By Alex Pollak, CIO Loftus Peak

Key takeaways

- Almost all companies fall in a downturn

- But those with the best metrics, like lowest gearing, can rebound much faster (read below for examples)

- For exposure to these kinds of companies in an investment, see the Loftus Peak Global Disruption Fund

Disruption as an investment strategy

Why is disruption working as an investment strategy? Is it actually different this time or just an extended build-up to a new tech crash?

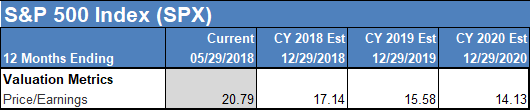

The rules of investing say the raw PE’s of Amazon, Google and the like are high by most standards, and this underpins a view by some that a correction in these names is imminent. In fact, some say it has been imminent for years (though if investors had sold on the basis of these warnings, they would have missed significant upside).

It’s not our view.

But for the sake of argument let’s assume that there is a correction, and that the high PE’s of some the biggest tech companies in the world get hit, as they certainly would. As legendary investor Benjamin Graham once noted, the market is first a voting machine – but then a weighing machine. So following that correction how will the market review these companies?

There are several reasons why the current solid gains in tech are well supported compared with the 2000 crash.

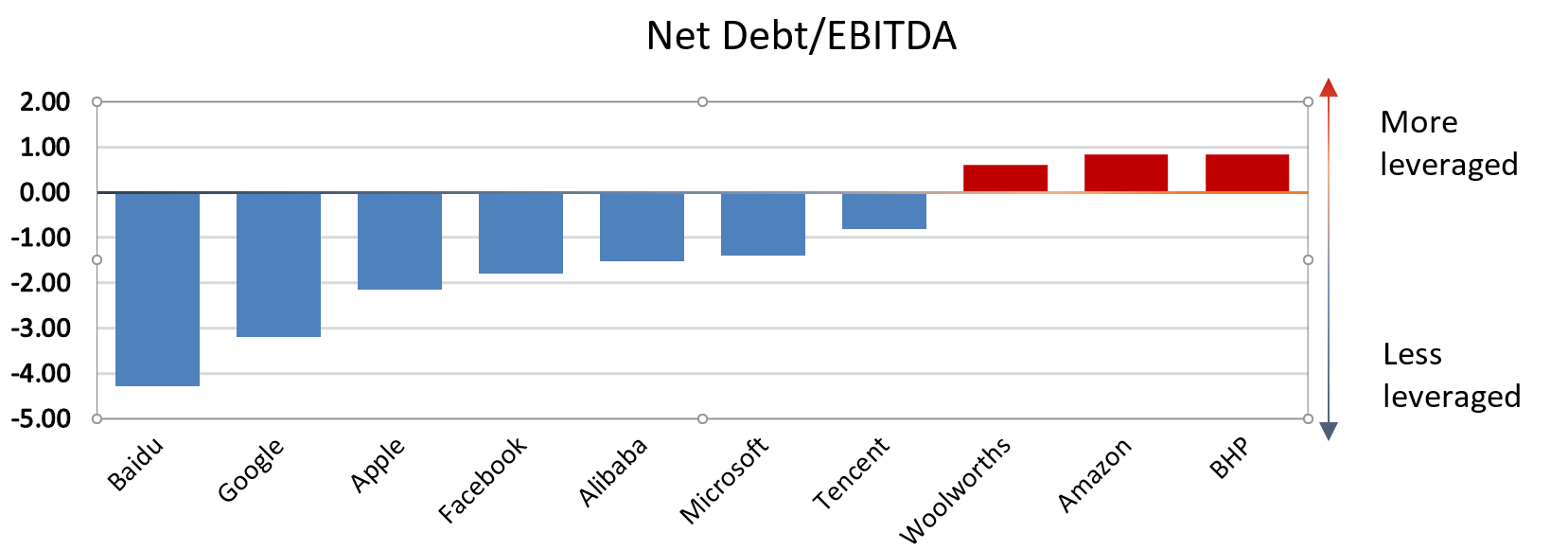

Gearing of some of the biggest and best companies is lower than Woolworths and BHP

One measure of financial health is to look at the levels of debt within companies, to see which are shaky and won’t be able to fund their operations in a downturn. A ratio often used is net debt/EBITDA. It’s a good ratio because EBITDA is earnings before interest, tax, depreciation and amortisation, virtually all of which would in theory be available to pay off any debt. In essence, the ratio measures the number of years a company would have to earn its EBITDA to become debt-free. A ratio of one means that a company could pay off all its debt in a year. The lower the number the better – negative is better still.

