By Alex Pollak, CIO Loftus Peak

“So much of what we do with customers in the cloud today and at the edge is about really transforming their business. And so classically what would have been thought as (an expense related to the) costs of goods sold (COGS) not related to IT.

“When we look at an opportunity for a large grocer in their stores to help them keep food fresh, it’s not about the servers we might sell them in the back of the office, or the PCs that we might sell in them in the front of the office. It’s everything from the sensor, the sensor fabrics, the large data stores, the AI capabilities that then help them reason over supply chain management for fresher foods.

“So effectively you could almost look at the IT market as expanding in to the world of COGS. And so, we see about a $2 trillion expansion on that market overall. And there’s good objective evidence of that. We have some of our largest enterprise customers now spending an order of magnitude more with us year over year than they ever have had before.

Judson Althoff – EVP, Worldwide Commercial Business, Microsoft, speaking at a Citigroup Conference in September 2018

What should we make of the meltdown that is taking place in disruptive companies? I am regularly questioned about these high multiple groups, like Amazon, in the same way as early investors in cable tv in the US questioned the valuations of these geographic cable monopolies.*

What Althoff is saying is that the management of the use of software within supply chain in an area as delicate as fresh food is not just limited to recording incoming stock but has expanded to calculating sales through the till with produce in the chiller, against time, quality and a slew of other variables. This may sound trivial – anyone can tell whether the grapes are looking tired – but when applied to every item in the store the job can get mighty complicated, fast.

He is saying that where wastage of fresh food was once part of the cost of goods sold, the ability of software (ie Microsoft) to reduce waste (say by marking down the item for a quick sale) also actually plays into the gross margin the retailer strikes, and extends the target market for software well beyond IT.

Of course, this whole concept is new, and as such likely to be viewed (and priced) with some lack of certainty. Meaning that one day, an investor might think it was not worth paying for, where later the value had become more apparent.

It is true that the volatility we are experiencing is a function of rising interest rates, and the reduction of money in the system as the US Fed sells or doesn’t roll bonds over, and the general uncertainty of having a tariff warrior in the White House. But it’s also about markets trying to price companies that are changing the business model using tools which, until the past five years, were not available – in this case those related to machine learning.

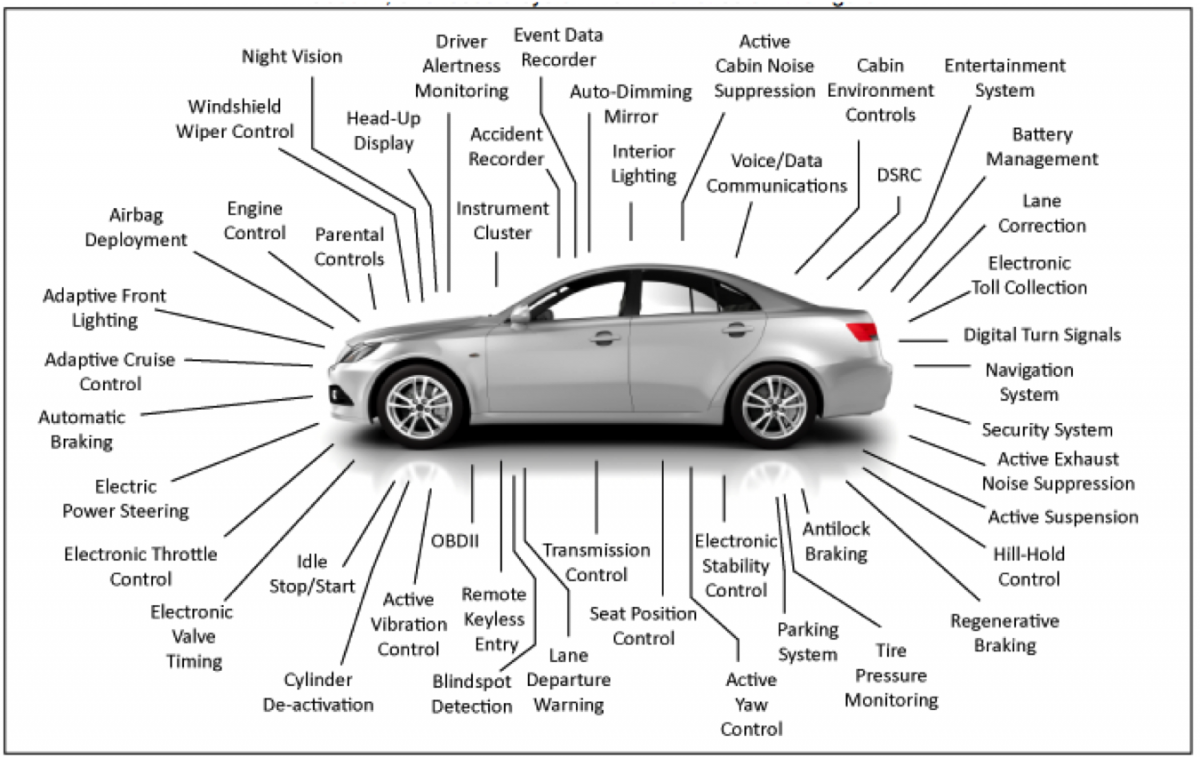

It is a matter of fact that software does more of the jobs that used to be done manually. Think about reduction in parts in a camera on your phone, or the mapping that happens when driving, or for that matter the number of parts in an internal combustion engine relative to an electric car. Now consider the number of computer chips used in a modern car (not a Tesla), below.

The silicon and software content in the average new car will approach $2,000 in the next few years. Source: Clemson University Vehicular Electronics Laboratory

Software is automating the world, or at least the large parts of it which used to involve mechanical gizmos, like car brakes, or rice cookers, or aeroplane rudders on a Boeing.

So it’s natural that there is a value transfer taking place in favour of the companies which are delivering larger parts of the overall solution.

As money managers, there is little we can do about global forces pushing stock prices in unfavourable directions – short of making a judgement that valuations are massively stretched (and that is not our view yet, as we outlined here).

What we can control is the kinds of investments we make, which we believe is what has driven the portfolio performance of the past four years and will do so again.

The key trends, again? Connectivity and networks, data and machine learning, networked devices, energy as a technology (not a fuel) and the rise of China.

Some of these trends are on show in the results of Amazon, which reported last Friday (Australian time). It is not well appreciated that the company delivered a profit in GAAP terms amounting to EPS of US$14.10 per diluted share for the nine months, up from US$2.39/share in the previous corresponding period. One quality broker has earnings at US$46.86/share the year after next, and US$76.05/share in 2022. So, there need not be a disbenefit in investing in high multiple companies that ultimately prove themselves in GAAP profits.

* No-one questions the asset value of the cable companies today (notwithstanding other issues related to pay tv), now that the roll-out has finished, depreciation has fallen and earnings have risen. If Amazon delivers on its GAAP profits, no one will question its asset value either.

Share this Post