strokes, renal and liver diseases. So that means that obesity leading to diabetes isn’t just the cause of just three percent of diseases causing death – but up to 30%! That may be the real calculus behind the role of obesity medications.

And it is here that things start to get really interesting.

Diabetes has for a century been treated with insulin, which has allowed sufferers to live much longer lives with relatively simple daily injections. It’s well known that one of the causes of type two diabetes is obesity. Insulin is a treatment for diabetes, while weight reduction may in some cases be a cure.

The plethora of diet programs, clinics, retreats and medicine designed to cure obesity runs to billions of dollars annually. So, any progress here really is progress, and thus it is that we have the off-label prescription of the class of drugs known as GLP-1’s (Glucagon-like peptide-1) to target weight control. These drugs go under the name Ozempic and Wegovy, or Mounjaro and Zepbound and have been shown under FDA tests to be effective in adult weight loss of up to 20% over a course of several months.

This note forms part of Loftus Peak’s rationale for the inclusion of Eli Lilly in the 2024 Sohn Hearts and Minds investment portfolio. Lilly is the largest drug company in the world, by market value. (NB: It is not the only major manufacturer of obesity drugs – Danish group Novo Nordisk is also a major player with medications that, like Eli Lilly, have a 5-7 year head start on the rest of the market). The proceeds of the Sohn portfolio are for the benefit of medical research. Loftus Peak derives no financial benefit from its recommendation, though not surprisingly, the portfolios we manage include a holding in Eli Lilly. For those who wish to watch a video Alex Pollak presenting on Eli Lilly at the Adelaide Sohn Hearts and Minds conference, click here.

Why was it chosen? The company is expensive by most investment measures. To get to the valuation of Lilly today requires quite challenging assumptions around market size, penetration, prices and costs, and competition including generics. The one year forward price / earnings ratio for this company is around 35x (about the same as that of Nvidia).

As noted, the table above lists diabetes as the cause of 3.1% of deaths in the U.S. in 2022. But obesity is implicated in much more than diabetes. In a release from March of this year, the FDA announced that Wegovy was the first weight loss medication to also be approved to help prevent life-threatening cardiovascular events in adults with cardiovascular disease.

Obesity is also a factor in stroke, renal and liver disease and even some cancers. So that means that obesity isn’t just the cause of three percent of diseases causing death but may be implicated in 30%. In our view, that will over time be shown to be the real calculus behind the valuations of Lilly and its competitors. The chart below brings this into sharp relief.

U.S. deaths by disease in which obesity is implicated (000s)

Source: Centre for Disease Control

Other markers: the World Cancer Research Fund’s Continuous Update Project report concluded that there is strong evidence that adult body fatness increases the risk of 12 types of cancer and the International Agency for Research on Cancer (IARC) has shown there is sufficient evidence that high body mass increases the risk of 13 types of cancer.

And what does the medical profession think?

The following comments come from S. Sethu K. Reddy, MD, president of the American Association of Clinical Endocrinologists, on the role of obesity in heart disease. “There is clinical evidence that these medications not only improve diabetes control but also reduce the risk of cardiovascular events. So, currently, if someone has type 2 diabetes and is at greater risk of cardiovascular disease, there is little controversy for the patient to receive GLP-1 analogs.”

“There is enough awareness amongst the public in that the patients themselves often ask their physician about the medication,” he said.

Anecdotal evidence and commentary from individual clinicians suggests that “well, but overweight” patients in middle age will be prescribed weight-loss drugs prophylactically. Doctors are pointing out that weight gain which typically advances with age could be slowed, with any side effects counterbalanced by the clear chance of the reduction of cardio-vascular-renal and liver disease.

Australian investors can see the impact of weight loss drugs on the stock price of sleep apnoea company Resmed – the price was down -35% after successful trials from Novo Nordisk’s weight-loss drug Ozempic triggered a wave of selling. The stock has since recovered somewhat, but is clearly affected by the implications of the weight loss drugs.

To be clear, our valuation does not depend on diabesity (the term was first coined in the seventies), as the principal cause of death in many related diseases, only that it is a factor. But it is the reason that we believe the addressable market for these products could be many times larger than that which is considered for diabetes alone.

We are of the view that what we have seen to date in the Eli Lilly share price is only the start of the lift in valuation. The World Health Organisation estimates that there are around 990m people in the world suffering from obesity. Currently, only 10m of them are taking obesity drugs.

We are not naïve enough to believe that 1 billion people will soon be on weight loss drugs, or could afford them, or would even benefit. While we expect competition will be intense. But on balance, these medications are the beginning of a disruption in the treatments for obesity and many of the co-morbidities which flow from it. And it is for this reason that the company has found a position in the portfolios of Loftus Peak.

Share this Post