On this measure, some of the world’s most ‘expensive’ companies have the strongest balance sheets. Amazon has no more leverage than BHP and only slightly more than Woolworths. For the record, the average net debt/EBITDA ratio for companies making up 97% of our portfolio is -2.27x. This means on the average this group has 2.27 times its EBITDA as cash.

On this measure, some of the world’s most ‘expensive’ companies have the strongest balance sheets. Amazon has no more leverage than BHP and only slightly more than Woolworths. For the record, the average net debt/EBITDA ratio for companies making up 97% of our portfolio is -2.27x. This means on the average this group has 2.27 times its EBITDA as cash.

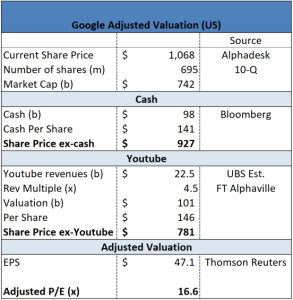

OK, then how about PER’s? Google, for example trades at 24x forward earnings, a premium of around 40% relative to the prospective PER of the S&P500.

What is the real PER of Google?

But Google has US$97b of cash at bank, which works out to US$141 per share. Most companies don’t have 15% of their equity value in cash sitting on the balance sheet, so it’s probably fair to adjust for this. And while we are at it, YouTube isn’t contributing to earnings yet, but clearly is a valuable property – say 4.5x revenue, which is a further $100b in valuation which contributes no earnings. These two items together add to US$287/share, bringing the adjusted share price on which the PER should be calculated to US$781/share. On this measure, Google is trading at 16.6x. Not that expensive for a company growing revenues at 22% pa compound.

And Apple, as we noted here last week is trading at a PE multiple of 11.6x once buybacks which are being calculated at US$200b are taken into account. This is just 10% higher than Telstra.

So there are two compelling reasons to view these companies as cheap. Looking more broadly, there are others for the other big disruptors. Alibaba, the Amazon of China, is riding the shopping boom of a rapidly growing middle class, at the same time rolling out banking, transport and media businesses. Of course it looks expensive – it is trading at double the multiple of the S&P500 – but it is leveraging the largest consumer base in the world in its home country, with offshore expansion available. So expensive, but expensive for a reason.

How about Netflix? This company does not really make sense by any financial measure, except on a dcf (which is what we use and even then only with relatively favourable inputs). We have been negative about Netflix in the past, on the basis of eventual competition. But honestly, any competitive threat now looks even further away than it was a year ago. Disney and Comcast are involved in an expensive (US$60b) bidding war to take over Rupert Murdoch’s 21st Century Fox.

Murdoch himself is selling have already noted that he can’t compete against Netflix and others going forward, and so has triggered the sale. Instead of taking their queue from this, the boards of Disney and Comcast have taken the view that the way to fight against new media (Netflix) is by doubling down on old media – which is what Fox is. Meanwhile, Netflix continues to grow subscribers and make compelling television – something which seems not to be in Disney/Comcast’s playbook. And the Netflix price is up 15% since the sale was first negotiated, while Comcast and Disney are down 25% and 10%.

Lastly, it is different now to the 2000 crash. In the run-up to the event, the internet was very new – many companies understood that the paradigm was compelling, but had not actually worked out a viable business model. The outworking of this was ever larger equity issues to fund operating losses, with no clear path to monetisation. The music then stopped, and stock prices fell. It took 16 years for the NASDAQ to regain its former peak.

Fast forward 20 years and the situation is vastly different. Virtually none of the big tech companies has had an equity issue after the date they first went public. That is a very big deal.

The Loftus Peak Global Disruption Fund is now available through the ASX as an mFund.

Click the button above to learn more

Share this Post