Global sharemarkets changed direction abruptly in mid-November 2021, with the trigger the ‘hot’ US inflation reading for October – it rose to +6.2% year-over-year, almost guaranteeing the US Federal Reserve would raise rates to prevent the number going higher (which it did).

It got worse. The Russian invasion of Ukraine put upward pressure on commodities: disruptions in oil, grain, fertilisers and some chemicals added new anxiety to a world still recovering from COVID supply shortages. Indeed, Shanghai remained in lockdown until last month. There is good news in the bad news – rising costs and tight supply are pushing prices to unacceptable heights for businesses and consumers, which of itself is slowing the economy and reducing upward pressure on interest rates.

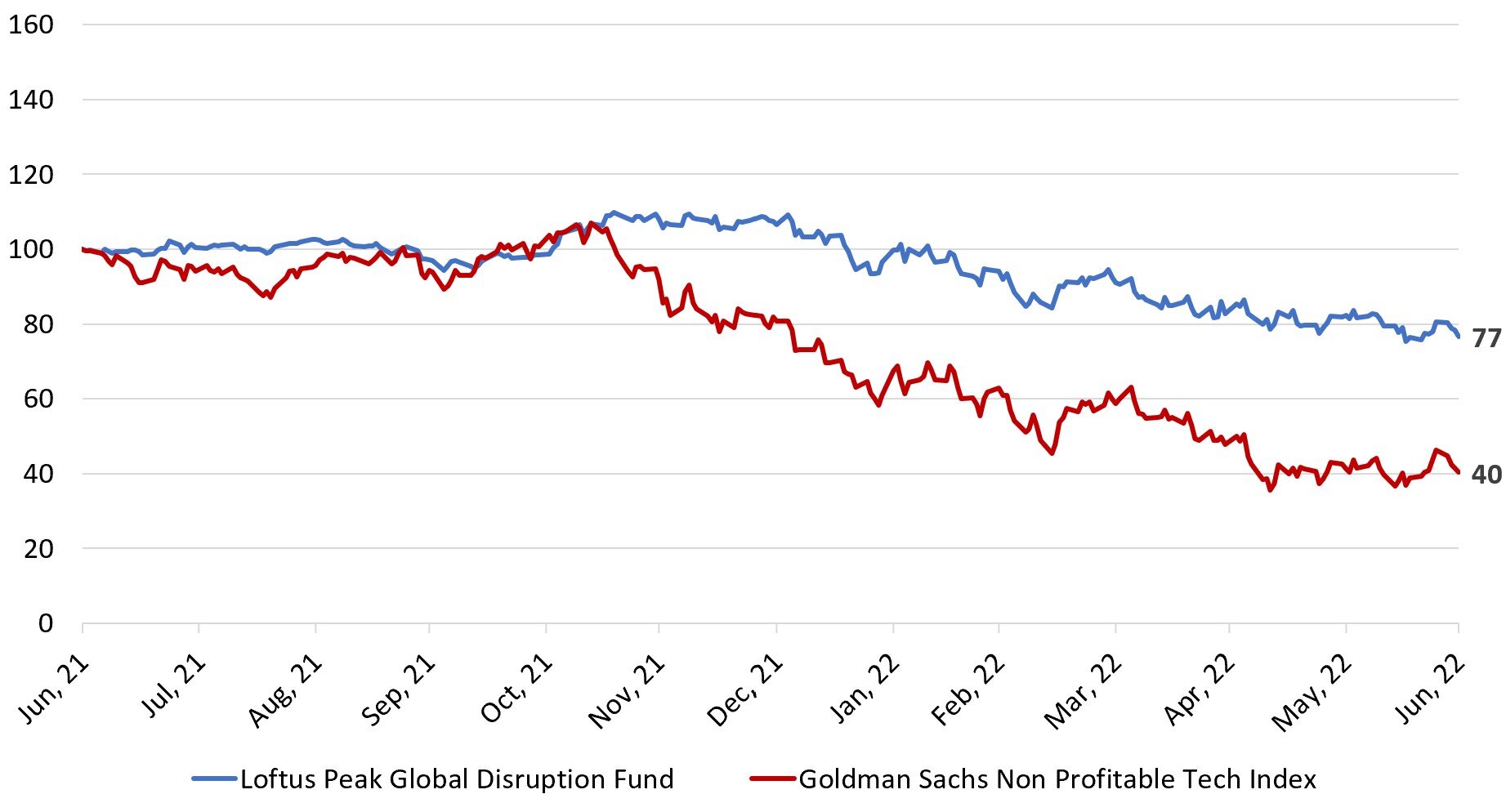

As monetary policy tightened investors bailed out of cashflow-negative, longer-dated growth stocks. These companies, exposed as they are to an intentionally-slowed economy, declined in value materially. Without profitability today, the market is anticipating that such companies will be forced to find new funding with fresh debt or equity – but of course at significantly higher cost to existing shareholders, which is pushing valuations down further. Sharemarket indices dropped by -20% to -30%, but many former sharemarket stars were down by -50% to -90%. There was safety in quality, relatively, with the Loftus Peak portfolio outperforming the “concept” stocks, as the chart below shows.

The market punished companies that were not profitable

Source: Goldman Sachs, Loftus Peak. Data in AUD, indexed to 100 as at 30/06/21

