For the 2023/24 financial year, the Fund gained +41.4% net-of-fees while the benchmark grew +19.3%, generating outperformance of +22.1%. While artificial intelligence (AI) dominated the disruptive landscape, and was a material contributor to return, there were a number of other companies that added to the Fund’s return outside of Nvidia or others of the so-called Magnificent Seven.

Holdings were managed with an eye to the disruptive trends at play and the valuations of companies involved. It is no surprise to us that the largest contributors to the Fund were the two largest holdings; Qualcomm and Taiwan Semiconductor Company (TSMC). The large weights in these companies are a function of the investment team’s conviction and valuation comfort.

Semiconductors remain critical to disruption

Qualcomm, which added +8.2% to Fund value, was notable given its importance to edge devices like phones and laptops. On top of this, Qualcomm’s ARM-based PCs are a credible substitute for Apple’s machines, which up to date have been superior because of battery life. Qualcomm is also at the beginning of a cyclical recovery in its mainstay smartphone business with a burgeoning design pipeline for the supply of semiconductors for automobiles.

TSMC, which delivered +5.8% for the year to 30 June, was another beneficiary of the cyclical recovery in electronic devices and the secular demand for high-end datacentre chips. TSMC is the fabricator behind Nvidia (+4.3% for the year), Advanced Micro Devices (+2.8%), Broadcom (+1.9%) and Apple (-0.1%).

