Hard and soft landings (recession versus not) are now the talk of the day, with a growing list of companies reporting hiring freezes and other cost controls along with lower forward earnings guidance, all of which points to a greater likelihood of economic hardship. None of which is good, and while a slowing economy is a fact of life it doesn’t stop consumers and businesses making purchase decisions each and every day (albeit with relatively smaller budgets). Loftus Peak’s strategy doesn’t rely on people spending more and more every year – although it helps – and instead relies on change and disruption rolling through every industry in favour of better, more efficient solutions for consumers and businesses. This all begs the question: how do disruptive trends, and the companies benefiting from them, perform during periods of economic weakness? As a guide, the Global Financial Crisis (GFC) is a good place to start.

Disruption and the Global Financial Crisis

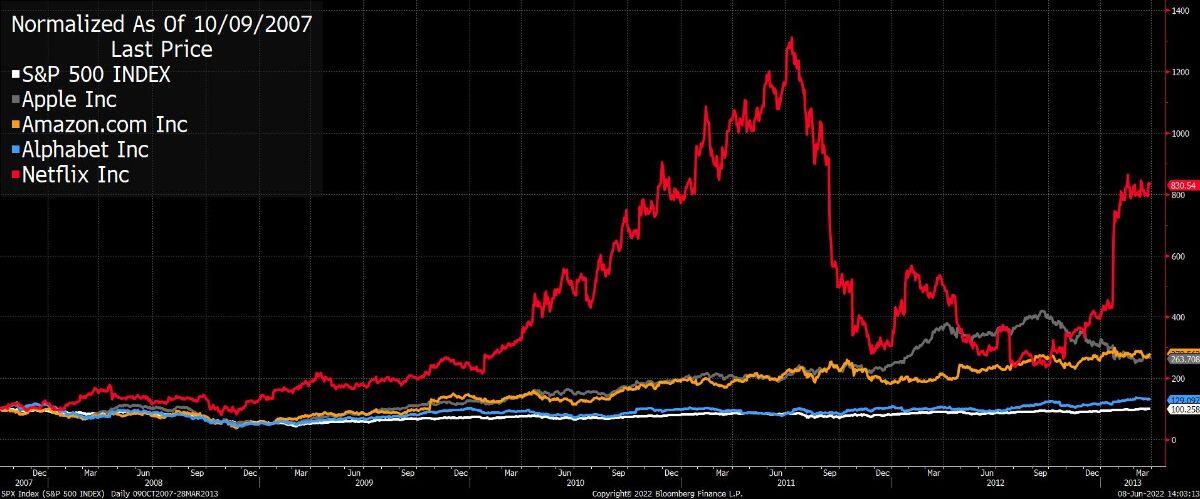

A recession is commonly defined as two consecutive quarters of real GDP decline. It is characterised by falling economic activity, increasing unemployment and decreasing consumer and business confidence: with both groups being more cautious in their spending. Investment spending also slows. The GFC, between mid-2007 and early-2009, was exceptionally bad on all of these metrics, resulting in a significant fall in sharemarkets – the previous peaks of which were not recovered for another five years. And yet, over those same five years, many disruptive companies outperformed the S&P500 (quite significantly in some instances). How could that be?

Over the five years it took the S&P to recover its 2007 high, Netflix’s share price grew +731%, Amazon +180%, Apple +164%, Alphabet +30%

Source: Bloomberg

Source: Bloomberg

Then, as now, there were a number of key disruptive trends working their way through the economy. Smartphones were becoming ubiquitous, e-commerce was in its infancy but growing strongly, online advertising was taking hold and streaming was beginning to benefit from faster download speeds. The simple answer is that the disruptive trends benefiting these companies were a greater force relative to the economic headwinds they faced.