For the 12 months to 30 June 2022, the value of the Fund dropped -23.3%, with most of this confined to the second half. This was underperformance of -14.7% relative to the benchmark MSCI All Countries World Index (net) as expressed in AUD from Bloomberg. The Fund closed out the month down -6.9% net-of-fees, which was underperformance of -2.1% against the benchmark.

Roku and Netflix, also hit in the second half, were among the worst performers, and cut -3.9% and -3.3% from Fund value respectively over the twelve months. Amazon cut -2.2%, Google -2.1% and Microsoft -1.2%, while AMD’s negative contribution was -2.1% with Taiwan Semiconductor (-1.5%) and Nvidia (-0.8%) also off. Qualcomm, the Fund’s largest position, cut -3.4% from the value of the Fund.

Read the full report here.

Streamers unspool

Netflix and Roku are two former market darlings needing neither debt or equity capital but which nevertheless were treated as if they did. The streamers, together, were the largest negative for the Fund in the financial year to 30 June 2022.

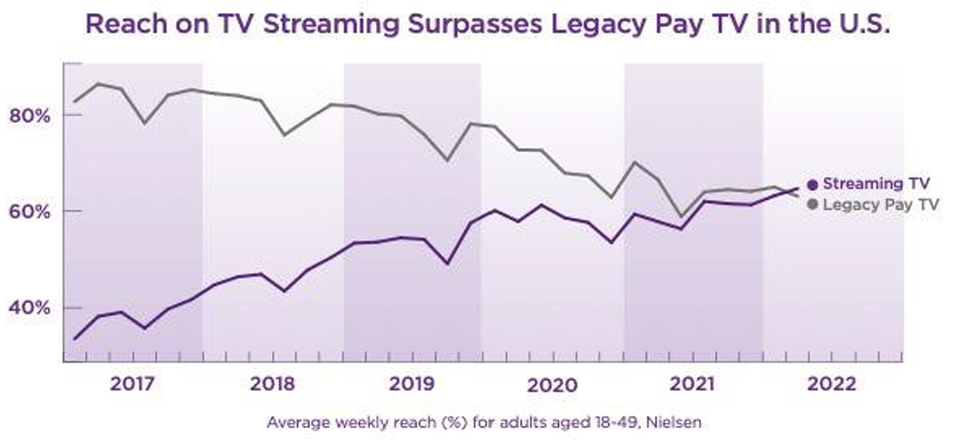

And yet it is difficult to find any informed industry participant who does not believe that all TV will be streamed by decade’s end. Indeed, in 2022 streaming eclipsed cable TV in popularity across the US , as reflected in the chart below.

Source: Roku Company Filing, Nielsen

That streaming companies, which thrived in lockdowns only to stall when restrictions are lifted, has little bearing on pivotal questions around their room for growth at the expense of linear TV. We believe Roku’s and Netflix’s penetration has not reached saturation with both having differentiated but solid medium- to long-term growth paths.

