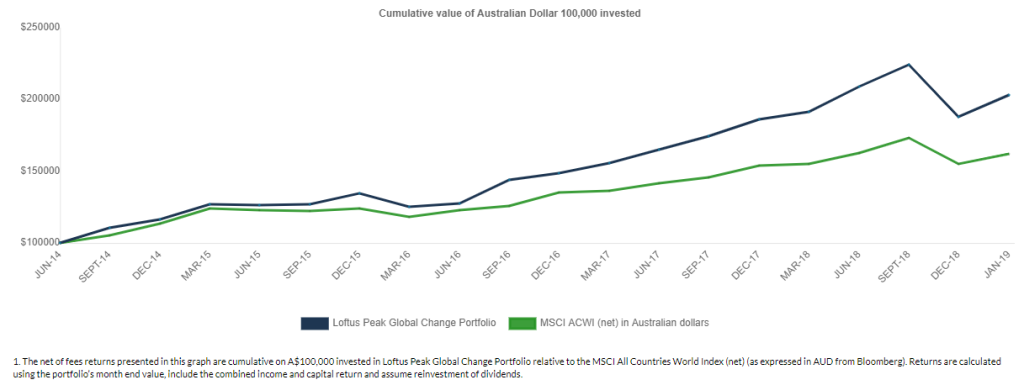

In just under five months Loftus Peak will have been operating for five years. The portfolio has delivered 19.3% p.a. since inception in June 2014, with outperformance of +8.2% p.a. Investors who held this portfolio from inception have seen the value of their holdings more than double (134% return).

We are delighted to have delivered this return to investors who have backed us, while it is also the reason that many others have asked about the process we use to consistently deliver these numbers.

It’s not just the FANG

It is useful to include a couple of real examples, rather than speak in generalities.

For the period, the number one performing contributor to return was Amazon, which added +21.3% to the value of the portfolio over a 55-month period. It is not the only FANG stock (Facebook/Amazon/Netflix/Google) in our top five performers – Google (Alphabet) is the other.

But the number two returning stock is Nvidia, which generated +14.3% over the period. A little-known, but very important company (Xilinx) was the fourth largest contributor with +11.8% of portfolio return. It was also the number one contributor in January 2019 with +5% of return. More on this shortly.

Amazon (AMZN)

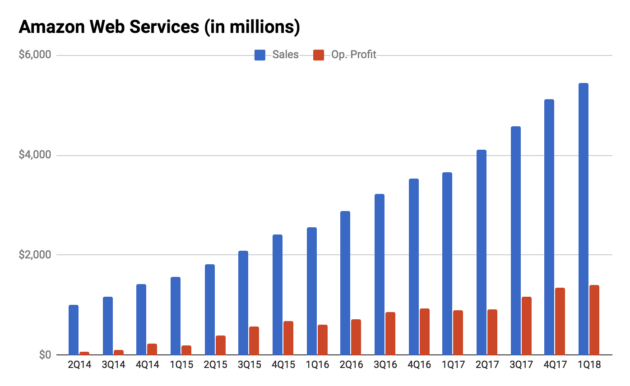

Why did we buy Amazon in 2014? It wasn’t for the retail alone, though there was plenty to like about that model, because it had largely been priced.

But it had become clear to us that the company’s cloud business, Amazon Web Services (AWS) had become a significant business – used by Kellogg’s, Conde Naste and Netflix among many other large companies (numbering in the hundreds). However, at that point, the market did not attribute a material value for the AWS business in the Amazon share price, which at that time was US$350.

Our views were confirmed two quarters later in January 2015, when the company revealed it had generated US$1.6b in sales in the previous quarter, with growth of almost 100% over the year. The stock has since risen to over US$1,500, in large part driven by the valuation of AWS, which is now broadly believed to be worth well over US$300b. Microsoft and AWS are duking it out for the number one position in the cloud.

The main characteristics we look for in companies is the ability to change the way business operates on a global scale. The global part is important. First, because it removes the information advantage which local investors may have through insider knowledge of management and directors, so that we are able to range internationally in search of significant data points to validate our investment theses. And second, there is a comfort around governance, reporting and integrity of financials that can be harder to find in small caps.

Xilinx (XLNX)

Another example is Xilinx (fourth best performer with +11.8% contribution to return since inception, and as noted the top performer in January). This company is not well held in Australian portfolios, but is emerging as a globally significant player in our data-driven world.