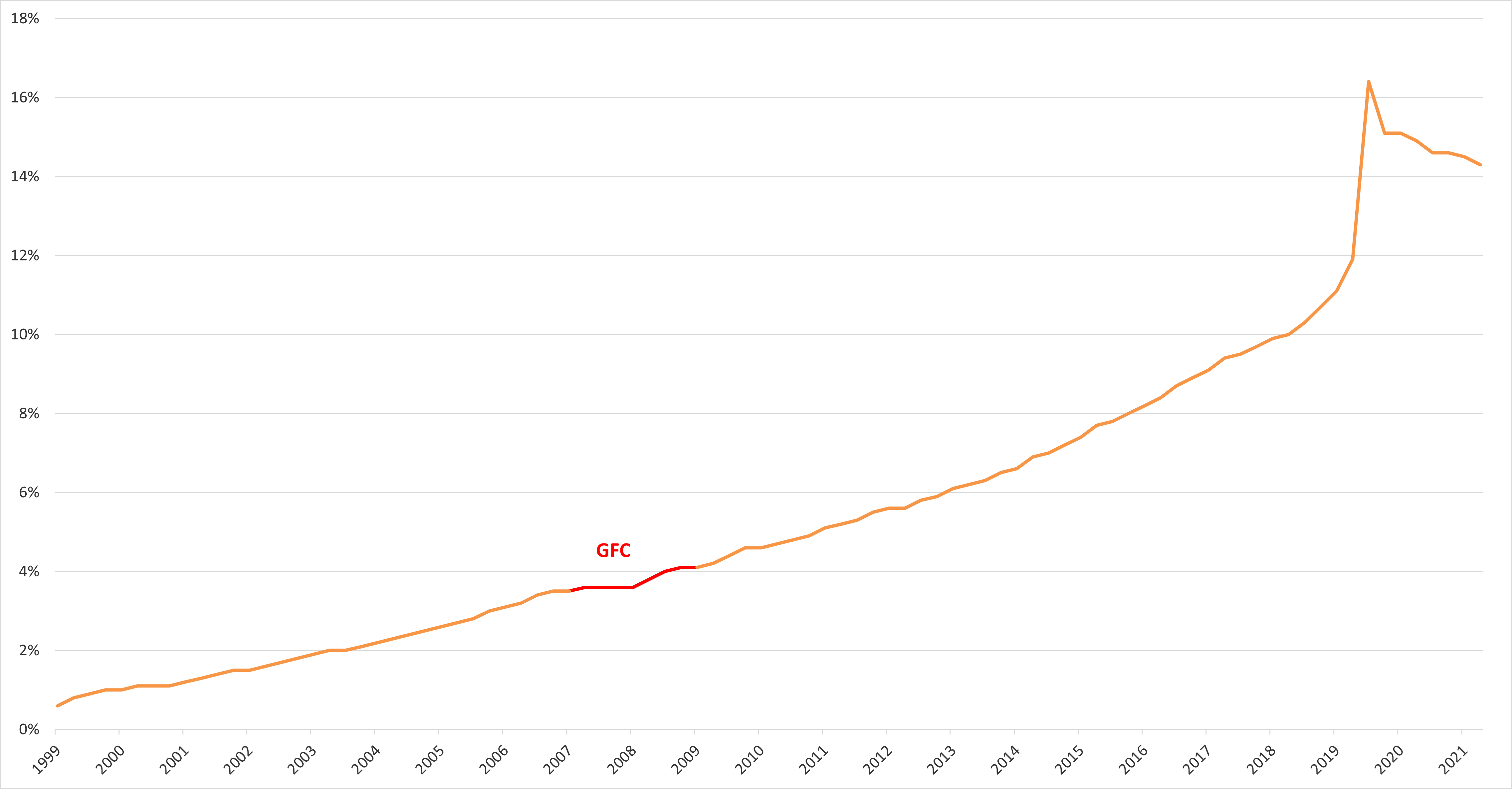

E-commerce and Amazon

For many decades, retail was a story of growing concentration, housed in a physical structure of some kind, from the early day ’mom-and-pop’ shops to shopping centres. However, it was the advent of the internet in the 1990s that brought with it the ability for consumers to browse and shop online, a much more convenient solution. Even with logistics networks that were not yet properly built out, e-commerce took market share from brick and mortar retail each year. E-commerce’s share of retail in the US still grew at the depths of the GFC between 2007 and 2008 (3.5% and 3.6% respectively), and the trend accelerated to the point until today (aided by superior logistics networks and same day delivery).

E-commerce as % of Total Retail Sales in the U.S.

