European inflation stays high, forcing US rates up

This month’s bogey was European inflation, which was up to 9.1% for the twelve months to August, so still increasing. Energy and food prices drove this rise, courtesy of the Russian invasion of Ukraine, likely resulting in inflation globally being higher for longer and making it harder for the US to cut interest rates. It’s a new take on the theory of the butterfly’s wing causing a tornado thousands of miles away, with Vladimir Putin’s global domination fantasy cast in the unlikely role of the butterfly. Read the full August update here.

Of course, there are positives to rising rates, such as the opportunity to buy some of the world’s best companies at heavily discounted prices. Over the month we have increased the Fund’s position into these high quality names and at August end the Fund was around 96% invested.

Decarbonisation – the next major disruption

Just as the mobile phone and the connectivity / networking it enabled drove an ocean of disruptive change for the economy, so it is that action around climate change, in particular fossil fuels, is ushering in the next wave of change. Arguably, it will be just as profound.

Writ large, decarbonisation affects oil companies and the energy grid, but also transport generally – cars of course, but also trucks, trains, ships and even aeroplanes, and all the peripherals, such as taxis, ride share, car hire and freight will be affected by the transition to a clean energy economy.

While lithium will be an important element in the mix, we should not expect all energy storage to come from traditional batteries alone. There is significant work well in train around the creation, storage and distribution of hydrogen, which if “refined” in the right way burns clean, producing only water as the by-product. Another mechanism for storage is green ammonia, which can be part of the energy chain and which can also be used as fuel.

In Australia, hydrogen buses have started to arrive in NSW, with most other States seemingly set to follow. Globally, many companies are working on hydrogen “batteries”, which for example are used extensively in forklifts in the United States.

Source: Shutterstock

The NSW government will stagger the transition of the entire fleet of buses by 2035 in Greater Sydney, Outer Metro regions by 2040 and regional NSW by 2047

Airbus Industries, maker of the A range of aircraft (such as the A380), is working on hydrogen powered aircraft. Another major partnership, HAPPS, is building a hydrogen system that can be used to retrofit existing regional aircraft. The partners hope this system will allow commercial hydrogen-powered aircraft to take off with their help in 2028 and aim for the planes to each have a capacity of 40-80 seats. The company is already aiming for a 10-20 seat commercial plane powered by hydrogen by 2024.

Source: Airbus Industries, September 2022

Motive power will not be the only major change for transport. The gains made in microprocessors to date have been used to power infotainment systems in cars, but these have always been separate functions brought together by the carmaker. With the fundamental architecture of the car moving away from fossil fuels, and given the capability of the chips as experienced in mobile phones, a new design of the car has emerged.

Qualcomm, the Fund’s largest position, already provides many of these functions with its chips, such as music, radio, 3-4-5G connectivity, Bluetooth, Wi-Fi as well as the satellite for GPS.

We reproduce the comments made last month at a briefing provided by investment bank JP Morgan, where Qualcomm CFO, Akash Palkhiwala said: “The auto market is on the cusp of big changes. We are focusing on electric vehicles ramping quickly, also automated vehicles or autonomous vehicles. Every car is getting connected to the cloud. If you look at the Tesla model, you have 4G in the car. You have Wi-Fi, Bluetooth, GPS, power line communication inside the car. We are the leader in those technologies. We have the ability to be the silicon provider that connects every car to the cloud. We are already the leader in that market. Second is the processing that’s needed inside the car. That’s changing to a digital tablet-like experience. We have the ability to take smartphone chips that we have, and bring them to automotive.”

