First published BRW and Smart Investor, 4 August 2014 and written by Loftus Peak’s CEO Alex Pollak. Australian investors, especially self managed super funds, should consider diversifying their portfolios to include blue chip global disrupters like Comcast, Apple and Google.

Tesla designs, manufactures, and sells electric cars – battery cars make obsolete entire value chains in hydraulics and transmissions. Photo: Stan Honda

I guess that now Apple and Google are together valued at about 14 per cent of Nasdaq (that is $US960 billion out of a total capitalisation of $US6.8 trillion) the global disruption theme is over, right?

Wrong. There are so many valuation disconnects that it is seriously premature to call end times in disruption. From cars to music, retailing to electricity, we are at the beginning of what looks like a super cycle in global change.

Fact. Amazon is on track to overtake Walmart as the world’s largest retailer. You won’t pick this up out of the company’s filings but it is heading that way, nevertheless. This is because Amazon’s sales include a line that it reports as 3p, meaning third party. It’s the net revenue Amazon records via the sale of goods to you from other retailers – Amazon’s equivalent of goods on consignment.

Amazon can continue to grow by leveraging other companies’ infrastructure.The point is that the company’s distribution model now far outreaches the physical limits of what can be captured through its own bricks and mortar. Amazon effectively borrows other companies’ product lines and supply capacity. Walmart, by contrast, is very much linked to its physical infrastructure. Which in turn means that Amazon can continue to grow by leveraging other companies’ infrastructure (which simultaneously gives us an inkling into why Uber is considering delivering packages, as well as people). Where this will stop, nobody knows. And by the way, Amazon is worth $144 billion, 61 per cent of Walmart, from a zero base 20 years ago.

Alert readers will have noted that Comcast, the largest US cable TV, internet and telephony company has bought some natty technology which will enable virtually blanket Wi-Fi coverage for mobile applications for its 30 million subscribers (assuming the Time Warner Cable deal closes). The system bypasses the 4G and 3G spectrum currently used for, yes, mobile calls. That is a very serious blow to the big mobile carriers, including Sprint, Verizon and T-Mobile, since using Comcast’s shared, ubiquitous Wi-Fi renders obsolete their multibillion-dollar 3G and 4G networks. It also completes Comcast’s royal flush in communications, since the only thing it was missing was cellular. A problem it could solve in spectacular fashion.

Hello, Telstra – you might want to take this call . . . (Though in fairness, David Thodey has worked this out, which is why he is spending so much energy on his technology investments).

Hello, Telstra – you might want to take this call . . .Here are some other examples. Microsoft’s market capitalisation is $US355 billion, about 88 per cent of Google’s, which is $US390 billion. This sounds weird to me, since, as publisher Axel Springer pointed out in an open letter to Google’s Eric Schmidt, Google has “the biggest search engine in the world, and the second biggest (YouTube), with Chrome the biggest browser, Gmail the most widely used e-mail provider, and Android the biggest operating system for mobile devices.

True, Microsoft has some very solid assets in Windows and X-Box. The latter is doing fine, even if the former is in the process of an agonising death-by-cloud, with the only uncertainty being whether it is three years or five, valuation-wise. For the record, Google’s multiple of earnings before interest and tax is 18.3x, Microsoft is 10x (meaning, broadly, how quickly the markets demand the companies be able to repay their shareholders and lenders, in years).

Apple, the world’s largest listed company is trading on a multiple of earnings before interest and tax of 8.4x. That is lower than BHP, Rio, Google or, for that matter, Telstra. Apple went past Exxon’s $US434 billion about a year ago, for the second time, though it may not be the largest company of all, since we don’t know a lot about private companies such as Saudi Arabia’s Aramco, or what the mysterious Koch brothers are up to.

But Apple, I hear you say, is ex-growth . . . Well, yes, in a way, if you disregard that they are on their way to being one of the largest entertainment companies in the world, by taking a clip of the ticket for every movie, newspaper, game and TV show that they sell through i-Tunes, the revenue of which is effectively doubling every couple of years. All without employing a single actor, journalist, game designer or director. And this is also before considering what they are doing with in-car connectivity, wearables, etc.

Still feel that we are in end times for disruption and change?

The facts are that the rate of change, and so disruption, is (if anything) accelerating.The facts are that the rate of change, and so disruption, is (if anything) accelerating. Companies carrying significant legacy systems at book value have already been the subject of acid attacks in the form of far more stringent SEC tests, regarding the carrying value of their businesses. There is more of this to come. Expect Telstra to go the way of Fairfax (which correctly wrote down billions from the value of its mast-heads). But also, as the energy industry moves towards sustainability (wind, solar), there are enormous write-downs in oil and gas fields and infrastructure on the books of Shell, and um . . . Exxon! Now we can start to better understand why Chevron and the like are running those feel-good multimedia infomercials about how green they really are, as they desperately try to shift their businesses away from oil so we keep buying their shares. Or why when you search solar panels, Origin Energy comes up.

We feel good about buying global companies such as Coca-Cola and Visacard, but disrupters are using these companies’ heft and inertia as their principal weapon, like a judo master felling a much larger opponent with a feint or trip. At a recent visit to Visacard, I was unable to pay for lunch in the company canteen with a Mastercard, or even cash. When the only sound you hear is your own, what then? Will Mastercard directors hear the silent stealthy approach of Paypal, or do the lights just go out with the thud of the cosh? Craft beers attack the majors, battery cars make obsolete entire value chains in hydraulics and transmissions (electric cars don’t need gearboxes), etc.

The equity value of Tesla is now half the equity value of General Motors.The perception has been that the global change thematic is somehow just a computer and mobile phone game. It is far from this. The big changes may have been driven by computational power at first, and affected only those companies which were in their nature digital (music, newspapers, film etc) but that revolution has made its way into the physical world of cars (the equity value of Tesla is now half the equity value of General Motors), retailing (see above) and energy. The post-mining boom investor, riding high on the back of a 94¢ Aussie dollar, might view this as a rare opportunity to get into the global change theme at a time when the currency buys plenty.

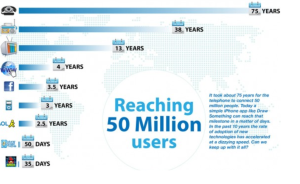

But we need to be nimble. The length of the company cycle (NB not the business cycle) is shortening significantly. The time it takes for companies to be born, thrive and die is reducing – it took 75 years for the telephone to hit 50 million users, and just 35 days for Angry Birds (see below).

This means just one thing. We must all pay very close attention to our investments, whether disrupters or traditional “safe” companies. Because it is almost certain that these issues are not being properly considered in corporate Australia’s board rooms. In the language of love, today’s market darling is tomorrow’s future ex. Get used to it.

First published BRW and Smart Investor, 4 August 2014 and written by Loftus Peak’s CEO Alex Pollak. Australian investors, especially self managed super funds, should consider diversifying their portfolios to include blue chip global disrupters like Comcast, Apple and Google.

Australia’s $7bn data centre | Harry Morrow features in SBS On the Money

18 Dec 2025Anshu Sharma features on EquityMates Best of the Best Podcast

18 Dec 2025December 2025 Update+

18 Dec 2025‘US Tech Volatility, AI Winners & Top Stock Picks’: Alex Pollak features on EquityMates Talk Money to Me

04 Dec 2025Share this Post