Source: Shutterstock

Source: Shutterstock

January saw a significant reversal of December’s sell-off. The Loftus Peak Global Disruption Fund gained +11.3% net-of-fees, with outperformance of +7.6% relative to the benchmark MSCI All Countries World Index (net) as expressed in AUD from Bloomberg, exceeding December’s underperformance. The biggest detractors for 2022, led the rally. Qualcomm alone logged +2.4% return for the Fund, with both Roku and Amazon at +1.4% each. The Fund’s return since inception (in 2016) is +15.4% per annum. You can read the January report here.

In part, the lift in sharemarkets reflects the softening outlook on future rate hikes. The December US CPI print showed annual inflation falling again – monthly inflation was even negative for the first time since 2020, declining by -0.1%. This helped allay fears of Fed hawkishness which dominated the past year.

Crucially, we did not cut positions in December at depressed valuations because of the strong business cases for the companies the Fund holds. This proved correct, as the top three detractors in December were the top three contributors in January.

2022: A review of the poor year

2022 was a difficult year for Loftus Peak unitholders, with a return of -31.7% net-of-fees, as the extent of the price/earnings multiple contraction was far greater than we expected. The largest detractor from the Fund in 2022 was Roku (-6.0% contribution for the year), the Fund’s main higher-risk, but higher-reward company. The other poor performers were Qualcomm which cut -4.5% from Fund value for the year, with Amazon detracting -3.8%, Advanced Micro Devices (AMD) -2.9% and Alphabet -2.4%. These strong-cashflow companies were held at higher weights for most of the year, crowding out the higher-risk companies, and so limiting a more serious loss of capital.

Mega data and the cloud

Regular readers will be familiar with the Fund’s holdings in the three largest cloud hyperscalers Microsoft (which cut -1.6% from the Fund’s value across 2022), Alphabet and Amazon. These companies have built cloud infrastructure and platforms needed to provide data storage and applications at scale, everywhere.

Cloud is increasingly a prerequisite for digitising businesses as well as the only economically viable means of applying deep learning methods to train artificial intelligence (AI) models such as OpenAI’s ChatGPT or Google’s LaMDA.

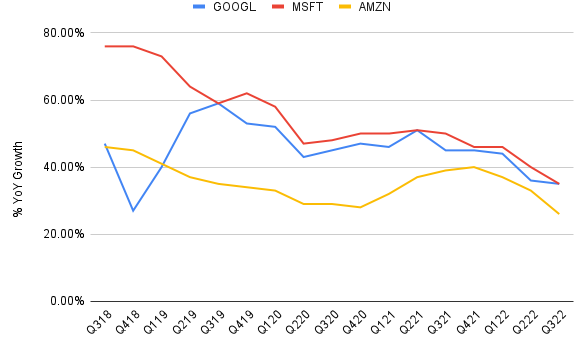

As of September 2022, quarterly cloud revenues sat at US$20.5bn for Amazon, $12.9bn for Microsoft and $6.9bn for Alphabet, but growth in revenue was falling as the chart below shows.

Cloud revenue growth YoY

Source: Company Filings, Morgan Stanley

Source: Company Filings, Morgan Stanley

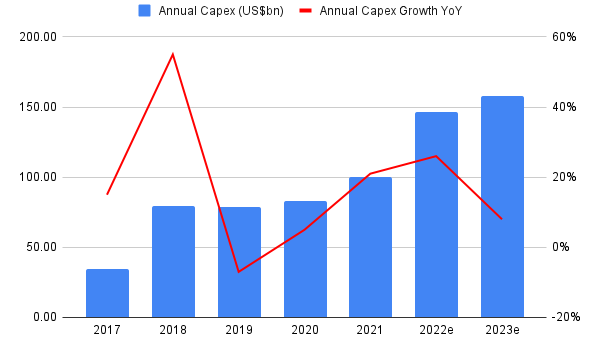

This slowing revenue growth has itself prompted a recalibration of cloud capital expenditure (capex) for 2023, which is now projected to be up only +8% following a much higher uplift of +26% in 2022, as the following chart shows. Notwithstanding both these issues, markets are now pricing in a solid recovery in these companies, which has helped portfolio performance considerably.

