Source: IMDB

This was one of our strongest years ever, with the Fund reporting +35.3% net-of-fees performance for the full financial year ending 30 June 2023.

It was truly a year of two halves, with the six months to 31 December 2022 negatively impacted by rising interest rates in the U.S., the Federal Reserve’s mechanism to fight inflation, causing the Fund to fall -5.1% net-of-fees, while the second half saw very strong performance of +42.5% net-of-fees.

For most of last year, Fed Chair Jerome Powell talked an aggressive game about knocking inflation down but his cover was blown in March (more on this later). From November 2022 onwards, artificial intelligence (AI) emerged as an enormous disruptive trend – particularly as we turned into the new calendar year.

And so the rally in the second half of the year started, almost from 1 January 2023, with our benchmark MSCI All Countries World Index (net) as expressed in AUD from Bloomberg up +16.5% to the end of June 2023.

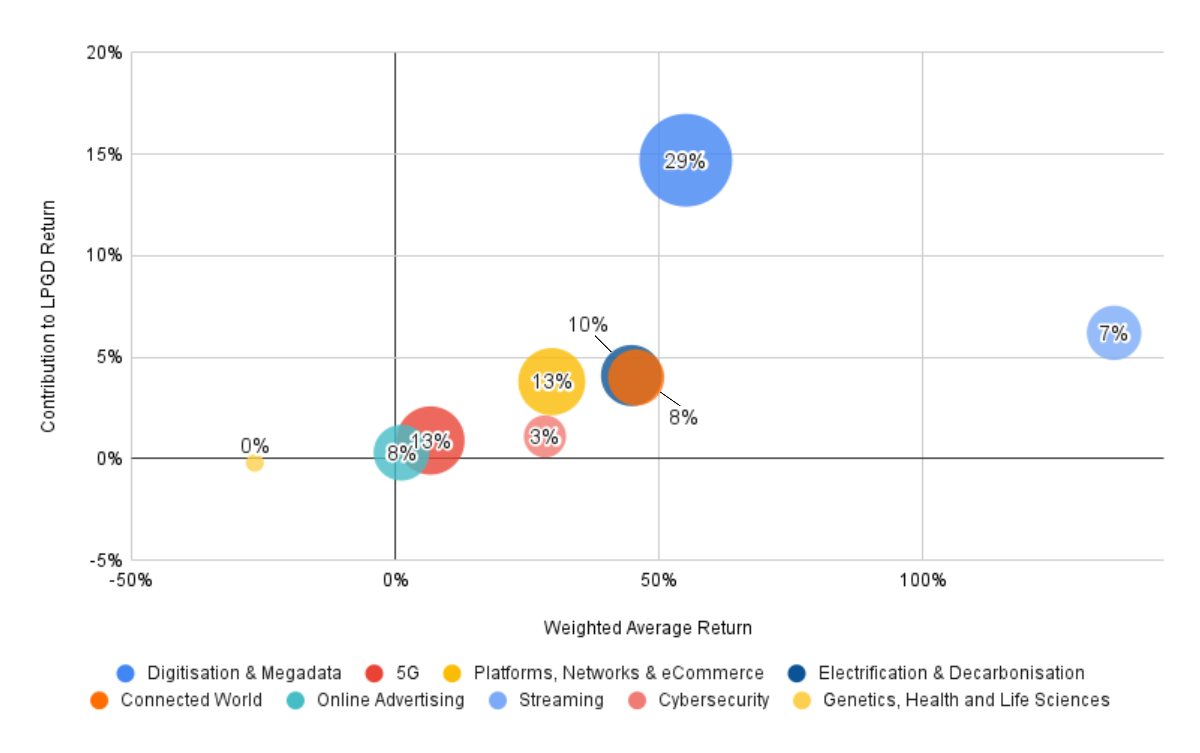

The best and worst of ’23

By far the biggest aggregate contribution came from companies exposed to artificial intelligence, largely falling under our thematic of Digitisation & Megadata. In fiscal 2023, Digitisation & Megadata contributed +14.7% to returns. Nvidia, AMD, Microsoft, Marvell, TSMC, Amazon and Arista were powerful forces for the year with most of that coming in the second half after a negative first half. Nvidia, the company at the core of artificial intelligence capabilities, had one of the largest revenue upgrades ever in combined dollar/percentage.

Netflix was the biggest single contributor to the Fund value for the year, lifting it +6.3%. Fellow Streaming and Online Advertising company Roku reduced Fund value by -0.5%, the largest detractor for the year. However, the stock has been a contributor since we entered and has posted gains since the end of December. Streaming for the year contributed +6.2% of performance.

The investments in Electrification & Decarbonisation companies such as Wolfspeed, On Semi and Infineon also did quite well for the year adding +4.1% to the Fund’s value. The steady demand for continued electrification allowed this thematic to grow across both halves of the year.

