The biggest thing on the radar of Woolworths and Coles isn’t Aldi, it’s Amazon. Richard Goyder himself said so in his address to the Retailers Leaders forum a few weeks ago. Quote: “Amazon… will eat all our breakfasts, lunches and dinners.”

But why – other than the obvious answers of size, speed and success? Should they be scared of Amazon?

It doesn’t have a lot to do with networks, or the internet – the answer isn’t that obvious. Increasingly, the success of the really big platforms, and the slow growth of the remainder boils down to simple logistics – the ability of Amazon (or Chinese giant Alibaba, or Latin America’s Mercado Libre) to get its product – any product – to the customer within 48 hours. The knowledge of distribution and logistics is something these companies have been building up over two decades and spending billions of dollars on.

Why is this so important? Because it’s the Trojan horse for something much larger, which is domination of the largest share of retail spending globally – the future of the retailing dollar.

We will focus on Amazon. The thinking goes like this. The company started by selling books and music 20 years ago, but quickly realised that margins were contracting and growth was slowing. To ensure relevance, the group recognised that it needed to be across a greater proportion of the purchasers’ choices. So it began investing heavily (about US$20b) in big, capital intensive distribution centres, placed strategically near population hot-spots in the US, UK, Europe and even China.

At first this was viewed very negatively, as a costly millstone around its neck. But this was in the early days of the internet, when the ability to buy something on a computer was itself viewed as a dark art. Why spend money on warehouses, trucks, logistics and inventory, investors asked – better to stay in areas where the unique selling point was the ability to magic up goods at prices which didn’t include fancy shop fit-outs in expensive retail malls. Sure, the cost of shipping was an additional, unpleasant add-on, but not a deal-killer.

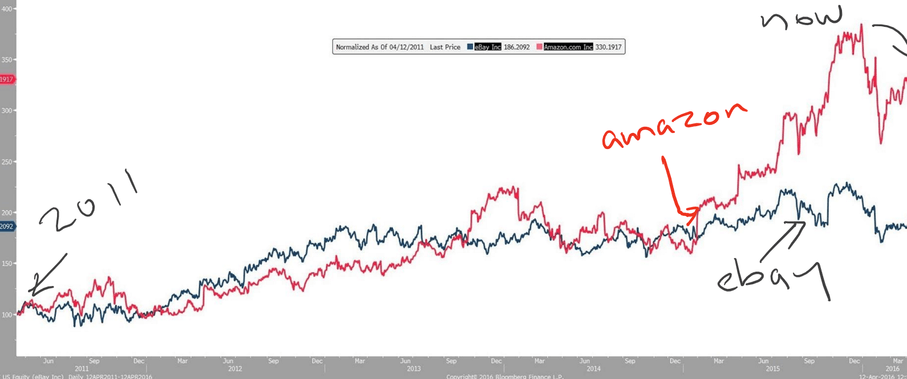

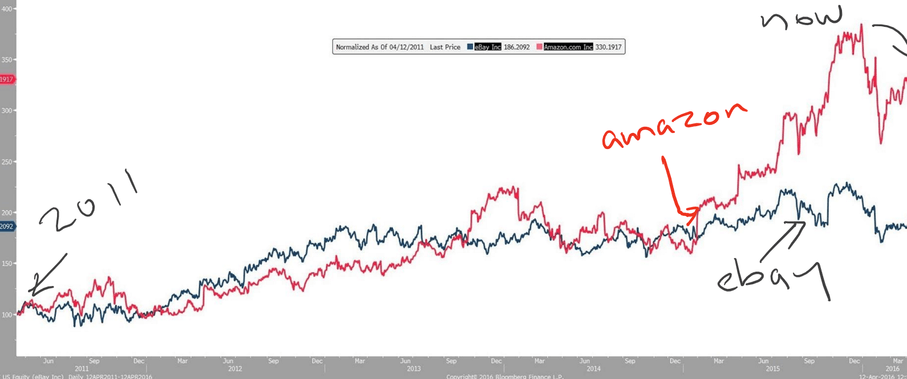

But the differing growth rates of companies with last mile logistics compared to those that don’t have them, as can be seen in the share price charts below.

Most recently, Amazon has realised that to truly control the retail value chain, the missing piece is the ability to source fresh produce and deliver it within a few hours. The proof of how serious this is can be seen with the recently-completed a deal in the UK to deliver fresh produce sourced from UK retailer Morrison’s, and delivered by Amazon Pantry, a part of Amazon Prime.

Amazon uses the push into fresh food in tandem with its Prime membership product. The arithmetic works like this. Amazon is estimated to have around 54m Prime members, who pay US$99/year for free delivery, with a turnaround of less than one day. That’s US$5.4b a year in Prime memberships – effectively the Prime businesses allows the e-commerce business to run at zero or below zero margin, while still growing customers and sales and profitability overall. From the customer’s perspective, once the US$99 fee is paid, it actually makes sense to push as much retail as possible through this channel because the cheap prices don’t stop and nor does the free delivery. The deal gets better the more it’s used. Previously, shoppers were compelled to go to the shopping centre to buy their fresh produce, filling the rest of the grocery list at the same time. Amazon Fresh negates this, in the process marginalising the big retailers with their heavy fixed costs in retail property. In doing this, value is transferred from mall owner to the Amazon customer and shareholder.

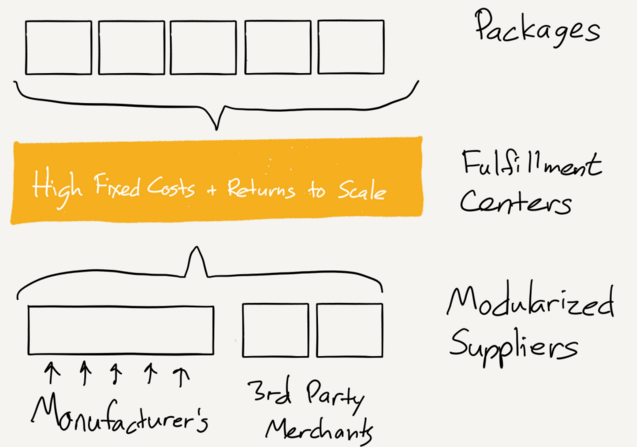

Reduced to its component parts, this excellent graphic from Stratechery shows the building blocks for Amazon’s retail business. (By the way, they are the same building blocks it uses for the mass deployment of its cloud business, Amazon Web Services).

The importance of the UK deal for fresh produce is that while some retail purchases are not time sensitive, fresh food isn’t one of them. Amazon is working on the theory that if this can work quickly/cheaply enough then it’s a mechanism to be able to pick up the entire grocery shop, and then the rest of retail will follow. And the rest is not small. We know that e-commerce is inexorably taking over more and more of the US retail sector and Amazon is taking over 50% of that e-commerce growth.

It’s one of the reasons that the industry is so focused on Amazon’s move into fresh produce. And it’s this that is keeping Coles and Woolworths executives focused.

To read the March Performance Review, click here.

Share this Post