Alex Pollak, CIO at Loftus Peak

What’s so special about the Loftus Peak Global Disruption Fund?

Traditional business models are being disrupted as connectivity, networks and the sharing economy impact all industries – retail, transport, communications, energy and banking to name a few. Loftus Peak generates investment return by focusing on these major secular shifts and how they will change the world in the next five to ten years. Loftus Peak’s strategy complements other sharemarket investments, particularly in Australia where there is a heavy skew towards banks, resources and the Australian dollar.

The year in summary

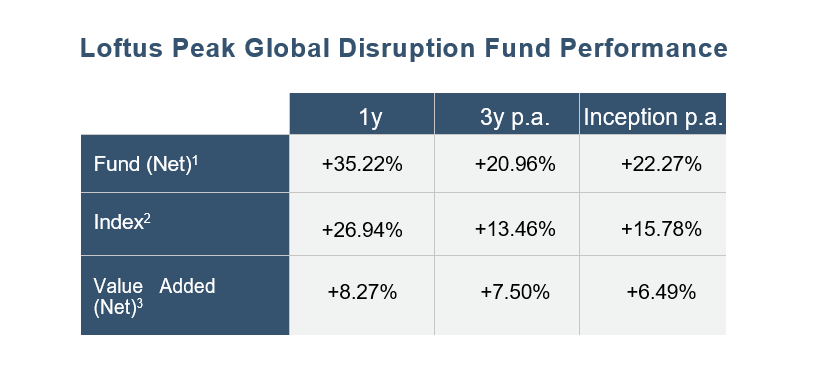

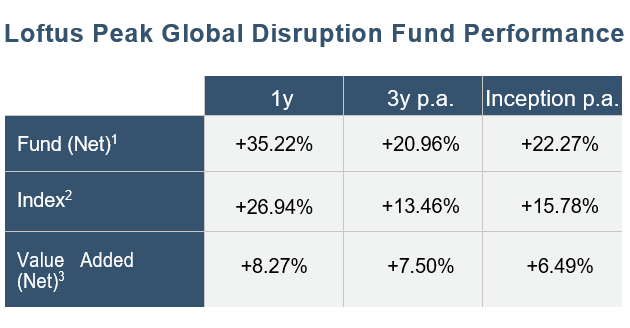

December brought an end to what was a volatile year for investors. The trade war between the US and China which has plagued markets throughout 2019 appears to be coming to a close, with rhetoric from both sides softening and a phase one trade deal struck in January. Subsequently, Loftus Peak’s Global Disruption Fund was named in the top performing global fund managers for 2019, as well as over three and five-years, in the Australian Financial Review:

Decreasing global tensions and uncertainty certainly helped lift markets, but we believe investing in disruption transcends geopolitics, and that Loftus Peak’s investment philosophy and process underpinned our results for the year. We have written previously on why we invest through the lens of disruption here, but for more on the portfolio construction process and specific contributors for 2019, please read on…

The Loftus Peak process

Loftus Peak has adhered to an investment process which has been refined and evolved over almost two decades, and that has been delivering consistent outperformance to investors since June 2014. 2019 was no exception. Every company in the Fund is there for a reason. 70% of our positions are at weights of 5% or more, and positions of less than 1% tend to be avoided. This discipline forces us to focus closely on business models and company-specific financials, which are then evaluated through our proprietary models. We believe this process is working, with our high conviction holdings making the most meaningful contributions.

Below we discuss the company returns which contributed to the overall +35% increase in unit price (net-of-fees). In Apple’s case it contributed +5.9% to the +35% return, with all other stocks therefore making up the remaining +29.1%.

The companies which drove performance

Apple (AAPL): The transition to services

In a phone market which is not growing, there have been legitimate concerns about Apple’s stock price. These have proved illusory, as the company’s +86% share price increase in calendar 2019 has proved. The company is well on the way to becoming services/software driven, which can be seen in many decisions, for example making Apple Music available on Amazon Echo smart speakers. Apple has an installed base of around 1.3 billion users with which to distribute digital services including health, entertainment and banking, to name just a few. By comparison, the largest cable TV and internet operator in the US has around 30 million users (or 1/40th the size).

We have held Apple at an average weight of 9% since inception, and its strong 2019 helped deliver just under one sixth of the total return for the year to 31 December, at +5.9%. We believe the company’s strong performance will continue, as it is only just making early inroads in many markets.

Qualcomm (QCOM): 5G major

Qualcomm wasn’t far behind Apple, up +55% for the year and contributing +4.7% to the overall return. The company’s research and development is helping push the telecommunications industry towards a 5G standard, which will benefit consumers through increased speeds and bandwidth with lower latency. We expect 2020 to be another big year for Qualcomm as 5G is made available to consumers, and phones with the capability to utilise these networks are released. The company is another high conviction position, with an average weight of 6% since inception. We do not see a 5G world where Qualcomm isn’t a key driver and beneficiary.

