By Alex Pollak, CIO Loftus Peak

Key Takeaways:

- Disruption is upending whole sectors such as energy and banking.

- This disruption has led to the US market significantly outperforming the local (Australian) index due to the emergence of companies like Netflix and Apple.

- Australian investors have missed out on exposure to these growing markets, and are still holding onto the losers of disruption, such as mining and banking.

- The Loftus Peak Global Disruption Fund aims to provide exposure to these overseas markets, specifically disruptors with strong balance sheets and net cash.

November was another difficult month for investors.

But it is useful to note that as recently as five years ago investing in high growth companies as a mainstream strategy seemed risky. The idea that a Fortune 500 business would begin moving its IT department (as for example Kellogg’s did) in favour of cloud-based functions ranging from product development to finance was still an edge case. But it is now considered best practice for many industries.

Yet it is still considered edgy to suggest that the changes the world has seen in media, telecommunications and transport (meaning taxi companies) will soon be followed up with major upheaval that will affect Australian banks, or will continue through retail into energy and cars. It has also been somewhat peculiar to suggest that Australian investors need to have more of their portfolios offshore. But this is now becoming mainstream, for three reasons.

The first: that as so much of what is consumed originates from outside Australia, having a source of earnings denominated in (for example) US dollars keeps living costs down. With the Australian dollar off 30% in five years, those that made the decision when it wasn’t mainstream would be feeling good.

The second reason to invest offshore is that Australia does not play globally other than in a few areas such as resources (which, though important, are commodity businesses with all the price implications that they entail). Even allowing for franked dividends, this is not even close. And when added to the 30% depreciation in the Australian dollar, local investors are well down.

In the digital space, yes, we do have champions like Atlassian, a global major for sure, but few others that have been a success overseas. But all the major global on-line players are certainly playing here. And it isn’t just Apple. The hold that Seek has had in the jobs market is under threat from Japanese group Indeed as well as LinkedIn, owned by Microsoft.

Domestic vs. Global

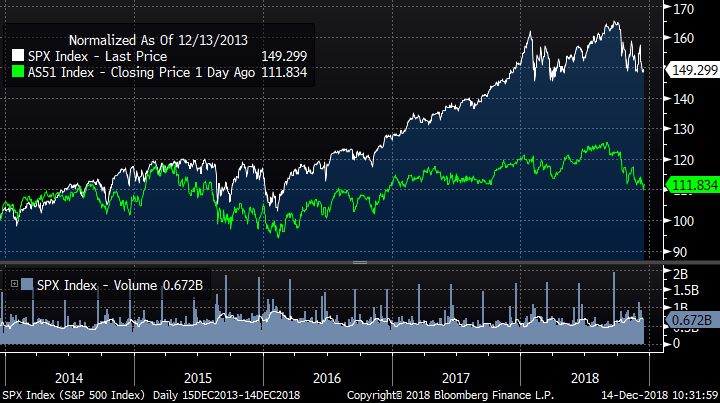

There is another, more obvious, reason to go offshore. The US market, which has been powered by the emergence of big disruptors like Netflix and Apple, has significantly outperformed the local index. As the chart below shows, over five years the US S&P500 has gone up 47.4% to yesterday’s close of 2700. By contrast, The S&P/ASX 200 on the same five-year basis – surely long enough given it was recovering from the GFC – has gone from 5190 to 5895, or up 6.8%.

S&P 500 v S&P-ASX 200 over five years. Powering the US index are companies like Amazon, Apple and even Alibaba (though its Chinese, the listing is in the US). Comparison of S&P500 v ASX 200 over five years

Remember, a stock that has fallen by 50% from the in-price needs to double in order to make the investment whole. Is it realistic, when considering the AMP or the banks, to believe this is in train?

Of course, this doesn’t mean investors weren’t hurt when some of these new economy stocks turned down in October and November, as they routinely do. But those companies have mostly made new highs after the 6 corrections of more than 5% we have had in the past five years (we are in the middle of the sixth). They were assisted by the tail-wind provided by the structural shift toward new economy businesses.

Electric vs. Oil

There may not be a lot of electric cars on the road, but it seems safe to say that the technology is here to stay – now the game will move to valuing the new carmakers in what will turn out to be a crowded market, with the Chinese playing hard globally.

It’s likely true to say that it should be easier to profit from a growing sector than trying to pick the trends in the oil, demand for which will fall over the years, with sectoral de-rating thrown in for extra measure.

The FT in July reported that Wood Mackenzie, one of the world’s most influential oil consultancies, has forecast peak oil demand within 20 years, “as a tectonic shift in the transport sector towards electric cars and autonomous vehicles gathers pace… The prediction illustrates how projections of peak oil demand, once confined to the fringes of energy planning, have become accepted within the mainstream, and are already shaping how the world’s biggest oil and gas companies will invest in the future.”

That’s big oil sounding cautious about its investment – would you feel comfortable holding a long term position in a company looking at a declining demand profile? The valuation multiples of the coal sector have halved in recent years.

Disruptors are cash heavy, less geared than companies such as Woolworths and BHP

Some have argued that it’s a dangerous time to invest in the companies that have been the winners thus far, citing concerns about profits and financial stability. We think those concerns, wrong for the past five years, will continue to be wrong. As we noted here earlier this year, most of these companies are marked by significant profitability, with virtually zero borrowings (the average net debt/EBITDA ratio for companies making up 97% of our portfolio is -2.27x. This means on average this group has 2.27 times its EBITDA as cash – you can read more on this here).

We run an investment company on behalf of investors, and have identified five key thematics which form the mainstays of our mandate, including data and machine learning and networks. The megatrends of which these thematics form part are here for the next few years, we believe. It’s just a matter of how to price them.

And so to the point. Re-balancing your investment portfolio at these levels may seem hard, or even risky. But after what has happened in the past five years, our view is that the really risky thing is staying in for the long haul in companies with outdated business models.

Share this Post