Source: U.S. Department of Commerce

Source: U.S. Department of Commerce

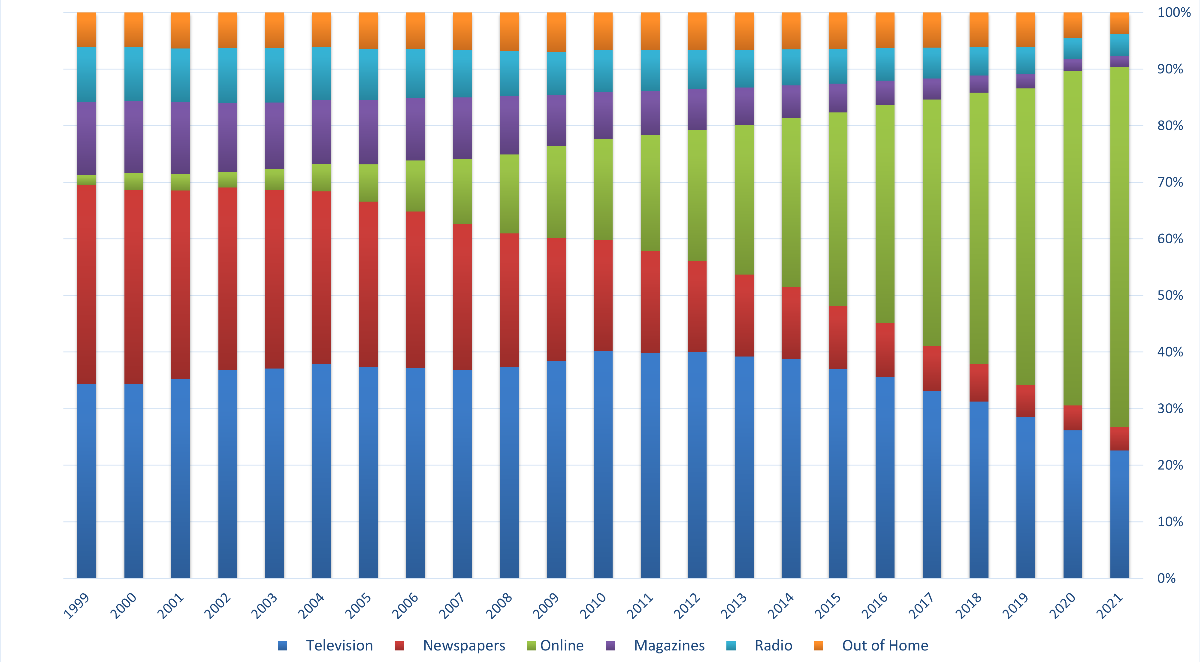

Online Advertising and Google

There was also significant change underway within the advertising industry at the time of the GFC, fuelled by digitisation and the changes to consumer behaviour that it brought about. Time spent online increased, so advertisers needed to follow. This time, however, companies placing advertising had granular targeting capabilities the likes of which were never available for traditional media such as newspapers, magazines, radio and linear television. Once again, a better, more efficient solution had arrived. So while the global market for advertising declined significantly during the GFC (almost -10% in 2009), market share within the industry tells a very different story.

% of Total Advertising Revenue by Category (Global)

Source: Magna

Source: Magna

Some of the more inefficient means of advertising, where reach (the number of people who saw the advertisement) was also suffering, experienced declines of almost -20% at the low of the GFC (linear TV was the only exception, largely a function of increasing – but peaking – growth in pay TV households). These types of advertising never recovered. Meanwhile, online advertising grew +5% at a time when many businesses didn’t know whether they would trade the following week. Online growth did slow from +20%, but given the overall market for advertising declined -10%, it resulted in some very large market-share gains.

