Chapter 2 of Retirement, investment and Blue-chips: What you really must understand

Here are all the things you are not being told

You are sitting in the office of your financial adviser, and he (or she) is talking to you and your partner about sums of money which are large. Talking about complex risk, tax and superannuation matters. And returns. There is a lot about returns.Invest a million dollars. Borrow $750,000. Salary sacrifice. Get a tax break of $100k.

The surprising thing is that this money is your money. It’s not actually large, in the sense of Warren Buffett large, but it is unusual in the context of money that you would handle on an everyday basis, or even annually. So it’s important.

You have already covered lots of ground in the meeting discussing estate matters, insurance and lifestyle objectives. And now you and your adviser have to make a decision about how to invest this money. You look down at the table of returns which have been achieved by different managers over the past 1, 2, 3, 5, and 10 years. The numbers vary as you would expect – some did really well in the past three years, but performed poorly in the GFC, and others did well in the GFC but haven’t done much since.

All the numbers have asterisks next to them, and all the asterisks point to other asterisks in the fine print, which say things like “past returns are no guarantee of future performance…” There is one row of numbers that can only be described as constituting a dream run for the manager and his investors. But again, you see the asterisks, so… actual dreams may vary.

You realise that all of this information about risk and returns is important, and most of it is not incorrect, or unfair or inappropriate, but none of it is actually helpful.

But your adviser is smarter than that. He or she understands that it is not just a matter of selecting from what has happened in the past, but trying to understand how to invest for the future. Because that is the critical piece of information. Get that wrong, and all the analysis of past results are a fiction. But that information is not on the page. It’s not in the product disclosure statements of the fund managers either.

Here are all of the things that you are not being told.

Most of the big managers are not materially incentivised to take any more risk than that required to replicate the index that you have chosen as your core investment.

Let’s say, for example, you have decided a third of your portfolio should be Australian shares. If you choose a mainstream investment product, it’s more than likely that the portfolio of 20 stocks you own will bear a more than passing resemblance to the top 20 stocks in the market. Meaning that most of your portfolio will be in the banks, BHP, Rio, Telstra, Woolworths and Wesfarmers (which owns Coles).

Individual portfolios will vary a bit. But the simple numbers show that if the top 20 managers have between A$10b and A$30b each to invest in Australia, then they are going to be constrained to the top 100 companies.

Why? The cut-off at the time of writing for the market capitalisation of the hundredth largest company on the ASX is $2.2b. Try investing A$10b in companies with a market value of around that. If you owned 10% each of the 20 companies with that market capitalisation, that would get you A$4.4b. You would still have A$5.6b to invest. No manager wants to own stakes of 10% in companies – it’s way too hard to buy or sell at that level without moving the stock price around materially, which would become clear when you tried to sell an amount which would trigger a substantial shareholding notice (one per cent). Indeed, there are only around 15 Australian companies with market capitalisation above A$20b.

The money managers for these funds are doing nothing wrong. But the point is, as an investor you are paying (for example) 1.5%-2.5% to effectively hold an index – the S&P ASX 200 index – that you could hold for a fraction of the cost.

And here’s a bulletin. If the money manager performs in line with the index by investing in these “safe” blue chip names then even if the index goes down by 25% there isn’t a serious penalty. This is because the manager can plausibly claim that in line with the market, the value of holdings declined by 25%. It is highly unlikely that you will pull your money out.

What happens if the manager takes the view that he is going to earn his fees and invests your money not according to the index but on the basis of the very best possible investment outcomes – and he still torches 25% of your money. The answer is that the manager would lose his job, and the fund would pretty much cease to exist, or at least have a near-death experience.

There is little or no incentive to outperform. Investing in the index, in the blue chips, regardless of the outcomes, will ensure the fund’s continuity. Investing away from the index could ultimately be an existential issue: the fund could go out of business.

