Big news in disruption in the next few days, with Amazon reporting Friday morning (Aussie time), Google the day after and Apple on Thursday. An equal dollar investment in all three has returned 35% since 1 January this year – and this is before the fall in the Australian dollar, which pushed that return to just under 40%.

This reporting season is expected to show the very big difference between disruptive companies compared with those that call themselves ‘tech’ but are really just struggling with yesterday’s business model. Case in point: IBM which has just reported its 14th consecutive drop in sales, along with a guidance reduction.

Yet at the same time, Silicon Valley VC is reportedly struggling with valuations which are increasingly being considered as inflated.

What’s going on?

For an explanation, I will rely heavily on the work of Carlota Perez and Jerry Neumann, both leading thinkers on disruption. Their commentary is important, because it puts structure around what is happening in this particular disruption cycle. In short, they argue, we are moving out of the age of innovation and into the age of deployment.

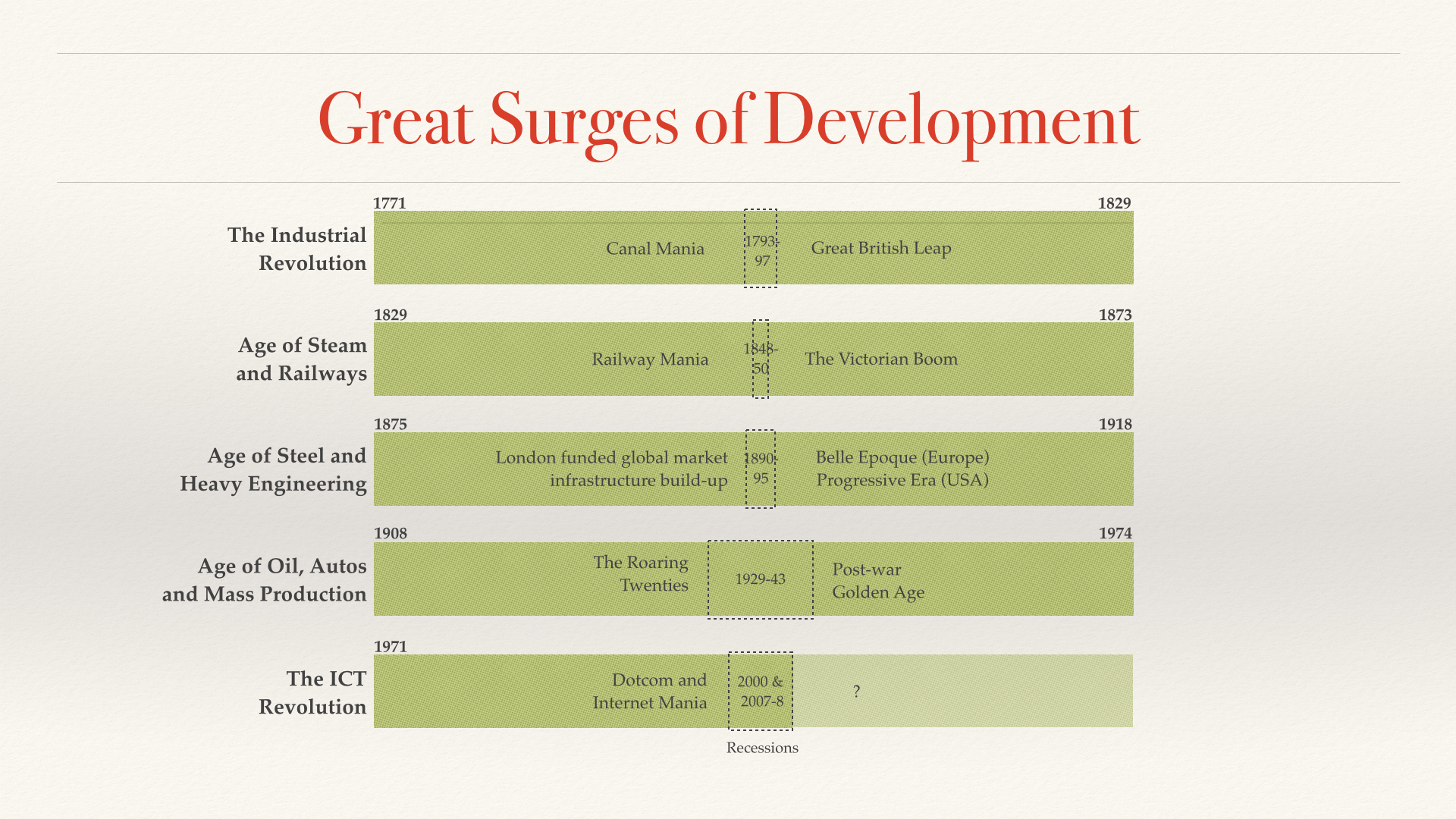

To explain: this disruption cycle feels new, but it seems to be following a pretty standard pattern. We can see this in the chart below, which shows where we are today relative to the previous disruption cycles of steam, railways, oil, mass production etc. These earlier cycles were followed by periods of mass deployment of the technologies – electricity didn’t die out, but electricity companies ultimately became utilities, with excess returns flowing increasingly to those companies which deployed the innovation (manufacturing, selling consumer whitegoods etc).

Which brings us to the latter half of the 20th century, when communication and information technology emerged as a disruptor. The big corporations of the day took the view (appropriate for their ten year business plans) that these were a drain on their existing businesses, and in any case could even put them out of business (Kodak and the first digital camera). The decision not to “mess with the magic” of tried and true corporate profitability led to the growth of the venture capital firm, which is where disgruntled tinkerers turned when the funding for their pet project was canned by the boss and the board.

In that happy place where computing power grew exponentially and the internet developed, super returns were created for these early VC players.

But once the early disruption phase is over, the age of deployment takes over. The VC role is now moving into the hands of corporation with the superior resources. And this time these companies have a very strong motivation not to be disrupted, but to build innovation capacity themselves.

Pushed from above and below, company managements now adopt with vigour the technologies which they previously kept at arm’s length. At the same time, with companies prepared to finance this disruption, the role of the angel investor became less important.

And companies that ‘get it’ recognise the adjacencies in their new business models, and deploy like crazy. Sound familiar? It’s the reason that Facebook bought WhatsApp and Instagram, or that Apple wants to move into cars, or that Microsoft is trying to remake itself as a cloud player.

And it’s part of the reason that VC firms are complaining about deal quality going down while pricing is going up – they are now competing not just with each other, but with the new group of corporates who are busy deploying.

All of this comes into play in the next three weeks, when reporting season in the US kicks off for real, and we get to see whether companies which disrupt (Alibaba, F-Secure, Paypal, Amazon) do better than companies which don’t.

It is certainly true to say that disruptive companies are getting to scale much quicker than their non-disruptive predecessors, and providing better returns to shareholders. It also explains in part the reason that VC companies are complaining about deal quality – some of the best deals are being snapped up by corporates.

If this is true, it may be the best place to be to play disruption is in the companies that are already set up to do so. It doesn’t mean that start-up won’t work, just that their path to market may lie through a corporate instead of venture capital.

Share this Post