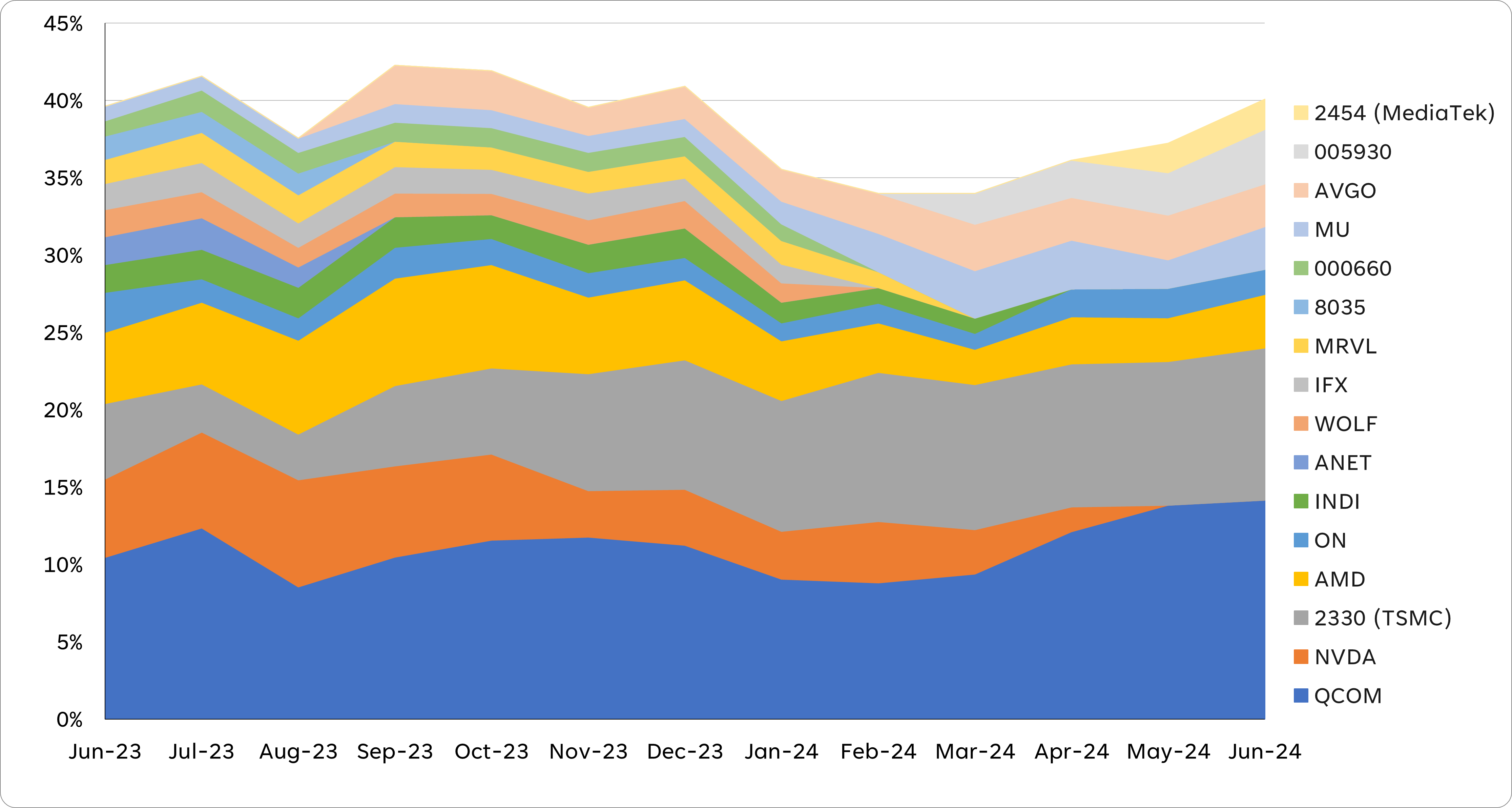

Clearly, semiconductors are at the heart of AI disruption. However in aggregate the sector is more richly valued than it was a year ago. which led to exits in Nvidia, Arista Networks (+0.4%) and Marvell (+0.4%) as well as a reduction of the position size in AMD. While the Fund’s overall semiconductor exposure decreased over the financial year, there was an increased allocation towards memory companies Micron (+1.8%), SK Hynix (+0.5%) and Samsung (+0.1%), which remain underappreciated given their exposure to the memory cycle (the cyclical demand for memory for use in smartphones and PCs) as well as cloud and edge AI beneficiaries.

Capital has been reallocated within the semiconductor exposure

Most AI models are being deployed in the cloud, with the top cloud providers being the largest chip customers. Microsoft (+2.4%), Alphabet (+3.7%) and Amazon (+4.1%) were all core positions through the year. Amazon and Alphabet were both held at relatively larger average allocations than Microsoft due to their more compelling valuations.

Apple is a more recent entrant to AI, as noted in an earlier Insight here. Apple is one of the largest contributors to the Fund since inception, but valuation compelled an exit at the start of the financial year. Apple is well placed to deliver on its disruptive AI ambitions, but generating return is harder given its valuation.

Digital advertising

Beyond semiconductors, digital advertising and streaming were strong across the financial year, especially in the larger players Meta (+3.0%) and Alphabet. The strength in Meta is the result of a cyclical recovery in advertising combined with the continued disruption of traditional advertising by digital. Netflix (+4.1%) contribution was driven by the comapny’s continuing execution against a large target addressable market, as well as its emerging advertising business and cost control. This was helped by competitors pulling back (as we suggested would be the case back in 2022). Two of the Fund’s exposures to the fast-growing programmatic advertising sub-categories of retail media, social and CTV did not fare as well. Integral Ad Science (-0.8%) and Double Verify (-0.9%) faced serious headwinds. Their adverse impact to the overall Fund return was managed by their non-core status and relatively low allocations.

Smart Vehicles and Electrification

Electric vehicles are undergoing their first ever cyclical weakness. This has put downward pressure on demand for electrification and other components (EVs tend to contain more assisted driving and sensor based features on top of being electric). Our largest automotive exposure is ON Semiconductor (-0.5%) with higher growth / higher risk names like Indie Semiconductor (-0.8%) and Wolfspeed (-1.0%) also feeling the crunch.

This cyclicality is unlikely to dampen the broader increase in demand for electrification. Not only do electric vehicles remain a long term demand opportunity, but demand from industrial and energy infrastructure is increasing due to AI.

AI disruption shifting into software

Compared with a year ago, the Fund’s allocation to software has increased markedly. New software names have yet to make a large impact on contribution to Fund performance, however the investment team believes select software name are well-positioned for the disruption brought to the industry by AI.

The large amount of semiconductor processing power that has been built out to date changes the landscape for software. Previously, uneconomic functions (like generative AI) can become viable, opening the way for the companies to monetise these features. It is likely that the companies that are already dominant in software that is easily aided by AI are best positioned. This includes Adobe (-0.1%) for image generation, Service Now (-0.1%) for workflow management and GitLab (-0.3%) for code generation.

Looking Forward

The 2024 U.S. presidential election is ramping up, complete with a last minute candidate change. The prospect of a second Trump presidency is real, but not a certainty. Irrespective of the U.S. elections, better and more efficient solutions will continue to proliferate across all industries.

Share this Post