June was a strong month for the Loftus Peak Global Disruption Fund, which recorded a return of +10.2% net-of-fees with +5.6% of outperformance. The top performer was Roku, which added +2.7 percentage points to the Fund for the month. There was also a good move by Qualcomm (+1.5 percentage points).

This brought total net performance for the 2021 financial year to +38.2%, outperformance of +10.2% relative to the MSCI All Countries World Index in Australian dollars (it was up +28.0%).

The two top contributors for the month were also the biggest contributors for the financial year. Roku contributed +9.9 percentage points and our biggest holding, Qualcomm, contributed +4.0 percentage points. Apple came in third, contributing +3.7 percentage points with its March quarter results confirming the company’s significant recurring revenues. Alibaba was a detractor, eating -0.9 percentage points of performance, as the company has grown more slowly amid China’s antitrust crackdown (including derailing the IPO of Alibaba backed Ant Group and later fining the e-commerce giant US$2.8 billion).

Loftus Peak CIO Alex Pollak speaks about Roku as a part of ASX Investor Day panel on ‘Investing in Global Markets’.

Financial year roundup

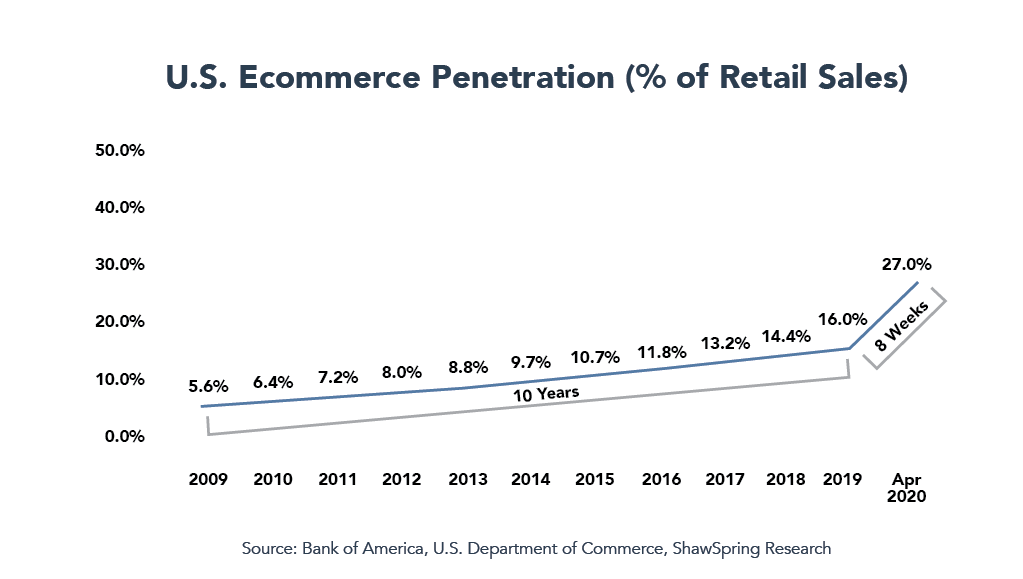

It was a year of significant disruption, with very different performance inputs across the first half of the financial year relative to the second. By July 2020, COVID had already changed the world, forcing people to work, socialise and shop remotely. One data point: US e-commerce growth in just the first few months of the pandemic exceeded that of the prior 11 years, as the chart below shows.

The requirement to work, socialise and shop remotely – for the most part a direction the world was already heading – drove significant performance in the Fund. The real question, then and now, is whether this lift in the various distance solutions will persist post-COVID. We believe it will.

By July, investors with grit were already buying companies which would benefit when COVID’s spread slowed, like airlines and hotels (the “re-opening trade”) – even as infections around the globe were still rising fast.

Importantly, Donald Trump became the former president. Little from his agenda survived, save for the push against China. President Joe Biden committed the US to a period of investment and modernisation at a scale probably without parallel in history. The US resumed its role on the world stage as a part of the G20, NATO, the Paris Accord, the World Health Organisation, UNESCO, the Trans-Pacific Partnership to name only a few, a signal that a more rules-based society is in the ascendancy after the chaos of the previous four years.

The re-opening trade really took off when the first vaccines became available around November, so much so that even a stellar set of Q1 2021 earnings results by a number of the Fund’s holdings failed to drive performance.

It was also the year when car companies, globally, including majors such as Volkswagen, recognised the inevitability of the shift to electric vehicles, whether via conventional lithium batteries or other technologies such as hydrogen. We invested.

Amazon too signed on to reduce its carbon footprint. The company stated that its emissions grew in 2020 as a result of the pandemic-fuelled growth of its business, but it still managed to lower its carbon intensity, a measure of emissions per dollar of sales, by 16% during 2020.

Not all are willing proponents of de-carbonisation. Global oil giant Exxon was forced to accept three board members advocating a tilt away from its portfolio of fossil fuel assets. BP and Shell are exploring alternative energy sources such as wind and solar, they say. We did not invest.

It was not until talk of rising interest rates as a means of dealing with inflation that the market paused during Q1 of calendar 2021. This hit especially companies considered “long-duration” – meaning those where earnings power was still a couple of years away (like Roku).

But by the end of June this year, investors had sloughed off those concerns, bond yields dropped and June equity performance was solid, more or less across the board.

From January to June, the Fund performed well (+13.7%) but the broader market – for example the MSCI All Countries World Index in Australian dollars (against which we benchmark) did better – it recorded a hefty gain of +15.3%.

Is disruption over? Not in our view. In fact, in many instances it is just beginning. We continue to position the Fund and our investors for the future the world is headed towards, which means exposures to mega-trends such as 5G, the Internet of Things (IoT), the Cloud, machine learning and AI, as well as those that are a little further along but still have a ways to go – e-commerce, streaming, digital advertising and more. We are excited for the year ahead as disruption continues to roll through all industries across the world.

Read the June Fund performance report here

Share this Post