Xilinx (XLNX) and Nvidia (NVDA): Acceleration in a post-Moore’s law world

Xilinx was solid, making a contribution of +4.5% for the year. The company benefits from the decision-making load being migrated away from the central processor unit, or CPU (where it would cause a bottleneck) toward a devolved, programmable interface – not only enabling more data volume to be analysed but accelerating the analysis of certain types of data, for example images. Think about this next time the GPS suggests alternate routes, times and transport modes in real time. Nvidia is another player here, about which we have written extensively. It performed strongly for the year and contributed +3.0% to Fund return for 2019. Going forward, it is vying for position in artificial intelligence, autonomous vehicles and the datacentre – trends which we expect to play out over the coming years.

Microsoft (MSFT): A company re-invented

Microsoft too hit its stride in 2019, cruising through US$150 and finishing the year up +57% to contribute +3.1% to the Fund’s overall return. It has achieved this by shifting its business away from being an on-premise provider of software in favour of making compute capacity available everywhere, by the second, through its Azure cloud products. The reason this is so attractive is that it removes the need for companies to provision their compute needs site by site, with the duplication and/or reduced capacity utilisation that this implies. Companies will continue to shift workloads to the cloud (for the reasons listed above), and Microsoft will reap the rewards, especially with the advent of 5G and the significantly larger amount of data flowing around the world and subsequent processing that will be required.

Tesla (TSLA): Expansion in China, Europe

Tesla’s underperformance in 2019 has been reversed in dramatic fashion this year as it appears on track to deliver 500,000 cars in 2020. The company’s newly constructed Shanghai Gigafactory will aim to produce 3,000 vehicles per week in early 2020, with another factory in Germany, the home of high-end car engineering, also planned. The market expects a lot of negatives from Tesla, but the company is on track to deliver over $50b in revenue in 2021. It delivered operating cashflow of US980m in the nine months to September 2019 on revenues of US$17 billion. More on the disruption to traditional car manufacturers here.

Netflix (NFLX) and Roku (ROKU): Streaming wars winners

We also had modest performance from Netflix (up +19% for the year) as investors fretted about competition from Disney, HBO, Amazon Prime and Apple. The idea that competitors hurt Netflix doesn’t really make sense – the introduction of new streaming services actually serves to speed up the dis-aggregation of the cable bundle globally making the streaming services more important than ever. We are still in the early stages of this disruption, but already many consumers have embraced the ‘streaming bundle’, given the price of subscribing to multiple streaming services is cheaper than a $100 monthly cable bill.

The weaker performance of Netflix has been wiped away in the current year, with Disney failing to win a Golden Globe for best animated picture (it normally does) while Netflix won two (and had 34 nominations across the television and motion picture categories). A close inspection of the Disney streaming offering reveals its relatively narrow catalogue. HBO’s new owners, AT&T, promptly fired the head of the HBO studio (who was responsible for Game of Thrones and a plethora of other successful titles) weakening the chance of profitable subscriber growth. HBO’s ambitions for profit internationally are also likely to be stifled given the company has sold forward its offshore rights and will instead be forced to work with existing licensing partners at the outset (eg Foxtel in Australia).

Roku is a company with which many investors may be unfamiliar. The company originally sold a ‘stick’ to consumers which made ‘dumb’ TVs smart, but has now moved on to licensing the operating system directly to smart TV manufacturers (Telstra’s TV box uses Roku’s technology). The benefit to manufacturers is that they are able to focus on what they do best – the hardware – and leave the interface to Roku.

A few of our previous articles on the streaming wars can be found here and here.

Baidu (BIDU): Struggling to monetise

Although 2019 was a strong year, it wasn’t without its underperformers. The worst performing company was Baidu, which detracted -1.1% from the Fund’s performance, as it failed to monetise across many key segments in China including travel, shopping and banking. It also faced increasing advertising competition from new players in the space. The company was subsequently thrown out by investors at the beginning of the year, and being a Chinese company, lost further ground during the trade war. Its share price has since recovered some of these losses as its advertising revenue stabilised and it also acquired a lead in driver assistance technology.

In Conclusion

The strong year in 2019 forms part of a longer track record spanning more than five years for the firm. While we are happy to have delivered strong returns to Loftus Peak investors in 2019, it is important to continue looking forward. We don’t believe disruption has run its course, and will continue to position the Fund to benefit from disruption thematics which will play out over the next decade – data, the cloud and machine learning, networks, energy as a technology, connected devices and China’s rising economical influence (more on our investment philosophy here).

If you would like to receive monthly performance updates and more content like this from Loftus Peak, you can sign up to be a part of our mailing list here.

Disclaimers for performance:

Source: Loftus Peak, MSCI

Past performance is not a reliable indicator of future performance.

1. Net-of-fees performance is based on end-of-month redemption prices after the deduction of fees and expenses and the reinvestment of all distributions. Investment return and the principal value fluctuate, so your units, when sold, may be worth more or less than the original cost. For further details, please refer to the Fund’s product disclosure statement and reference guide.

2. The index for the Fund is the MSCI All Countries World Index (net) as expressed in AUD from Bloomberg.

3. The Value Added is shown as the Fund (Net) minus the benchmark.

Share this Post