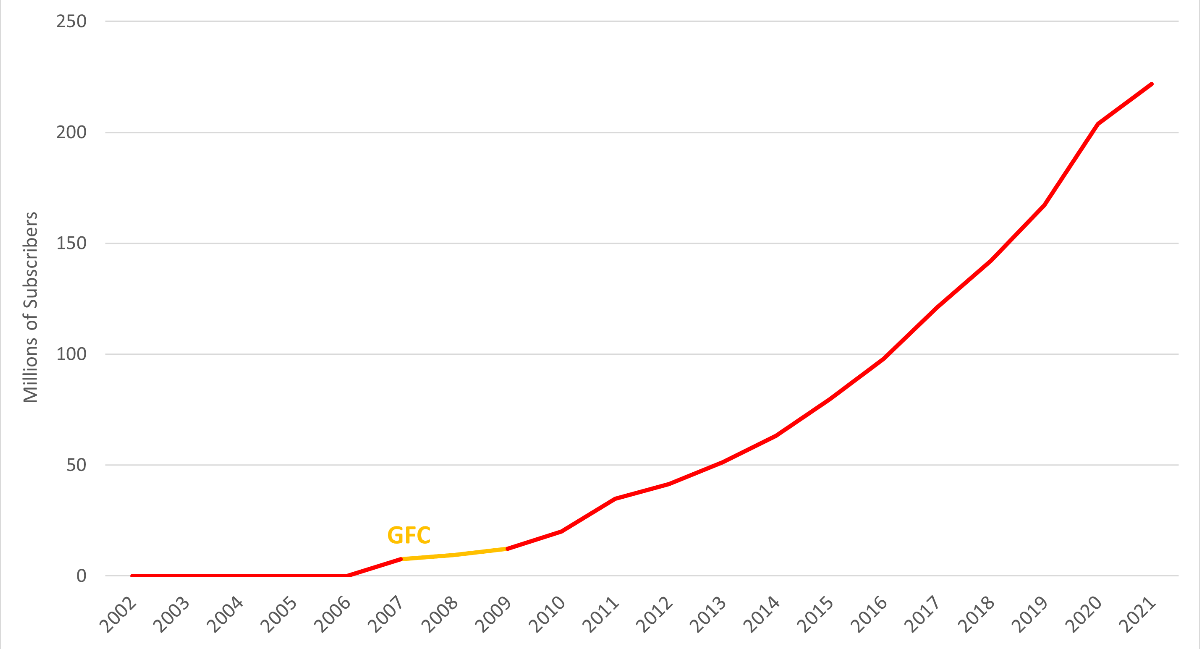

Streaming and Netflix

There was also an interesting dynamic occurring in the lead up to and during the GFC in the entertainment industry. Pay TV households in the US were still growing, but streaming was also becoming an increasingly appealing option. It was a new and better way to consume content from the largest and best studios, although often with a slight delay, but without the $100-200/month price tag of cable. That it was a better solution was often lost on those working at incumbent entertainment companies. The head of Time Warner Jeff Bewkes famously stated in 2010 that Netflix was not a threat to media companies and that it was “a little bit like, is the Albanian army going to take over the world? I don’t think so.” We know how that played out. During the GFC Netflix managed to grow from 7.5 million subscribers to 20 million subscribers by the end of 2010 (a respectable +39%, 3-year subscriber compound annual growth rate).

