Below is an extract from Tony Boyd’s Chanticleer article ‘Chanticleer’s super fund falls off its perch′ which was originally published in the Australian Financial Review on 6 August 2021. For the original article, please click here.

Tony writes:

The fund returned 13.76 per cent, which is not quite a feather duster. But the performance was poor relative to an index benchmark of 20.20 per cent.

Contributing to the weaker performance was a reasonably large hit from the data analysis company Nuix, which was purchased after the company floated and sold about four months later at a 60 per cent loss.

The lesson from this was to step up due diligence on so-called growth stocks and search prospectuses for red flags.

It is noteworthy that about 70 per cent of the shares in the portfolio have been there for five years or more.

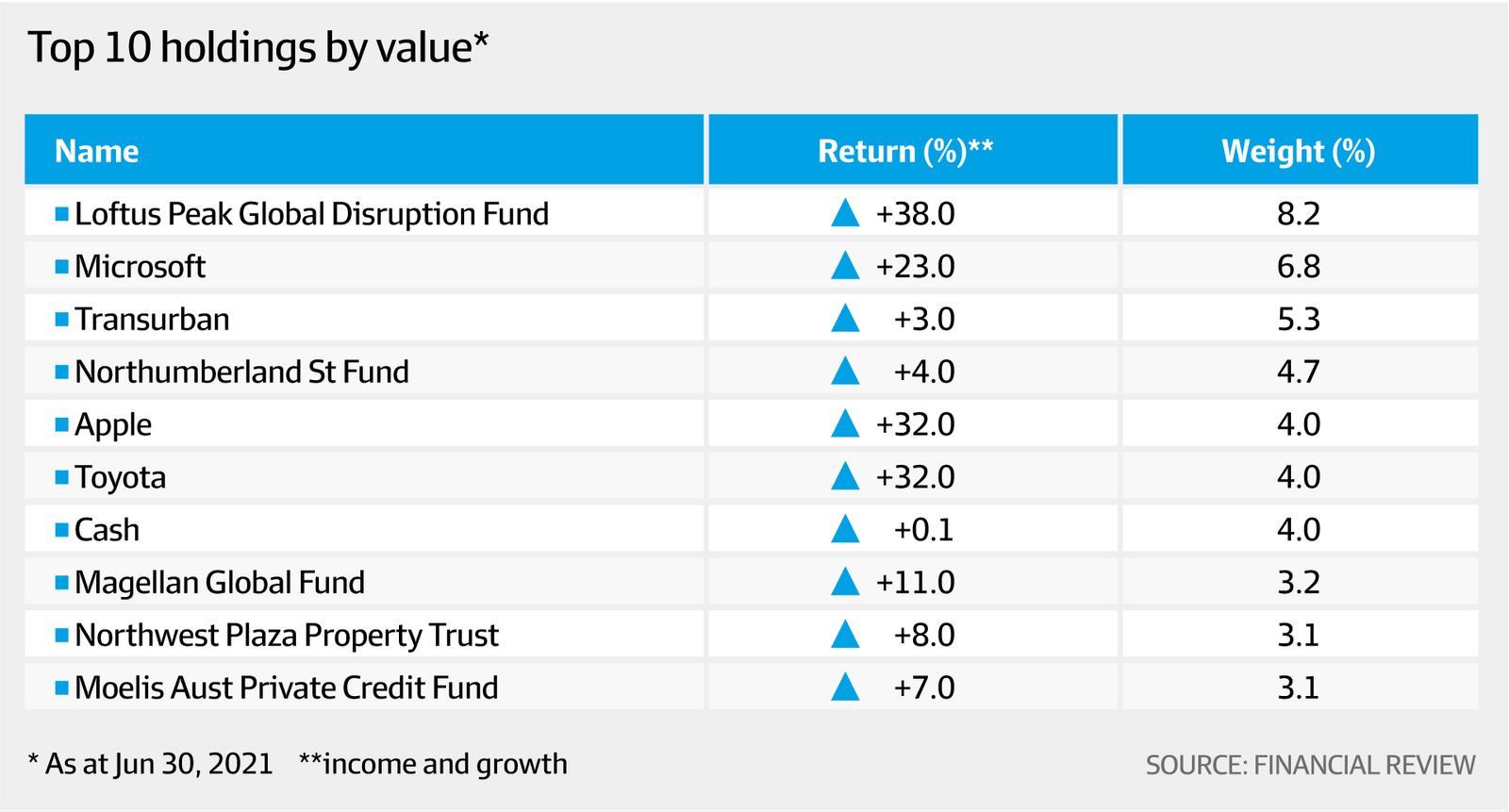

The fund’s policy of buying and holding positions for the long term has meant that outstanding performers such as Loftus Peak Global Disruption Fund and Microsoft are approaching the prudent limit for any one exposure – 10 per cent of total assets.

Another factor working against the fund was holding about 5 per cent of the fund’s assets in cash in US dollars. This conservative approach was in readiness for a market correction which never came.

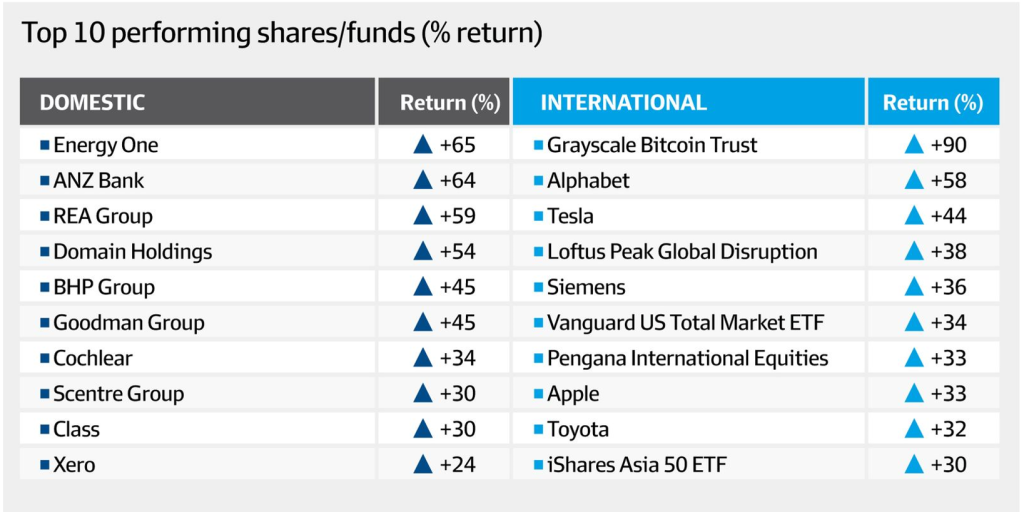

But the main reason why the fund could not match the performance of leading industry super funds such as AustralianSuper was the long-standing underweight position in banks and miners.

The fund’s financial adviser, Charlie Viola from Pitcher Partners Sydney, said that any investor who did not hold a market-weight position in the major banks and miners, and major tech in the US, would have struggled to hit the index numbers in 2021.

“The Chook fund has long been underweight major banks and miners which, over time, has benefited the fund,” he says.

“The fund holds small positions in ANZ Banking Group, BHP and Fortescue Metals Group, but not at market-weighting levels.

“The goal is always to produce long-term returns, so when you take smaller snapshots in time – given the tracking error the fund carries – you may see some diversion from index returns.”

The fund was set up nine years ago for three reasons: to take a more active interest in the management of the family’s retirement savings; to pool the family’s financial assets; and, for the first time, to seek professional financial advice.

Seeking professional advice was a smart move. It resulted in the construction of an investment portfolio guided by the following principle: have a long-term strategy of holding good, quality companies that generate income through the cycle.

“The longer-term outcome remains about 31 per cent above the market-weight average over a nine-year period, which is exceptional,” Viola says.

Share this Post