Annual capex growth of top 10 hyperscalers (excl. Amazon)

Source: Company Filings, Morgan Stanley

Source: Company Filings, Morgan Stanley

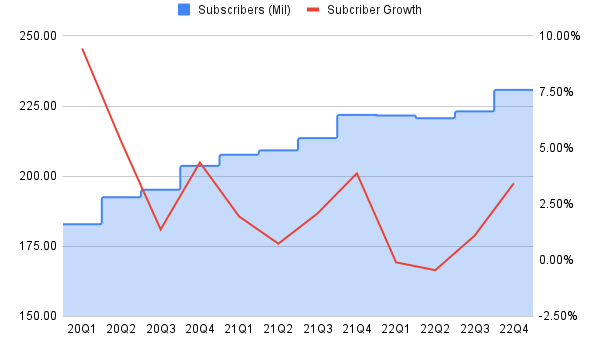

Netflix returns to growth

Netflix had a tumultuous 2022, which saw investor confidence in the streamer cave after the company reported its first ever quarterly subscriber loss. Among the first of the Fund’s companies to report quarterly earnings, the company added 7.7 million new subscribers – far ahead of the 4.6 million expected, showing a re-acceleration in the rate of subscriber growth.

Netflix subscriber growth re-accelerates

Source: Company Filings, Morgan Stanley

Source: Company Filings, Morgan Stanley

The newly announced ad-supported tier broadens Netflix’s appeal which is driving new subscriber growth without cannibalisation of existing standard and premium subscribers – a very strong outcome for the company.

The streaming prize is large – nothing less than a position in television globally is at stake – and Netflix, as the only large profitable global streaming service, is extending its lead. By way of illustration, Peacock’s recent five million subscriber growth to 20m is built on fickle sports fans (largely from the Football World Cup). Disney continues to face negative earnings-before-interest-and-tax (EBIT) margins in streaming (-21.9% compared with +18.2% for Netflix). Warner Bros. Discovery is also flailing, having just licenced a chunk of its content to Roku.

What’s really around the corner for autos

Qualcomm’s move into automotive has begun to excite investors. At the Consumer Electronics Show in 2023 in Las Vegas, the company introduced a concept vehicle showcasing its Snapdragon Digital Chassis. This is part of the rapid expansion of the company’s automotive design pipeline, which stands at more than US$30bn.

Source: Qualcomm

Source: Qualcomm

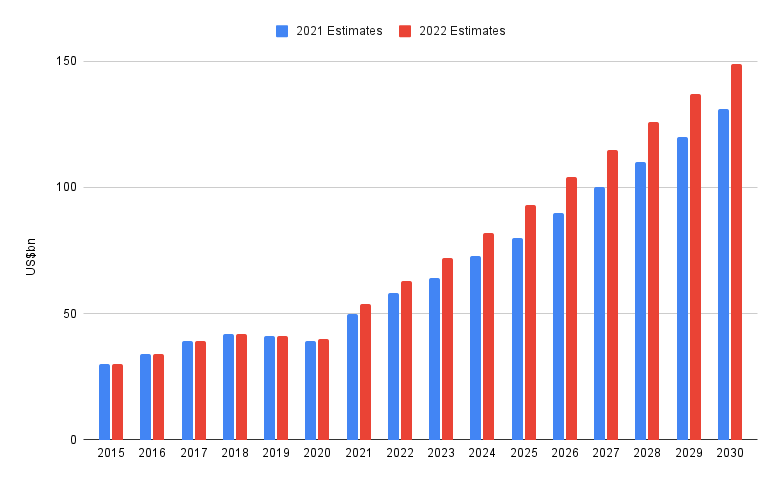

This announcement reflects the growing importance to semiconductor companies of autos. Meanwhile, estimates for the size of this end market continue to expand, as the chart below shows.

Estimations for automotive end market expansion are themselves expanding

Source: ASML

Source: ASML

Leading edge logic is needed to operate the advanced driver assistance systems in the car, while the growing market share of EV’s demands ever greater input of power semiconductor companies. The likes of Qualcomm and Nvidia are critical in the first case while Onsemi, Wolfspeed and Infineon are required in the latter.

China stirring

Source: CBS

In the midst of last year’s inflation, China experienced a worrisome decline in GDP growth, largely stemming from the government’s Zero-COVID policy. Based on December estimates from the World Bank, 2022 was the second weakest year since 1976, coming in at +2.7%. Only COVID-affected 2020 was worse at +2.4%.

The Chinese government’s crackdown on big technology firms (which started with the suspension of Ant Group’s IPO in 2020) hurt fast-growing digital companies in particular. During early-mid 2022, big Chinese technology companies like Alibaba and Tencent were hit with anti-trust fines.

Only late in 2022, did these problems start to resolve after wide-spread anti-COVID protests. Chinese markets climbed with the Hang Seng Index up +10.4% in January and +48.7% over the last three months. The Fund’s small holdings in important Chinese companies followed – Tencent rose +20.4% in January and +95.7% over the last three months while Alibaba gained +24.8% and +75.1% (respectively).

Our view is that while Tencent and Alibaba are still trading at appealing valuations, the threat of fiat rulings still hang over them, limiting higher exposure.

Share this Post