The Loftus Peak Global Disruption Fund was up +0.8% net-of-fees in December, outperforming the benchmark MSCI All Countries World Index net in Australian dollars by +0.7% (it rose +0.1%). One-year net performance to 31 December is +40.5%, which is outperformance of +34.3%.

Read the December Fund performance report here.

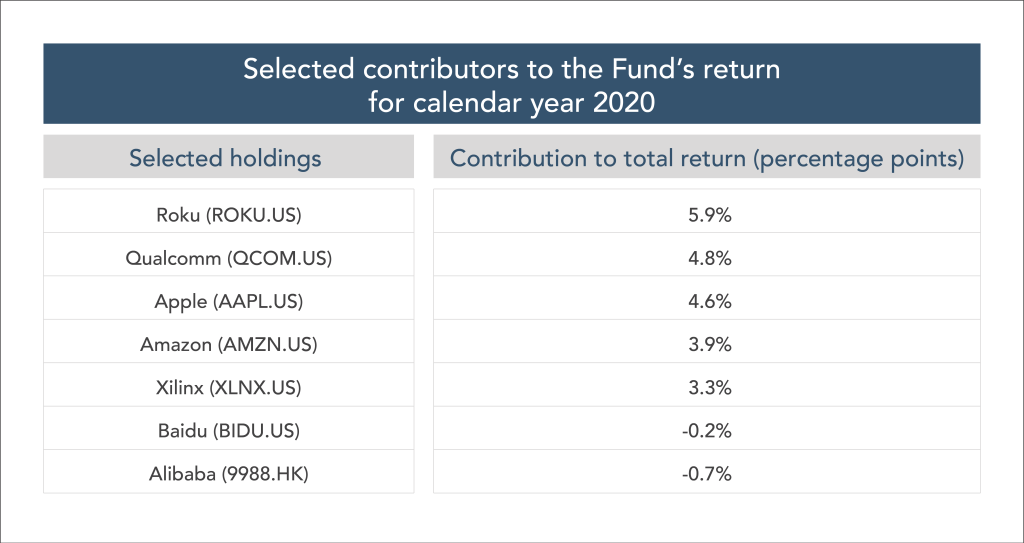

In earlier years, Loftus Peak returns were enhanced by solid contributions from Facebook, Apple, Amazon, Netflix and Google (so called FAANG). But in the top ten contributors for the year 2020 only Amazon and Apple made the cut, adding +3.9 percentage points and +4.6 percentage points return respectively (NB the table above shows a selection of contributors only.)

This is not to say that the FAANG stocks didn’t do well – they did, just not as well as a number of other lesser-known companies which are emerging as the major names of the next few years, a point which was picked up in the Australian Financial Review Chanticleer column from Tony Boyd.

There is no better example of this than Nvidia. Its stock price has appreciated tenfold over the past five years, and is now worth 50% more than Intel, once considered the most important microprocessor company in the world, as Nvidia provided the speed improvements while Intel struggled. The company contributed +2.7 percentage points to the Fund’s return for the year. Its importance is confirmed in the recent decision by Mercedes Benz to use Nvidia to implement advanced driver assistance across its range.

Despite criticism, Apple remains an important disruptor across a number of industries.

Apple was very much in the mix (still); it took 30 years to hit a market value of one trillion (US) dollars, and 8 months to double from there, contributing +4.6 percentage points to total return for the year. The company’s payment system, its TV and music offerings, health focused wearables, as well as its hardware business (the recent Mac with Apple’s own M1 chip has been a solid success) are all adding value.

Qualcomm (+4.8 percentage points contribution to return) holds some of the most important patents for mobile phones (many of which relate to 5G). The company sold down with the broad market decline driven by COVID-19 concerns and because of legal and regulatory fears (at which point we increased our position in the company). It has since overcome these legal challenges and will play a crucial part in the roll out of 5G in 2021.

Roku: the new operating system for TV

The biggest contributor to performance for the year was Roku (+5.9 percentage points). The company is a strong chance to emerge as the de-facto operating system for TV – it already is the most popular choice in the US, where it accounts for 40% of all new smart TV (which is pretty much all TV) sales. The value to a user who has recently cut the cord – ie is choosing to watch streaming services like Disney+ and Netflix rather than cable tv – is that the Roku-enabled TV has upwards of 10,000 free (and by free we mean advertising-supported) channels available worldwide, everything from local free-to-air stations to specialist offerings such as wildlife and cooking, among many others. Since we entered the stock two years ago, the company has appreciated markedly. The lesson in this is that disruption continues to evolve and is moving toward a paradigm which will likely create a new group of household names.

We of course benefitted from the huge rise in the value of Tesla. Now a company included in the S&P500 index, we accepted the higher risk profile of Tesla when we bought in at US$60, but kept the weight in our portfolio commensurately lower. Even with a small position the company was able provide +3.2 percentage point return for the year. We no longer hold the position, as we believe its risk/return calculus is not justified at this price.

The biggest negative contributors (though they were not significant, at under -1 percentage point combined) were Baidu, Intel and Alibaba. Baidu until recently had struggled to find a comparable monetisation engine (relative to Tencent and Alibaba). Intel meanwhile is in difficulty, having flubbed its attempt to bring its CPU’s to the next level, which would have enabled lower power usage and higher performance. The company is at risk to cede its dominance in the datacentre if it cannot pull out of this operational dive, which is the reason it has hired a capable engineering veteran, Pat Gelsinger, as the new CEO.

We noted in last month’s commentary US President-elect Joe Biden’s sensible plan to improve US digital infrastructure. Specifically, here is what Thomas Friedman wrote in the New York Times regarding his personal interview with Biden:

“I want to make sure we’re going to fight like hell by investing in America first,” said Biden. He ticked off energy, biotech, advanced materials and artificial intelligence as areas ripe for large-scale government investment in research.

And this time, he insisted, rural America will not be left behind.

“You know, it really does go to the issue of dignity, how you treat people,” Biden said. “I think they just feel forgotten. I think we forgot them.”

We have “got to end the rural health care crisis right now by building on Obamacare. I visited 15 rural hospitals. A lot of these rural hospitals and clinics could benefit from telemedicine, but they don’t have the broadband connectivity”.

“We should be spending $20 billion to put broadband across the board,” Biden said. “We have got to rebuild the middle class,” but “especially in rural America”.

This commentary seems to point to a more measured approach for the US, which we believe bodes well for our portfolio.

Share this Post