Connected World and 5G together represented 21.0% of the portfolio on average and contributed +4.0% and +0.9% respectively.

Internet of Things (IoT) company Samsara, falls under the Connected World thematic and the stock is up more than +150% since we entered in late 2022. The company is facilitating the digitisation of physical industries and serves many mature, cyclical end markets like transportation, logistics and manufacturing. However, due to the early nature of the disruptive trend, the company has fared much better than the market expected, with Samsara displaying resilient revenue growth and margin expansion.

Qualcomm (which falls under both Connected World and 5G) detracted -0.1% for the year, the fifth largest negative contribution. Cyclical headwinds continue to overpower the strong secular opportunity we see for the company.

Heavily AI-exposed Digitisation & Megadata performed strongly in FY23

Source: Loftus Peak

Note: thematic weighted average return incorporates each companies’ fiscal year 2023 return, average portfolio weight and thematic exposure.

Contribution represents the return added (or subtracted) by a thematic to the total return across FY23 for LPGD.

The size of the bubbles represents the average weight of the thematic in the portfolio (also written inside the bubble).

Online Advertising was one of the weakest thematics in the portfolio, adding +0.3%. Roku was part of this, Alphabet (Google’s parent company) – while a contributor – lagged Microsoft and Amazon. This stemmed from Microsoft’s blustery entry into AI, which has shaken the market’s faith in Google as the historical leader in AI as well as its grip on the search market.

And then Artificial Intelligence hits the headlines…

It has been mentioned, but Nvidia, the company at the core of AI hardware, had one of the largest revenue upgrades in dollar/percentage terms in a quarter of any company, ever. Revenue expectations jumped from US$7b to US$11b for the three months ended July 2023. Last week it even beat that number, clocking a US$13.6 for the quarter on the back of GPU purchases from customers seeking to implement AI solutions in their business.

Globally, few, including ourselves, expected a move of this size. In fact, we believe even Nvidia did not predict the scale of demand for their AI vital chips – July earnings were even better than the company anticipated despite their guide still being ahead of the sell-side estimates.

But there were more than enough signs. Progress toward increasing machine learning has been accelerating for years, with a heavy investment in cloud computing and the data centre as evidence, fuelled by the mindboggling numbers of transistors on a silicon chip. (In the case of M1 chips in Apple devices, there are 16 billion transistors within a 1.19 square centimetre area.)

It is broadly understood that there are under ten major data centre companies (the “hyperscalers”) in the world – Google, Amazon, Microsoft, Meta, Alibaba, Apple, Tencent, Oracle and possibly Huawei. These companies exist because they provide scalable compute services which can be charged even by the second, allowing their customers to outsource back-office data-intensive functions which otherwise would have required the provision of hardware and personnel for peak loads, a poor use of capital when those loads happen only a few days a year.

The demands of enterprise to outsource data requirements to cloud has resulted in the massive – by which we mean hundreds of billions of dollars – investment in compute, storage and networking, with data centres as close as possible to end customers. At the same time, customers have demanded the most up-to-date services, including artificial intelligence.

But just to set the record straight, AI isn’t just a 2023 phenomenon. It has been brewing up for almost a decade, and we have been investing in it since the strategy’s inception. In 2016, Google CEO Sundar Pichai noted that the coming decade was all about AI, following a decade during which cellular communications were in the ascendancy.

We have referenced over the years that every time Netflix produced a recommendation, or Uber a route, or email triaged spam from the inbox, it was a form of AI that was in the background.

This is mostly discriminative AI, meaning it learns to decide between two or more possibilities. Generative AI synthesises something new from its input data. An example is shown below: a chair optimised by Autodesk Generative Design under a set of instructions from renowned designer Philippe Starck.

Source: Starck

Meanwhile, a banking crisis is being averted, we hope

Since March of 2022, the U.S. Federal Reserve had engaged in the most aggressive hiking cycle seen since the 1980s. In doing so, Silicon Valley Bank suffered a run on deposits during March – ending the bank in its previous form.

Students of finance know that when one bank goes it calls into question others, and so it was that both Silvergate and Signature Banks failed. As late as this month there are still negative ramifications, with ratings agency Moody’s downgrading 13 mid-sized banks and putting under review a further five big players including Northern Trust Corp and Bank of New York Mellon. We would be remiss if we failed to note that the U.S. itself was downgraded a notch to AA+ by Fitch. Every borrower in the U.S. can expect some effect.

Most of the trouble arose as a result of a failure to deal with declining values of the banks’ bond portfolios because of the rapid rise of interest rates in 2022. However, with failures and downgrades now a part of the U.S. financial landscape, the Federal Reserve’s ability to raise rates again is severely crimped.

Share this Post