We spent two years looking at this company before building a significant position, supplementing our reading with attendance at non-investor-centric conferences, in order to be entirely certain that what we knew from the company’s own numbers and external commentary was confirmed by experts in the field – including academics as well as rival company executives.

Xilinx was capitalised at US$15b when we bought our first holding in the company back in March 2017. As we accumulated more data points over the years, our conviction in the company increased and the stock became a core position, and then our biggest holding in November 2018 – edging out Amazon, Apple and Alibaba. As a conviction call, the position size was set at the high end of our investment range (it is currently around 11%) which enabled us to both manage the risk and take advantage of the return opportunity from being early in the stock. It has now doubled to a capitalisation of US$28b – and jumped 26% in the days following the release of its financial results for the quarter ending 31 December 2018.

Nvidia (NVDA)

Nvidia, which generated +14.3% of the total return was based on a very similar process, and again was not a company which found its way into most Australian investment portfolios.

Both companies form part of one of our five thematics – data and cloud. The other four are networks, energy as a technology (not a fuel), connected devices and China (by virtue of the change in its geopolitical status and size.

Loftus Peak’s process

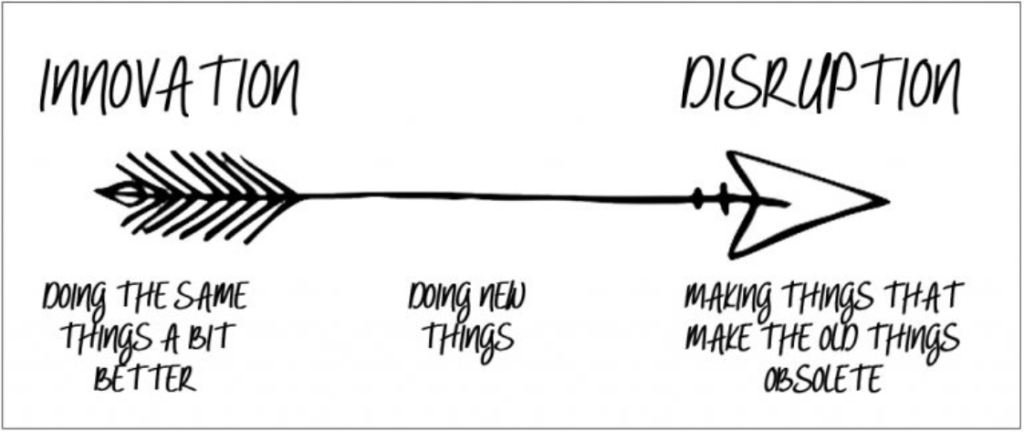

The Loftus Peak process focuses on identifying and valuing the big disruptive changes and thinking through the valuation implications over a multi-year period, which invariably leads to some non-consensus outcomes, like those above. And of course, it’s also a process of laboriously ploughing through company filings, conference calls, spreadsheets and industry meet-ups in search of an important, though possibly not new, business which has slipped through the radar of other investors. (We don’t need to be first to recognise value – seeking to do so carries its own risks; just early enough to harvest a solid return. Then we continue to monitor against our expectations simply buy and hold; as investors we are a patient.)

Disruption and change is here to stay – and is not simply a characteristic of the household name technology companies. As Microsoft CEO Satya Nadella said recently, technology may provide the tools, but disruption and value creation is what comes from the use of the tools. This provides us with two opportunities, investing in the tools themselves, but also the disruptive model that comes from those tools – whether in transport, retail, energy, media, medicine, banking and insurance, to name just a few.

On the Microsoft conference call last week for the announcement of the December 2018 results, CEO Satya Nadella expanded: “We are seeing these very large digital transformational efforts and projects and they span, quite frankly, all industries. I think in the last quarter you saw healthcare and retail (and) financial services. I think of them as what our relationships with our traditional (computer manufacturers) were – some of the partnerships we have with customers are of the same magnitude. And that just speaks to, I think, what’s happening in the economy, which is every company is becoming a digital company and essentially what used to be an expense is all going digital.”

Car makers still model fine design details of a car in clay, but many other parts of that process are now also digital, which significantly changes the cost structure, with value harvested in the digital process, on which Loftus Peak is focused.

We do not search for the next “widget” maker, however solid the returns may be, because this crowds out time better spent looking for ways the digital economy creates value across a whole range of industry adjacencies – thus it is that we bought the Chinese company Tencent, which started life a games business, has grown into an on-line bank (Wechat Pay).

Looking at the world through the lens of disruption and change has given us a clearer understanding of where value is emerging, which is reflected in our returns.

Share this Post