Chip stocks weak, for now

The Fund has held investments in semiconductor companies including Qualcomm, Nvidia, Xilinx, AMD and Taiwan Semiconductor over a number of years. We invested because these companies are foundational to the disruption economy, though they do not command the same valuations as software-driven companies such as Facebook, Netflix and Google, which, along with many others, have boomed as applications for the networked, streamed economy were turbo-charged by the smartphone.

But in this tougher economic environment, when growth multiples are under pressure, the semiconductor stocks have provided significant shelter, while the outlook for them has materially improved as their usage, across virtually all industries (either directly or indirectly) increases.

For example, one very important announcement barely noted by financial markets was that Apple had failed to meet the deadline for the 2023 rollout of its own 5G modems in its newest phones. This is important because Apple’s failure was preceded just two years earlier by that of the titan Intel to produce the same part – meaning that Qualcomm will continue to be the 5G supplier through 2023.

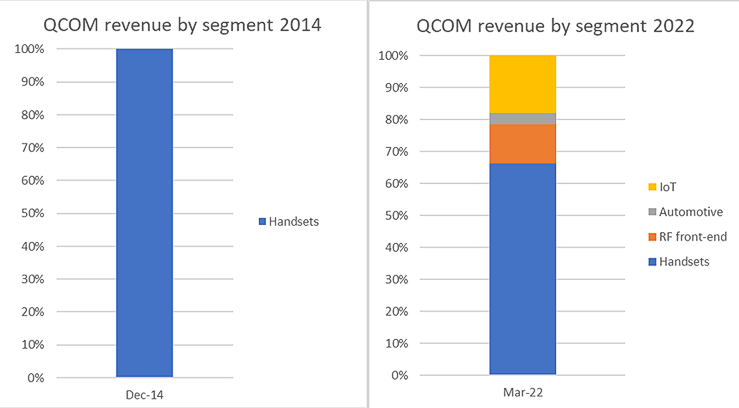

Qualcomm’s technological superiority, coupled with its financial strength, create a formidable moat ensuring growth for several years for its 5G business. We hold Qualcomm not just for the phone business, but for the significant diversification it has engineered relative to its position a few years ago.

Source: Qualcomm Company Filings

Qualcomm’s automotive revenues in the most recent quarter were up +61% on the prior year period, as the performance requirements of and higher demand for automobile intelligence is necessitating a huge increase in chip usage. The company’s connected IoT (Internet of Things) business was up +41%. Even Qualcomm’s ‘mature’ smartphone business showed growth of +56% year-over-year, driven by its dominance in 5G.

Another of the Fund’s holdings, AMD, also has a sizeable moat – built by besting the incumbent, Intel (which the Fund does not hold) in the area of low power, high performance chips for the most discerning of end markets, data-centres – which, according to McKinsey & Co, represent the single largest and fastest-growing end market for semiconductors globally.

Why does McKinsey say this? Because datacentres are the hardware on which cloud computing runs, an evolving megatrend brimming with promise as the convergence point for the miscellany of remote work, connected supply chains, networks and more. These are areas targeted by Taiwan Semiconductor and Nvidia, which have, unsurprisingly, constructed formidable moats of their own, using deep pools of capital amassed by years of excellence in product execution. This is technology and disruption, to be sure, and not the commoditised kind, either.

The Blue Sky in the Cloud

Megacaps Amazon, Google, Microsoft, Tencent and Alibaba form part of the Fund’s cloud exposure. It is possible that these cloud businesses may one day eclipse the legacy businesses of their parent companies (especially true of Amazon and Amazon Web Services). Information technology in business globally is moving to the cloud, but it is only a fraction of the way there. Building a cloud business isn’t for the faint of heart – it is a scale game requiring tens of billions of dollars of investment.

This has led to a few large players reaping most of the rewards to date, which we expect to continue given the capital requirements. These companies now represent 73% of the global cloud infrastructure market by revenue. Amazon alone accounted for almost half, while Microsoft had the largest market share growth.