Netflix Subscriber Growth from Inception to 2021

Source: Company Filings

Source: Company Filings

Smartphones and Apple

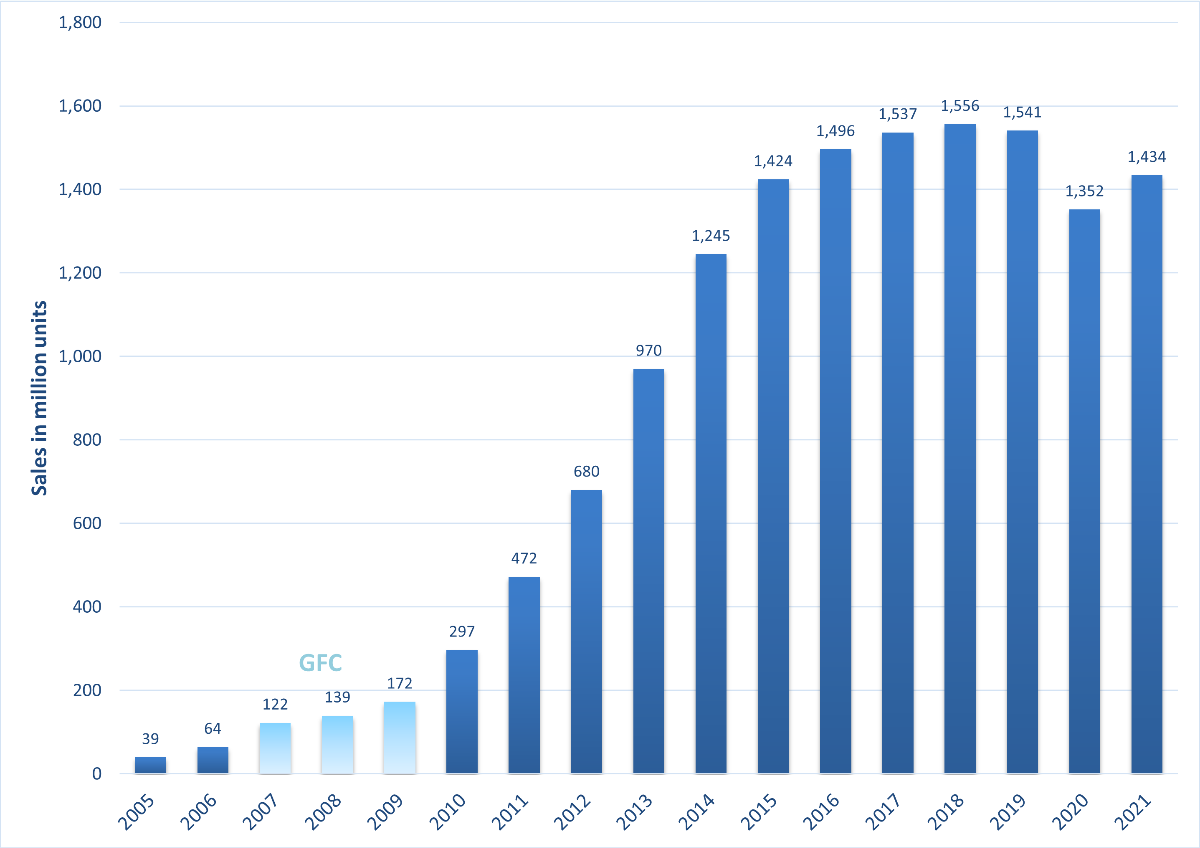

The iPhone was launched at the beginning of 2007 and arguably kick-started the mobile revolution (although it wasn’t the ‘first’ smartphone). The product launch came just a few months before early signs of financial stress and at a time when Nokia was king of the mobile market, with market share of almost 50%. But the iPhone was different. There was no stylus or keyboard, it provided access to the open internet in a way that smartphones of the past didn’t and there was soon an app for anything and everything (especially functions previously performed by other devices). It was simply a better solution than its predecessors and it was because of this that Apple grew its iPhone sales from nothing in 2006 to 4 million in 2007 and 48 million by 2010. It wasn’t just Apple iPhone sales either – smartphone sales showed significant growth, despite higher price tags and severe economic weakness:

Number of Smartphones Sold to End Users Worldwide from 2007 to 2021

Source: Gartner

Source: Gartner

There are many new disruptive trends happening right now that are unlikely to change course in the face of economic headwinds. Carmakers aren’t going to go back to making more internal combustion engine vehicles, nor are they going to cut back on safety features like advanced driver assistance or digitised infotainment (all of which is powered by semiconductors). Business aren’t going to turn back on their digital transformation plans. They certainly aren’t going to cut back on their cybersecurity budgets either.

And interestingly, many of the disruptive trends listed above still have a long way to go, even after more than a decade of progress: online advertising shows no signs of slowing, e-commerce is at under 20% penetration, streaming represents only 46% of TV viewing and smartphones are undergoing a 5G supercycle.

Despite the potential of a recession, disruption marches on.

This isn’t to say that the companies the Fund holds won’t experience any pain at all – while many disruptive players will grow their share of the pie, the overall pie might shrink. However, that’s likely temporary, and given the portfolio is invested in a majority of companies that have strong balance sheets and cashflows, we expect them to make it through any period of economic weakness to reap the rewards of growing market share when things begin to look up again.

Share this Post