Buying the blue chip names through an ETF doesn’t solve the problem either. (An ETF is an exchange traded fund, which is a basket of stocks which is the same as a given index, for example SPY, which is an ETF for the US S&P500.) It gives you access to the same stocks as you would hold in the index, at a significantly cheaper rate than a fund manager.

It’s worth spending a moment on this. People in the industry talk about expensive and cheap beta or alpha. Normally, people make simple sounding things complex with Latin, but in this case, it’s Greek. Beta is just a term which means how the market moves. If your portfolio has the same beta as the market, it will move the same as the market. The ASX S&P 200 ETF has the same beta as the market. And more than likely so does your large cap manager. Alpha is outperformance. For an investment manager, alpha is important.

To beat the index, don’t invest in the stocks in the index.Which brings us to capital L Learning number three. To beat the index, don’t invest with managers that track the index. Even if it’s at a cheaper price, like it is in an ETF or index manager.

Lots of people are very successful doing this – Warren Buffett, George Soros or Julian Robertson. Unlike ETF’s, which are normally invested in indices, active investors like those mentioned above do better than the market just by buying stuff that is better when it is cheaper and selling it as it gets more expensive.

They get hit by falling (or rising markets) in an adverse way from time to time, but they outperform by working hard to understand which companies do well, and invest accordingly. It’s not just luck that enables good managers to do well, it’s also skill. It’s also true that every so often one of them will have a run of very bad luck which will be business-ending. But it’s the exception, not the rule.

But unless you ask questions about how to diversify your exposure, the issue isn’t really going to get raised. Clever advisers will raise it with you – but you will have to be receptive to it.

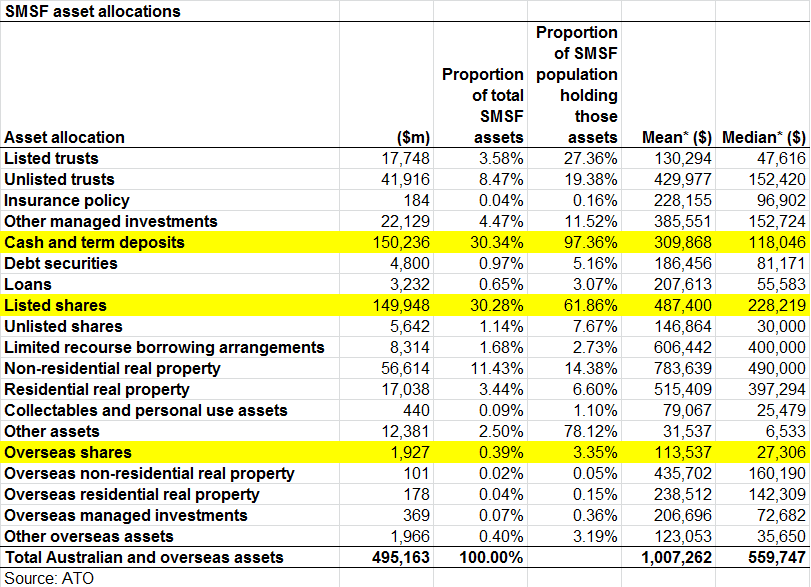

We know this is the case from Australian Tax Office figures for 2013 which show SMSF’s hold 30.3% of their total assets in listed Australian shares. This amounted to A$150b. There was virtually the same amount in cash. In overseas shares, there was A$1.9b, or just 0.39% of the total SMSF pool. The table below, which is from the ATO, shows the SMSF mix by asset class.

Anecdotally, most SMSF’s have lots of banks, and Telstra and Woolworths – and the official figures show this this not just to be more of less the case, but conclusively true! The vast bulk of self-managed super funds are virtually un-invested in the offshore companies which are remaking global businesses before our very eyes.

From a risk perspective, this is extremely unwise, for the reasons already outlined above.

What to do about this?

This is chapter two of Retirement, investments and blue-chips: What you really must understand by Alex Pollak. Download a full copy of the book here. Or read more about the risks of not investing in disruption on our website.

Share this Post