The Growth/Value dichotomy lies in plain sight – at the time of writing, the Dow had risen 0.7% overnight, while the NASDAQ fell 0.5%. These moves have been in train for most of the year to date, with investors of both persuasions wondering whether the price of growth companies has largely been captured with value companies yet to fully reflect the ‘re-opening trade’ as vaccinations increase, borders reopen selectively and airline bookings pick up.

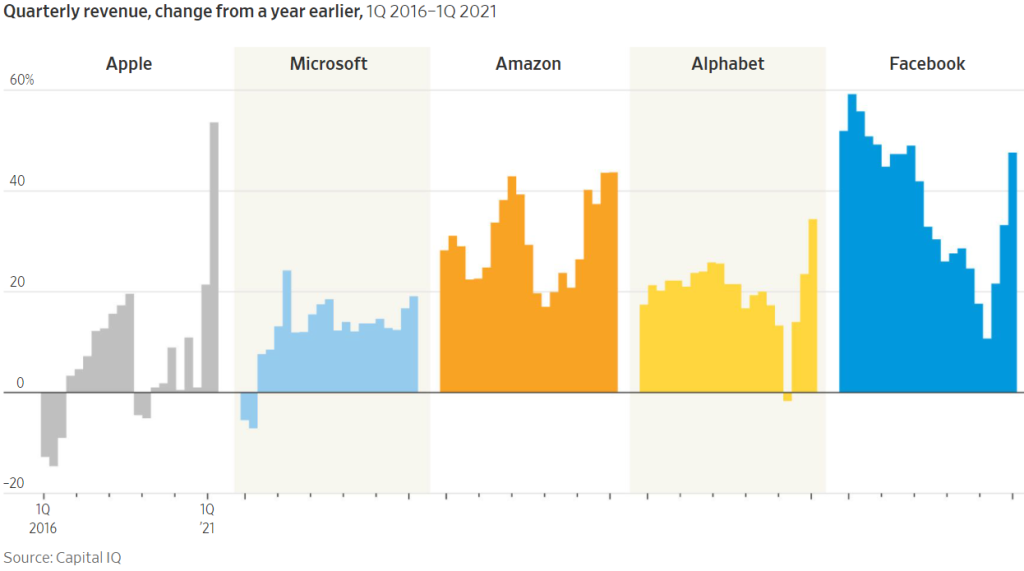

We think not. Earlier this month, the Wall Street Journal published the following chart, with accompanying commentary, of the quite mind-bending revenue growth numbers produced by the disruption giants in the March quarter, relative to the same period last year. These numbers show a pattern of growth accelerating coming out of the COVID year. Remember, this group, of which some are core holdings of the Fund, picked up steam even as COVID hit. A fall in revenue growth could have been expected as the world began the slow climb to recovery.

These companies are recording (for the most part) their strongest quarterly revenue growth in five years. Microsoft chief Satya Nadella, on the most recent earnings conference call, said: “Over a year into the pandemic, digital adoption curves aren’t slowing down. They’re accelerating, and it’s just the beginning. We are building the cloud for the next decade, expanding our addressable market and innovating across every layer of the tech stack to help our customers be resilient and transform.”

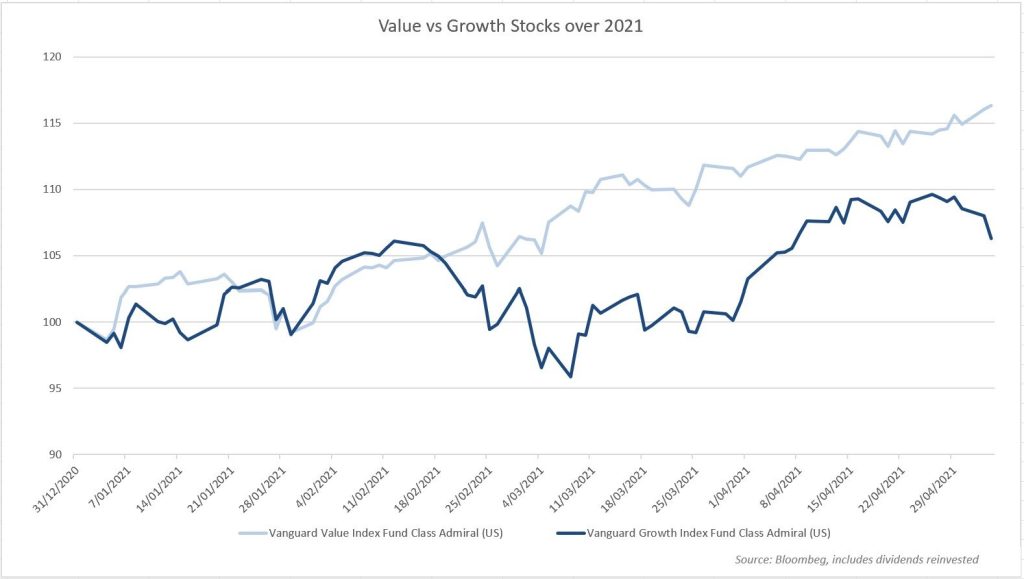

But the share prices of these stocks did not rise following these blow-out numbers – indeed a couple fell. In truth, they mostly rose in the weeks leading up to the results, so perhaps no further lift on the result was to be expected. There is no doubt that some of the beaten-down value players are enjoying their period in the sun, as the chart below shows.

Our caveat is that this value resurgence should be regarded with some circumspection. Take for instance the European car-makers. On the one hand, Volkswagen, the largest car producer in the world with production of over 10 million vehicles annually, has fully embraced the electric vehicle, committing to the virtual phase-out of internal combustion engines entirely within a decade. It has been reported that VW’s admittedly smaller rival, BMW, has not committed to the electric switch, with the BMW board against it because the margins are lower than for the ICE cars. Frustrated innovative, creative, and smart engineers left BMW, partly founding their own battery electric vehicle startups in China or the United States, it has been widely reported.

In our view, there are value (lowly-priced) stocks, and there are value companies that have a plan for the future, and they are different. Disney is in the latter group, moving from a model in which it relies on cable companies to sell its programming in favour of a streaming service like Netflix. Kodak is an example of a value company which failed to adapt, and so never realised its value promise. Looking at the world through the lens of disruption can assist in not just identifying winners, but avoiding the losers. We believe it is important to understand how well a company is positioned for the next 2 to 5 years of change when considering it for investment, so as to avoid holding the next Kodak.

Share this Post