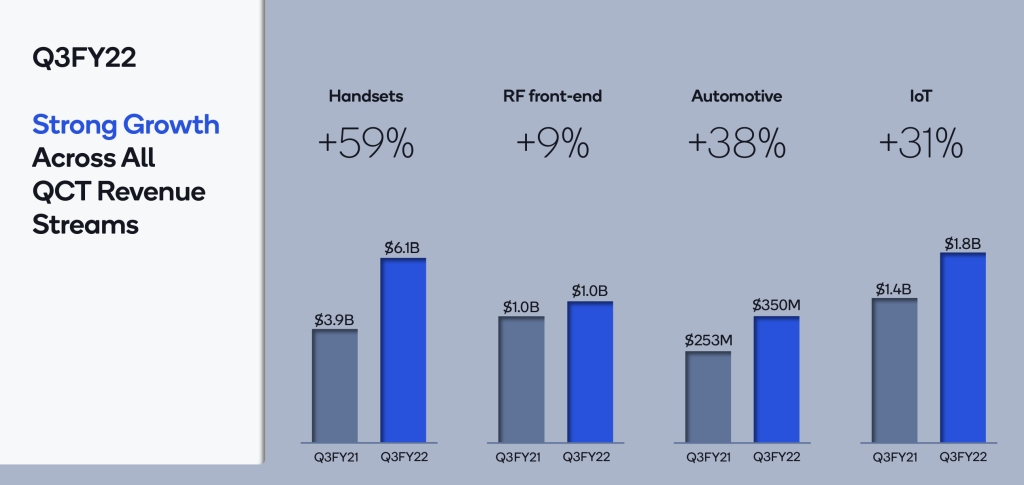

The chart below, from Qualcomm, shows the very strong growth the company is recording from its automotive division.

Source: Qualcomm

The Streaming Wars

The Fund has long been a supporter and investor in the streaming space given the fundamental shift in the way television is consumed. In the recent times however, streamers have been heavily penalised by markets for not beating growth targets, with their share prices down substantially since the beginning of 2022. We believe that despite these sector headwinds, the Fund’s streaming holdings, Roku and Netflix, continue to present strong long-term value propositions as the shift to streaming increases.

SVOD (subscription video on demand) player Netflix still has substantial room to grow. There are currently 221 million subscribers to Netflix – when we consider there are billions of internet connections globally, and the fact that many of these existing subscribers are in North America, we believe the company is nowhere near saturation. Netflix is heavily investing in local content to cultivate this international growth and has seen huge success from titles such as South Korea’s Squid Game and Spain’s Money Heist. The company has also announced plans to launch an ad-supported tier on its platform to target more cost-conscious consumers. These may be either consumers who have never had a Netflix subscription due to the price, or those it lost earlier in the year when the subscription price was increased. Advertisers have long sought to connect with Netflix’s subscriber base with ad customers reportedly looking to pay premium prices for access. This long-term growth runway for Netflix looks very attractive, especially given the current price of the stock.

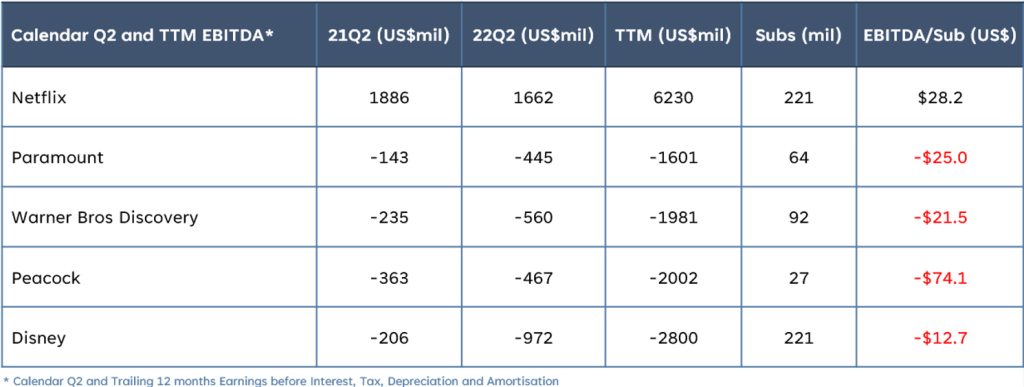

The below table from Lightshed Partners distils the Netflix value proposition into one elegant dataset. It shows a 12-month view of EBITDA/subscriber**, a measure of the profitability of each service on a per subscriber basis. Netflix generated EBITDA/subscriber of US$28, while other streaming services generated losses per subscriber. This is important because it shows that amongst these competitors, only Netflix has a profitable business in the SVOD space.

**(earnings before interest, tax, depreciation and amortisation)

Netflix shows profitable subs, others show losses

Source: Lightshed Partners

Notably, streamers from legacy media companies like Comcast (Peacock) and Warner Bros Discovery struggle to match the profitability of Netflix given their existing clumsy legacy businesses and the costs associated with the transition to streaming. Compounding this are the lost revenues from subscribers switching from pay TV, which generate over $100 per month from customers, to a much cheaper streaming option. As a pure streamer, Netflix doesn’t have this problem. Even Disney, which is frequently cited as the legacy player most likely to be successful in streaming, is running at an EBITDA loss. We should also note that a recessionary environment will speed up cord cutting as households become more vigilant to minimise expenses.

The writing is clearly on the wall for the legacy media players with pay TV products – cable bundle providers Altice, Charter, Comcast, Verizon and more are losing subscribers at a rapid pace because the service provided by streamers is accessible from anywhere with an internet connection, more functional, cheaper and overall a better experience. This is the nature of disruption.

Share this Post