This post was originally published on the SMH. Click here to read it on the SMH website.

The release of quarterly super fund data today showing negative returns for balanced funds, including a decline of 6.5 per cent for Australian shares in the three months to 30 September, should cause all investors to take a much closer look at their portfolios.

Your superannuation, which you may manage yourself or may be run by one of the many managers, is there to harvest returns for your retirement, right?

So what, exactly, do you hold? And should you be surprised that to learn that irrespective of what manager you have chosen, they have all chosen the same shares? And in ratios that are quite close to one another, when considering the overall portfolio?

Take a look around

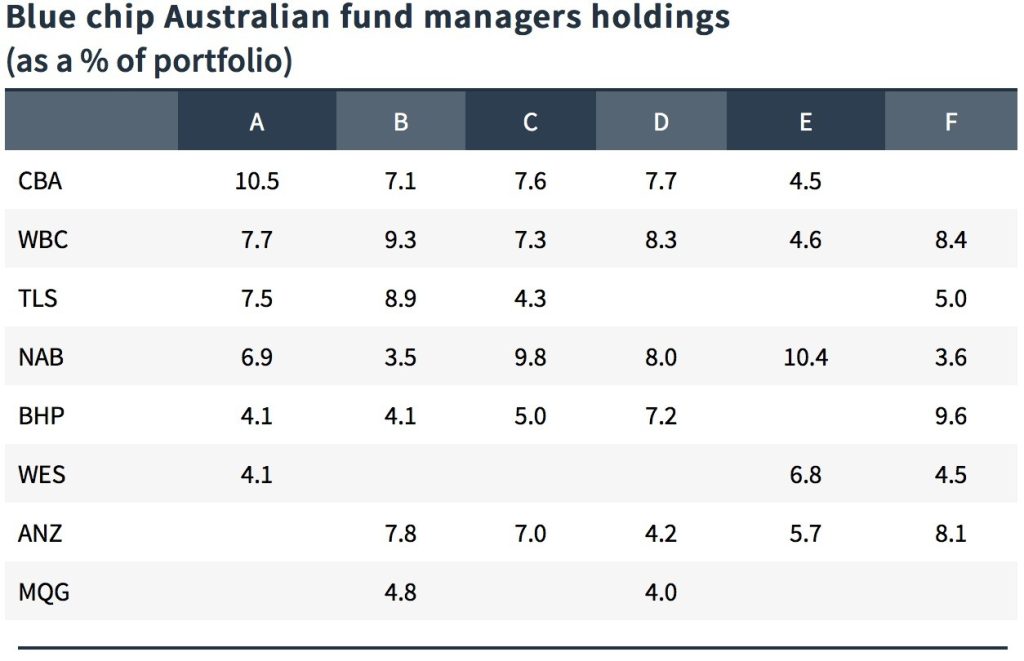

Take a look at the table below, picked more or less at random from the managers of blue chip Australian shares. (I have not run the names of the portfolio managers, though I could. Let them just be letters of the alphabet, for now.)

These are their biggest positions. You can see the heavy weighting of banks, BHP Telstra and Wesfarmers. Probably the same things you own yourself, as a self-directed investor.

But why do the managers all hold the stocks in similar ratios one to another. Surely that shouldn’t be the case?

The answer is: Investing in the blue chips, at weights close to the index, regardless of the outcomes, will ensure the fund’s continuity, while investing away from the index could ultimately be an existential issue: the fund could go out of business.

To explain: If the manager performs in line with the index by investing in these “safe” blue chip names, then even if the index goes down by 25 per cent there isn’t a serious penalty. This is because the manager can plausibly claim that in line with the market, the value of holdings declined by 25 per cent. It is highly unlikely that there will be any serious problem, other than for you as the owner of these shares.

But if the manager takes the view that the investments should be on the basis of the very best possible investment outcomes, and the same 25 per cent fall is experienced, the portfolio manager would be sacked because of underperformance relative to all the other, benchmark hugging managers.

Winners and losers

What this means is that investing in line with the index is a no-lose option for the fund manager (though not for you) while investing away from it may result in the end of the fund manager’s business.

This isn’t a witch-hunt. It’s entirely appropriate that if you want a portfolio of blue chip Australian shares, then you will wind up with pretty much those shares that are the biggest in the Australian market. That is what you asked for.

The money managers for these funds are doing nothing wrong. But the point is, as an investor you are paying (for example) 1.5 per cent-2.5 per cent to effectively hold an index – the S&P ASX 200 index – that you could hold for a fraction of the cost. Remember, you too can buy the banks and BHP.

You could buy the same names through an ETF, which would get you the same exposure, but for a fraction of the cost. But you would still be exposed to the same names, and the Australian dollar, which this year has declined by 25 per cent.

The way forward

The truth is that the name of the game is diversification. The idea of providing in retirement is about creating income to match expenditure. And since so much of what we purchase comes from offshore (cars, holidays, computers, entertainment) it is good sense to have a component of retirement assets in currencies that shield us from prices rises in these imported purchases.

By the way, Australian Tax Office figures confirm the heavy bias toward Australian share investing. It shows SMSF’s hold 30.3 per cent of their total assets in listed Australian shares. This amounted to $150 billion. There was virtually the same amount in cash. In overseas shares, there was $1.9 billion,or just 0.39 per cent of the total SMSF pool.

The sensible thing to do as an investor when looking at the Aussie market with its heavy weighting in resources, which are suffering structural upheaval, and banks which are close to all-time highs, is reduce your exposure to it. This isn’t rocket science, or even risky, it’s just good sense.

This post was originally published on the SMH. Click here to read it on the SMH website.

Share this Post