Nvidia is now the fourth largest company in the world. It is larger than Tesla, Meta, Alphabet and Amazon. Despite this scale, the company grew quarterly revenue at +265% year on year as reported in its latest earnings call. The data centre segment grew an astonishing +409% year on year. Even as we become strangely accustomed to Nvidia’s beats and raises, this should in no way be perceived as anything even remotely resembling normal in the stock market.

The size and speed of this growth has never been seen before.

Our history with Nvidia

Nvidia has featured in portfolios managed by Loftus Peak since the beginning of 2016. Back then, the share price was around US$30 (equivalent to ~US$8 after the company’s 2021 stock split).

At the end of 2016, Nvidia’s data centre business had just (!) grown +145% year on year and accounted for 12% of total revenue (gaming was 60%). Nvidia was the graphics processing unit (GPU) specialist and it disrupted, in a way, the incumbent central processing unit (the CPU). By processing independent calculations in parallel, Nvidia offered a far more efficient hardware solution for dealing with large calculations.

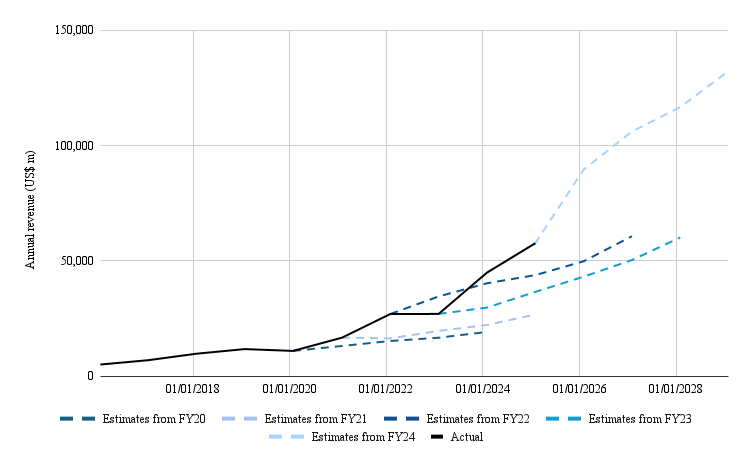

The company grew due to the cyclical gaming business and the secular data centre business, of which Artificial Intelligence (AI) was a driver. We believed the company could grow revenues at a little bit better than 20% p.a. across the next five years. This is what we priced from 2016 to 2022.

Using these assumptions, Nvidia featured in the portfolios we manage.

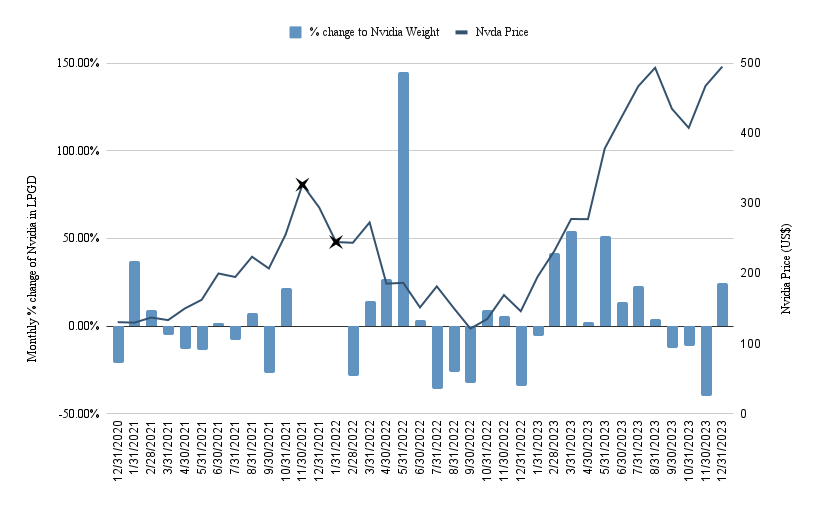

Source: Loftus Peak

Source: Loftus Peak

Nvidia went through its price target in late 2021 and we exited all together (represented by the first X) around 30x up from our entry price. The 2022 sell-off brought the company back into an investable range (with us re-entering at the second X).

Then AI came along…

The nature of Nvidia’s disruptive edge has not changed since 2016. However, the demand for their cloud compute has exploded due to artificial intelligence and Large Language Model workloads. This is the fundamental driver of the company’s incredible growth.

We understood the potential but nobody expected the pace

Source: BBG, note that the Nvidia financial year is eleven months ahead of the calendar year.

Source: BBG, note that the Nvidia financial year is eleven months ahead of the calendar year.

The translation of AI demand into Nvidia revenue was clear to us from February 2023. We increased our growth assumptions, our price target climbed and we increased the company’s weight in the portfolios we manage. After falling -50% in 2022, the stock grew +239% in 2023.

What comes next?

Commentators flit between euphoria and scepticism. To confuse matters further, projected earnings upgrades make the company appear as one of the cheaper semiconductor names on a forward P/E basis. Some cynics have acquiesced. This capitulation combined with the capex numbers from customers like Meta and Microsoft have fuelled Nvidia’s share price to climb +58.9% in 2024 to 27 February.

Nvidia valuations need revenue growth to remain significantly ahead of historical levels despite several quarters of triple digit growth year on year. This is a tall order, but there is currently no data point to prove otherwise. Nvidia keeps beating guidance on data centre GPU sales while maintaining optionality in software and its DGX cloud offering. The company is also doubling the speed of product development.

But to play AI in a risk controlled way, we took the view that some level of diversification outside of Nvidia was necessary.

We see little risk in other chips replacing Nvidia GPUs. We believe that the best of these competitors will meaningfully ramp their products into the data centre (this is the investment thesis behind Advanced Micro Devices). However, there is so much demand for high powered compute that there need not be one winner at this stage.

The bear case for Nvidia would arise from a general pull back in GPU demand. Hyperscalers are building out data centres with the expectation for future AI workloads. As capital expenditure grows, the future workload necessary to justify the expense increases as well. If the workloads do not eventuate, the valuations of Nvidia will not cut the mustard.

Nevertheless, the market likely underestimates the inherent GPU demand within the hyperscalers themselves. Of the estimated US$105 billion Nvidia is estimated to make by the end of the year, we already know Meta will make up over 10%. If Microsoft were to do the same along with additional orders out of Amazon, Google, Apple and Oracle, that would represent 50% of Nvidia’s revenue.

Nvidia’s chips will be used for cloud computing of which AI workloads are a subset. These workloads can be further broken down into operations and products. The market focuses on product workloads which are the incremental use case for Nvidia GPUs. Even if AI products do not emerge as fast as the market predicts, these hyperscalers will still have a reason to buy more Nvidia GPUs.

We see a runway for Nvidia to go higher. But if the company moves beyond fair value, we believe other AI exposed semiconductor names can offer compelling valuations. Any chip sold by Nvidia is likely to be fabricated by Taiwan Semiconductor Conductor Manufacturing. Nevertheless, the manufacturer is trading at a forward P/E of 18.4, – a discount against the S&P 500’s 21.1 (note that we do not prepare our valuations based on P/E ratios but is an easy way of illustrating valuation differentials).

We see similar opportunities in Qualcomm which supplies chips to the devices outside the data centre. Large language model designers have moved to significantly lower the computational demands of their models, making them feasible to run on edge devices. This, combined with a cyclical recovery in smartphone sales, furnishes the company with a double tailwind.

Share this Post