The Loftus Peak Global Disruption Fund was up +5.2% net-of-fees in January, outperforming the benchmark MSCI All Countries World Index net in Australian dollars by +5.0% (it rose +0.2%). One-year net performance to 31 January is +39.5%, which is outperformance of +37.0%.

Read the January 2021 Fund performance report here.

Around two weeks ago, General Motors CEO Mary Barra announced that it would end the sale of all petrol and diesel powered cars by 2035.

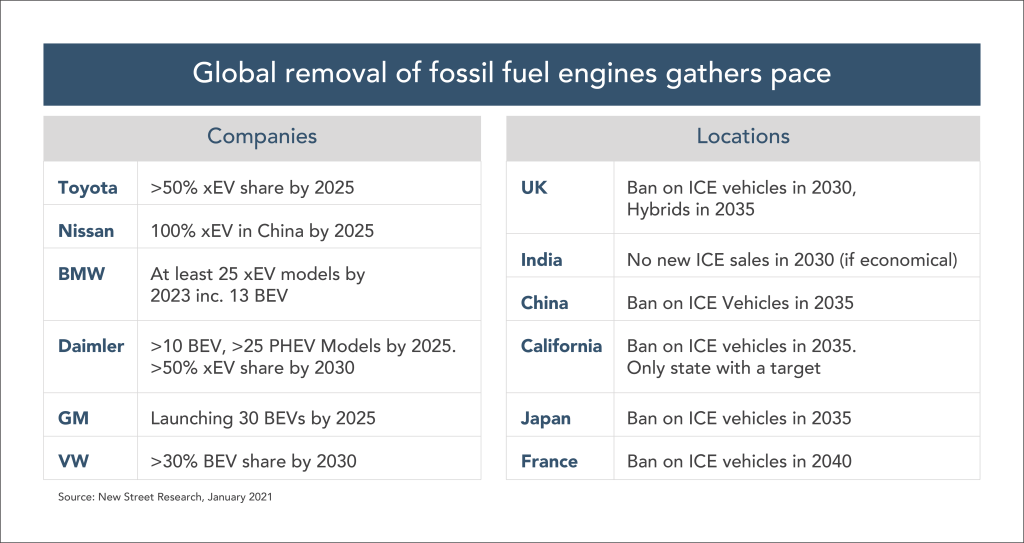

GM’s decision is in-keeping with decisions being made by Governments around the world to outlaw the internal combustion engine, as the table below shows. It’s not just the success of the Tesla, it’s equally the growing concern about climate, along with the VW diesel cheating scandal that is pushing things along.

The implications of these decisions are that all major car makers will need to field competitive green cars in the future. And to illustrate how hard this is, consider the following commentary from the Wall Street Journal on VW’s 5-year, US$50b plan to develop the electric car – the biggest commitment of any of the carmakers.

The WSJ concluded “The car did not work as advertised”.

“It could drive, turn corners and stop on a dime. But the fancy technology features VW had promised were either absent or broken. The company’s programmers hadn’t yet figured out how to update the car’s software remotely. Its futuristic ‘head-up’ display that was supposed to flash speed, directions and other data onto the windshield didn’t function. Early owners began reporting hundreds of other software bugs.

“Volkswagen decided in June last year to delay the launch and sell the first batch of cars without a full array of software, pending a future update, which is now scheduled for mid-February. Tens of thousands of owners will have to bring their cars in for service to have the new software installed,” the WSJ noted.

“Volkswagen, the world’s largest car maker, has outspent all rivals in a global bid by auto incumbents to beat Tesla. For years, industry leaders and analysts pointed to the German company as evidence that, once unleashed, the old guard’s raw financial power paired with decades of engineering excellence would make short work of Elon Musk’s scrappy startup.

“What they didn’t consider: Electric vehicles are more about software than hardware. And producing exquisitely engineered gas-powered cars doesn’t translate into coding savvy.”

We should not conclude that VW is alone. Daimler Benz, BMW, Ford, Fiat Chrysler are all heading in the same broad direction, with varying degrees of success.

We have written and spoken before about the problems of converting a fossil fuel car company to one that builds sustainable green vehicles. The short answer is that most of the existing plant/outsourced manufacturing becomes obsolete – electric cars have 90% fewer moving parts. There is no need for exhaust pipes, turbos, fuel pumps and the like. The parts that remain are very different, such as regenerative braking systems which use the car’s slowing momentum to harvest energy for the battery, extending range.

How do you tell the head of the internal combustion unit that his or her services, and that of the division, are no longer required – effectively reducing spending in the areas that are currently delivering 99% of revenue, even while the success of the electric car is not assured?

But while the fossil fuel based car making incumbents are finding it tough, we believe that Tesla is ‘priced for perfection’, so we are no longer holders at the present share prices.

Disruption in cars is very visible, but disruption is everywhere, really.

The virus has already driven a dramatic uptake of tools to remotely operate business, health, retail and leisure. It is extending dramatically, even down to the home music system, as well as the doorbell and over time the lights, air conditioning and blinds.

And powering all of this? It was obviously not possible when broadband, either cellular or in-ground, was constrained by inadequate fibre or earlier generations of mobile. But that is all changing, as is the mechanism by which business – any business – operates.

The new architecture of business is decentralised, with compute, storage, memory and applications increasingly housed in the cloud and datacentres. For example, the banking app on your phone is almost certainly cloud-based.

Which raises the question: How is all this possible at scale? And the answer is a massive increase in processing power. We have written before that Google search processes 67,000 queries per second. That is 5.8b requests in a day. There simply isn’t a global workforce large enough to deal with this volume were it to be done manually.

It is for this reason that datacentre and cloud resources are undergoing enormous expansion, with many of the beneficiaries being companies which are held in the Fund.

All of this is driving the earnings, and therefore valuations of companies engaged in this disruption. Apple recently reported its first ever US$100b sales quarter.

Some of these company valuations are high, a point picked up by the US value investor David Einhorn, who is waiting for the return of more normalised valuations before investing.

Sometimes companies are expensive because they are in a bubble (like GameStop, among others). But other times, where this market is concerned, it is because genuine disruptive change is at play.

Still, we do see pockets of overvaluation, so remain committed to our own disciplined valuation process to help protect investors against holding poor quality assets in a downturn. We believe the portfolio is well-positioned for the generally anticipated sharemarket economic upswing as the impacts of the virus are reined in and people continue to look for better and more cost-effective ways of doing things online, whether it is working, shopping, learning or playing.

Share this Post