Silicon’s cousin – the power semi-conductor

Beyond all this, the roll-out of electric vehicles along with increasing use of wind and solar power are driving the development of new specialised componentry for electrification known as power semis, typically silicon carbide. ON Semiconductor is a major player here, and is critical to the supply of componentry that facilitates this power transfer.

How to grow an Apple

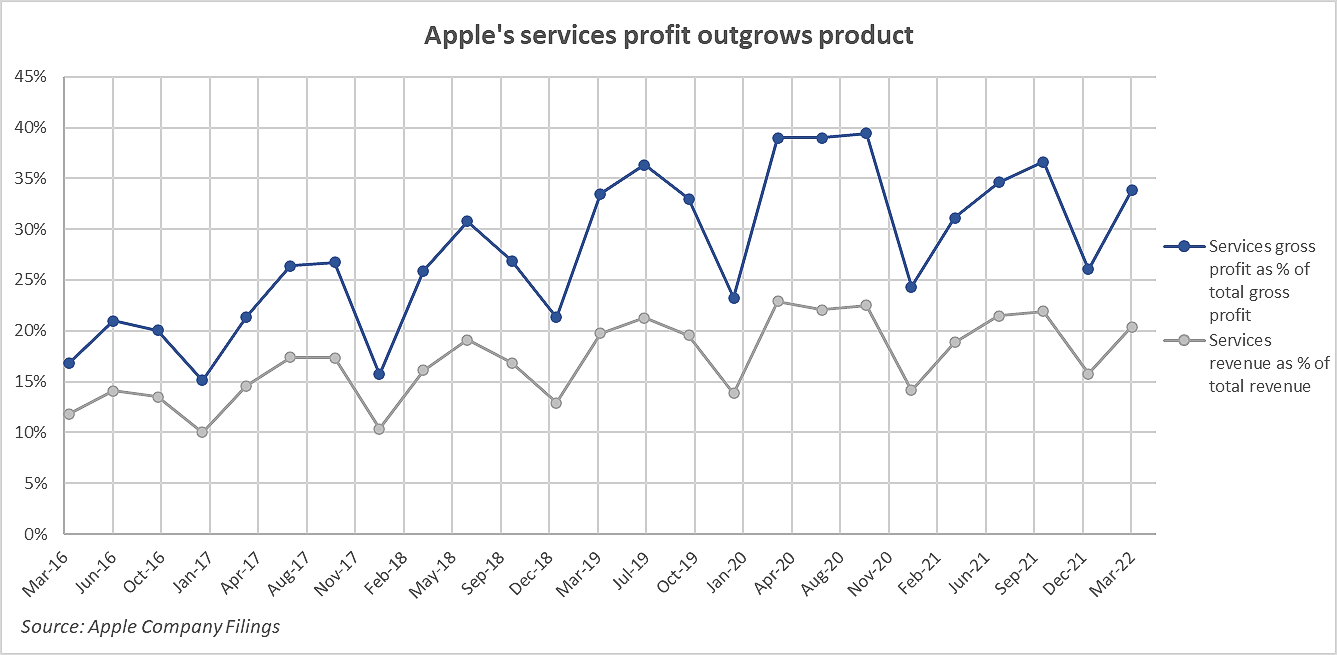

Services – not just products – are a keystone of Apple’s future growth. The services business, including Apple TV+, Apple Music, Apple Fitness+, Apple news+ and more notched double the annual revenue growth of the products business in the March quarter. One of these services, Apple Pay, is expanding quickly, and only a few weeks ago moved into the buy-now pay later space. The chart below tells the story of Apple’s services businesses now accounting for almost 35% of gross profit, compared with 17% in 2016.

Source: Apple Company Filings

Looking ahead

We understand the market’s concerns about recession and what that might mean for consumers and businesses. However disruption and the associated long-term secular trends continue through even the worst periods of recession. It is for this reason, along with the quality of our holdings, that we believe the companies held by the Fund are well positioned for any short-term economic headwinds and more importantly, for the medium and long term.

Share this Post