From its inception in 2014 Loftus Peak has strived to implement a future-focused investment approach that respects the value and importance of environmental, social and governance attributes of the companies in which we invest.

Lately, we have received feedback from investors who tell us they care about the ways in which they invest, and wish to avoid harm to people and the environment.

The core proposition of the investment portfolio from day one was and is to invest in great businesses that use the best tools to execute business models which create superior returns for investors in the long term. The descriptor ‘long term’ is very important – we don’t invest in fossil fuels because of the harm they do to the planet. Now that there are superior solutions, fossil fuels finite life as investments is becoming clearer. Indeed, one of the five central investment theses around which we built the portfolio in 2014 was (and is) “Energy as a technology, not a fuel.” It was for this reason that we held Tesla (until late last year), but did not hold BP.

But to institutionalise our commitment (to what has always been a major part of the thinking of the investment team) Loftus Peak has partnered with a third-party, Sustainalytics (owned by investment research house Morningstar), in order to consider the ESG ratings for many of the companies within our investment universe. According to Sustainalytics, as at 31 May 2021 the Loftus Peak Global Disruption Fund’s exposure to ESG issues was 9% lower than its benchmark, the MSCI All Countries World Index.

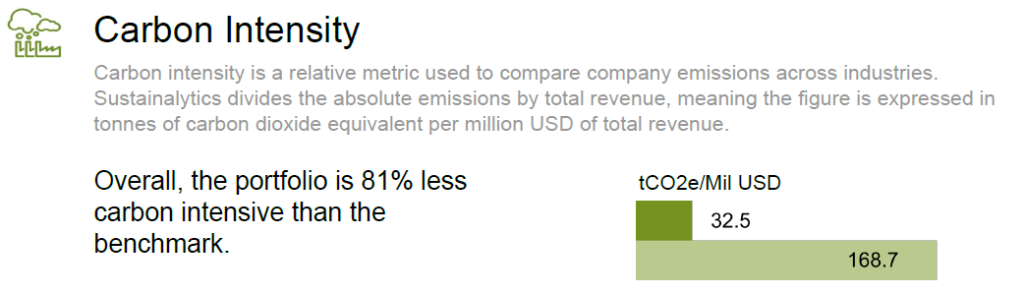

Within that overall rating, Sustainalytics also provides information relevant to the Fund’s climate credentials. As at 31 May 2021, emissions from Fund holdings were 32.5tCO2e / Mil USD, 81% less carbon intensive than its MSCI benchmark (168.7tCO2e / Mil USD), with no exposure to companies involved in fossil fuel extraction, generation and related products and services.

By way of example, Google has been carbon neutral for over a decade and Apple has raised almost five billion euro in green bonds since 2016. Paypal and Amazon both have high levels of success on environmental matters, particularly around energy use and carbon management. Amazon produces half of its energy needs for its web services cloud business from its own renewable energy sources; the company has announced plans to build a 105MW solar energy project in NSW to come online this year, its second in Australia.

We do not, and have not invested in gambling, alcohol, tobacco, armaments, adult entertainment, or the logging of old-growth forests. Long term investors in our Fund know this has always been the case.

Similarly, the governance of companies in which we invest is a daily consideration. We are uncomfortable with companies that provide poor disclosure, or complex voting structures, or where boards do not have clearly defined policies with respect to race, gender and harassment.

We believe our record of investment success is in part a function of this approach to ESG, as investors globally move away from stranded assets such as coal and oil and toward better, cleaner more sustainable businesses that draw fewer of the scarce resources of our planet.

Our CEO, Rick Steele, has spoken on this subject many times over the years.

Share this Post